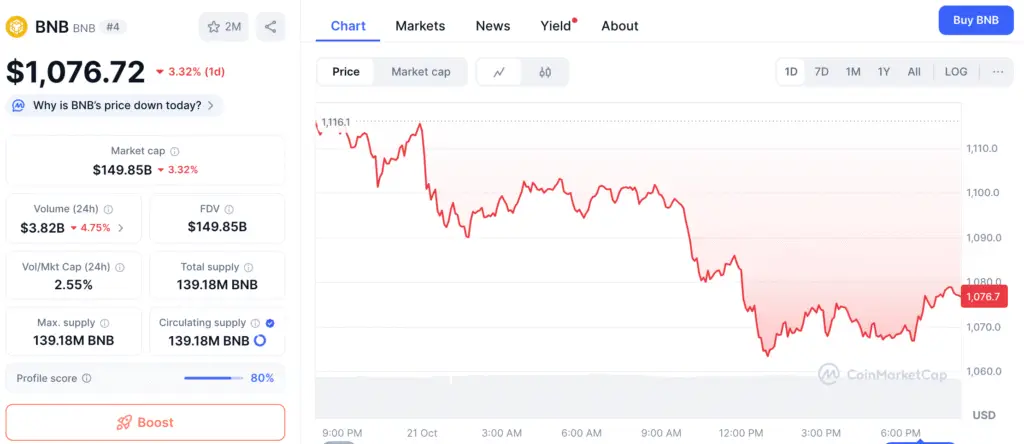

BNB Price Bounces Back After Big Drop

After falling 18% from its annual high, Binance Coin (BNB) is beginning to regain momentum. This week, the token is trading around $1,120, up from a monthly low of $890. Analysts note that BNB remains one of 2025’s top performers despite short-term volatility, driven by increasing activity on the Binance Smart Chain (BSC).

This rebound signals continued confidence in BNB’s fundamentals, with both technical and on-chain indicators showing the token’s long-term growth remains intact. Experts consider the recent correction a cooling phase following months of strong expansion.

Over 120% More BSC Transactions in 30 Days

The Binance Smart Chain has seen a major increase in network activity, signaling renewed interest in BNB. Over the past month, BSC transactions surged 120% to exceed 537 million. Network fees climbed 392% to $66.65 million, while active wallet addresses rose to 37.8 million, highlighting growing participation in DeFi and gaming sectors.

These rising transaction levels reinforce BNB’s deflationary token model, as most fees are automatically burned. On-chain data shows that over $1.5 million worth of BNB was burned in the past week alone, bringing total burned tokens to more than $308 million since inception.

BNB Burn Plan Targets $1.2B in Tokens to Boost Long-Term Scarcity

BNB’s burn mechanism remains one of its most bullish long-term catalysts. In the coming weeks, developers plan to burn more than $1.2 billion worth of tokens, followed by another $1.4 billion in the next quarter. The goal is to gradually reduce the total supply to 100 million BNB, enhancing scarcity and supporting future price growth.

This deflationary approach has positioned BNB as one of the strongest assets in the market, comparable to Ethereum’s post-merge burn model. As demand for trading and DeFi utilities continues to rise, BNB’s shrinking supply is expected to sustain long-term value appreciation.

Recommended Article: BNB Price Nears $1,150 Breakout as Solana Patterns Reappear

DeFi Growth Gives the BNB Chain Ecosystem More Power

The total value locked (TVL) in BSC-based DeFi projects has increased 5% in the past month to $12.3 billion. Including bridged liquidity, the network’s total TVL now surpasses $52 billion, demonstrating continued investor confidence in BSC’s ecosystem.

This consistent growth underscores BSC’s role as a vital hub for decentralized applications. Its high throughput and low fees continue to attract developers and retail users seeking efficient alternatives to Ethereum’s mainnet.

BNB Shows Bullish Momentum Despite Emerging Double-Top Formation

BNB’s daily chart highlights a strong recovery from its March lows below $500, rallying to an annual high of $1,375. The price is currently consolidating between the 23.6% and 38.2% Fibonacci retracement levels, showing that buyers are defending support despite ongoing profit-taking.

The token also remains above its 50-day and 100-day exponential moving averages (EMAs), confirming a sustained bullish structure. However, a double-top pattern has emerged, suggesting potential short-term resistance in the $1,150–$1,200 zone.

Risks: Uncertainty and Technical Resistance Ahead

While fundamentals remain solid, the formation of a double top and a bearish Supertrend signal indicate short-term caution. As BNB approaches a key resistance range, analysts warn that the price may experience heightened volatility. Failure to reclaim $1,150 could trigger a pullback toward support levels between $1,000 and $1,050.

Nevertheless, sentiment remains largely optimistic as long as BNB holds above $1,000, a price level where consistent accumulation has been observed.

BNB Eyes $1,200 Once Accumulation Resumes

Despite potential short-term fluctuations, BNB’s overall trajectory remains favorable. Rising BSC activity, a deflationary token supply, and expanding ecosystem utility all strengthen its long-term outlook as both a utility asset and investment vehicle.

Analysts project that if BNB breaks above $1,150 and maintains momentum, it could target the $1,200–$1,250 range in the coming weeks. With record on-chain metrics and continued token burns, Binance Coin appears well-positioned for sustained growth through late 2025.