Bitcoin’s Sharp Drop and Long-Term Holder Sell-Off

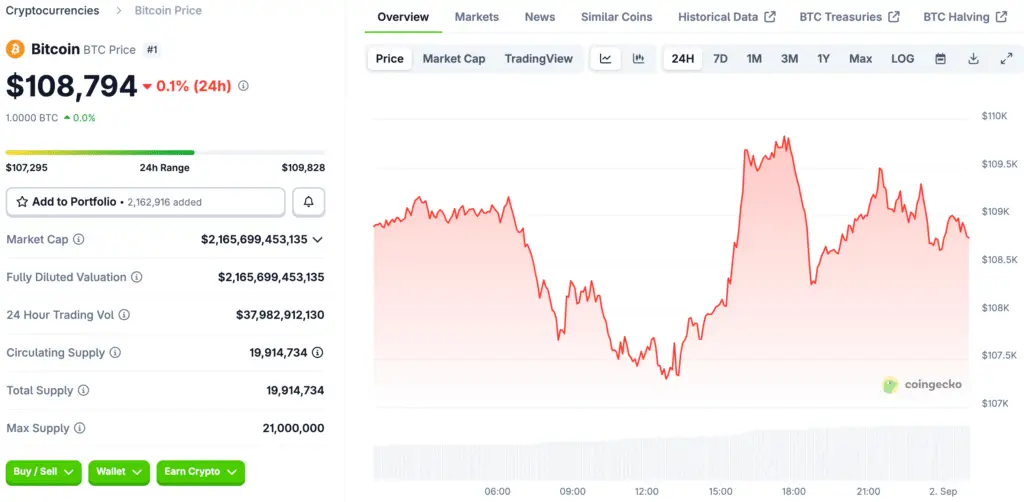

The price of Bitcoin has dropped a lot at the start of September. The price went down 6.5% to $108,000. This drop was caused by a huge sell-off by people who had held on to their stocks for a long time. This was the biggest dump of the year so far.

Older wallets sent out almost 97,000 BTC. There is a lot of uncertainty because of this unusual activity. This shows that long-term holders are acting very differently now.

The Anatomy of the Long-Term Holder Sell-Off

Most of the coins that were sold came from wallets that had them for one to five years. For some reason, these long-term holders are selling their positions. Wallets that held coins for one to two years let go of 34,500 BTC.

The 6- to 12-month range brought in another 16,600 BTC. The wallets that were 3 to 5 years old also sold 16,000 BTC. This is more than 70% of the total sales volume from only three age groups.

Why the Real Story Is Corporate Accumulation

Bitcoin is still up for the year, even though the price has gone down recently. This is a very good sign for the future. The price isn’t the most important thing here. It’s about who is buying.

Companies, both private and public, are buying a lot of Bitcoin. Every day, this trend gets louder. This new wave of companies buying things is very strong.

Recommended Article: Bitcoin’s Fate Tied To RSI Support Level

The Michael Saylor Playbook and How It Affects People

Michael Saylor came up with the idea for how businesses should buy things. Strategy was the first company to use this method. At least 180 other companies have copied his playbook. This shows that the model works.

Buying stock in these companies is like buying cheap Bitcoin. This is a very cool new way to put money into something. People are starting to see Bitcoin as an asset in a different way because of this trend.

JPMorgan’s Take on Bitcoin’s Market Change

A managing director at JPMorgan thinks that this new group of buyers is already having an impact. He said that this wave could make Bitcoin more appealing. It could also be a stronger competitor to gold if its volatility goes down.

The steadier the buying, the more likely it is that Bitcoin will be in portfolios. In the past, these portfolios only held metals and cash. This is a big and important change in the market.

How Quantitative Easing Affects Markets

As the US economy is in the shadow of quantitative easing, the buying surge is happening. During the COVID pandemic and the crash of 2008, the Fed used this. This process put a lot of money into the economy.

People have called this “money printing” for a long time. They say it makes people act in dangerous ways. They also say that it makes new bubbles grow faster.

What the Future Holds for Bitcoin as Companies Buy It

Companies’ treasuries are also holding Ether and other smaller coins. This trend is a clear sign that a lot of new money is coming into the market. The buying spree and the green light from the government are happening. The future looks very good.