BNB’s Momentum Under Scrutiny Following Recent Technical Issues

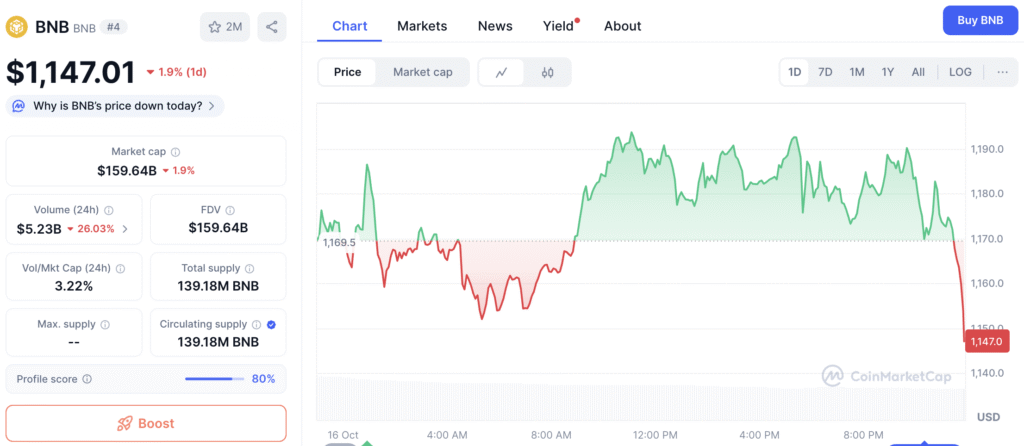

Following several months of steady advancement, Binance Coin (BNB) appears to be approaching a brief period of stabilization as market participants respond to technical challenges and intricate on-chain discrepancies. The token, now priced at approximately $1,181, has experienced a resurgence of volatility due to recent oracle mispricing events and brief depegging of wrapped assets like USDe, BNSOL, and wBETH on the Binance platform.

Despite the overall positive momentum, experts warn that BNB’s short-term path may depend on the speed at which user trust is restored following these disturbances. The scenario reflects a wider adjustment in the market as liquidity becomes constrained and leveraged positions are being reduced.

Market Data Shows Divergence Between Spot and Futures Positions

Insights from CoinGlass indicate a significant shift in BNB’s market dynamics. The cumulative volume delta (CVD), which measures net buying activity, increased from $2.34 billion in February to $3.3 billion, indicating robust spot accumulation.

Nonetheless, the combined futures CVD plunged further into the red, decreasing from -$41 billion to -$45.8 billion during that timeframe. This divergence highlights a notable difference between long-term investors accumulating positions and futures traders scaling back their exposure, indicating a strategy of hedging rather than a straightforward bearish outlook.

BNB Strengthens as Spot Demand Rises and Futures Leverage Declines

DarkFrost, a verified analyst at CryptoQuant, notes that the gap between spot and futures markets suggests “investors are placing their bets on the long term.” He notes that the current transition towards spot holdings signifies a “market-wide shift towards stability” following recent significant liquidations.

Despite a more cautious stance among futures traders, the ongoing influx of spot investments highlights a strong belief in the long-term fundamentals of BNB. Experts contend that the divergence could function as a stabilizing force as speculative leverage gradually diminishes.

Recommended Article: China Bank Targets $600M BNB Fund As Token Hits Record Peak

Short-Term Indicators Suggest a Cooling Phase Ahead

While there is a sense of hope regarding BNB’s fundamentals, the data from short-term derivatives reveals a more intricate scenario. The total number of open long and short positions, known as open interest, has decreased by 36% over the past week, now standing at 555,000 BNB. This decline coincides with reductions in both spot and perpetual CVDs.

This concurrent decline indicates a strategic withdrawal of profits and adjustment of positions, frequently signaling an impending phase of market stabilization. Should open interest and CVD persist in their decline, it suggests that traders might be closing out positions instead of starting new long ones, indicating a possibility for short-term price adjustments.

BNB Sentiment Shaken After Binance Oracle Glitch and Temporary Depegs

Recent oracle errors and temporary asset depegs have unsettled segments of the Binance community, sparking conversations about the trustworthiness of the exchange’s wider ecosystem.

Alexandr Kerya, VP of Product Management at CEX.IO, remarked that these incidents “caused a quick drop in confidence,” while noting that selling pressure “appears limited” and is mainly driven by overall market sentiment rather than any inherent weakness in BNB itself.

External Factors and Rival Exchange Support Offset Weakness

This week, BNB’s market outlook brightened as Coinbase revealed its intention to include BNB in its listing roadmap, indicating an expanding acceptance beyond the confines of Binance’s ecosystem. This action could enhance liquidity and increase exposure, possibly mitigating short-term downside risk.

Traders are exercising caution, as the trajectory of Bitcoin continues to influence the overall market dynamics. The future strength of BNB appears to hinge on the potential resurgence of institutional investments, particularly as macroeconomic conditions are expected to stabilize towards the end of Q4 2025.

BNB Holds Above $1,100 as Market Consolidation Signals Temporary Pause

Despite the supportive long-term fundamentals and on-chain metrics for BNB, the likelihood of short-term corrections is rising due to growing community unease and a decline in derivatives activity. Experts interpret the recent price movements as a necessary adjustment in the market, rather than an indication of a downward trend.

Should BNB sustain its position above $1,100, the overall positive trajectory continues to hold firm. Nevertheless, persistent decline beneath that threshold may lead to a retracement prior to the resumption of renewed buying interest. At this moment, the market conveys a straightforward message: BNB might require a pause before its next surge can proceed.