BNB Consolidation Strengthens as Traders Watch for Breakout

As traders get ready for what may be the next big step in Binance Coin’s (BNB) continuous ascent, it continues to get a lot of attention in the market. After weeks of moving sideways, experts now see signals that BNB may be getting ready for a bullish breakout. This is because of strong accumulation patterns and strong on-chain activity.

The cryptocurrency is still one of the best-performing large-cap assets in 2025, even if the market as a whole has been unstable and it hasn’t lost much value. As Bitcoin and Ethereum prices go up and down, BNB’s consistent trading range shows that long-term investors are becoming more confident in the asset as a key part of the DeFi ecosystem.

Bullish Pennant Pattern Signals Upside Momentum

Crypto expert Henry has identified a bullish pennant formation on BNB’s 4-hour chart, suggesting price pressure is building before a significant breakout. If confirmed, the breakout could potentially reach $1,300 to $1,350, a 20% to 25% increase from current levels.

Henry believes that Binance CEO Changpeng Zhao’s past effects on market confidence and BNB’s strong brand momentum in the exchange ecosystem could help boost volatility. As long as BNB remains above $1,050, traders may soon see volatility return, benefiting bulls. This suggests that the asset’s strong brand momentum and potential breakout could be a catalyst for further price pressure.

BNB Holds Strong at $1,073 as Traders Accumulate in Key Support Zone

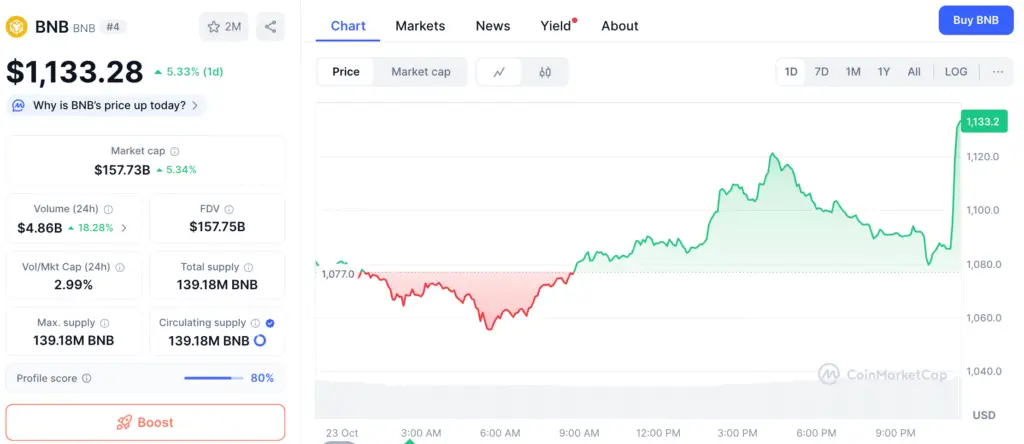

BNB, valued at $1,073.26, has a market valuation of $149.26 billion and trades at $3.06 billion per 24 hours. Despite a 0.31% drop in the last day, it appears to be a protective yet active large-cap crypto asset. The price chart shows rejections below $1,050–$1,060, indicating a powerful accumulation zone.

Traders are returning to positions after small falls, indicating high institutional and retail confidence. This continuous base construction often leads to mid-term rallies when combined with better liquidity and a constant influx of buy-side orders.

Recommended Article: BNB Price Aims for $1,150 as DEX Volume Surpasses $2T

Technical Indicators Suggest Calm Before the Move

BNB/USD is currently trading at $1,069, indicating a stable market after a high of $1,375 in early October. TradingView data suggests a smaller range, indicating rising volatility.

Key indicators, such as the BBPower oscillator flashing red and the Chaikin Money Flow measurement near zero, suggest a temporary balance between buyers and sellers. Traders are waiting for a breakout over $1,150–$1,200 or a fall below $1,050 to determine the market’s direction.

BNB Pennant Formation and High Volume Signal Potential Breakout Rally

Market analysts remain optimistic about BNB’s structure, citing past consolidation patterns that led to significant directional continuation, especially with increased volume. The current pennant structure resembles those seen during BNB’s surges in early 2025, with increased volume potentially increasing the chances of a breakout towards $1,300–$1,350.

On-chain indicators like transaction counts and total value locked (TVL) remain high, indicating genuine network activity is driving BNB’s market capitalization. This suggests that BNB’s structure is still a strong driver of its market capitalization.

Broader Market Context Supports Upside Bias

BNB’s consistent success is in line with what most people in the crypto space are doing: moving money from Bitcoin to altcoins with strong liquidity. As decentralized exchanges (DEXs) and DeFi platforms grow, BNB’s value as the native token of the BNB Chain ecosystem grows as well.

Analysts say that BNB is one of the best altcoins for both speculative and functional growth because of the combination of expanding DEX volumes, constant TVL above $8 billion, and exchange integration. The coin’s long-term backing from its ecosystem offers it an edge over other large-cap coins that are having trouble with volatility right now.

BNB Eyes $1,300 Target if Price Holds Above $1,050 and Breaks Resistance

Analysts predict that if BNB stays above $1,050 and breaks back into the $1,150–$1,200 resistance zone, it will continue to rise into $1,300–$1,350. This is more likely due to tighter pennant structures and increased money. The market is generally positive, but short-term declines may occur.

If a breakout occurs, institutional traders and algorithmic funds may buy again, potentially propelling BNB to new local highs. BNB’s bullish story is strong for Q4 2025 due to solid fundamentals, steady ecosystem growth, and technical alignment.