BNB Stays Steady Despite Market Volatility

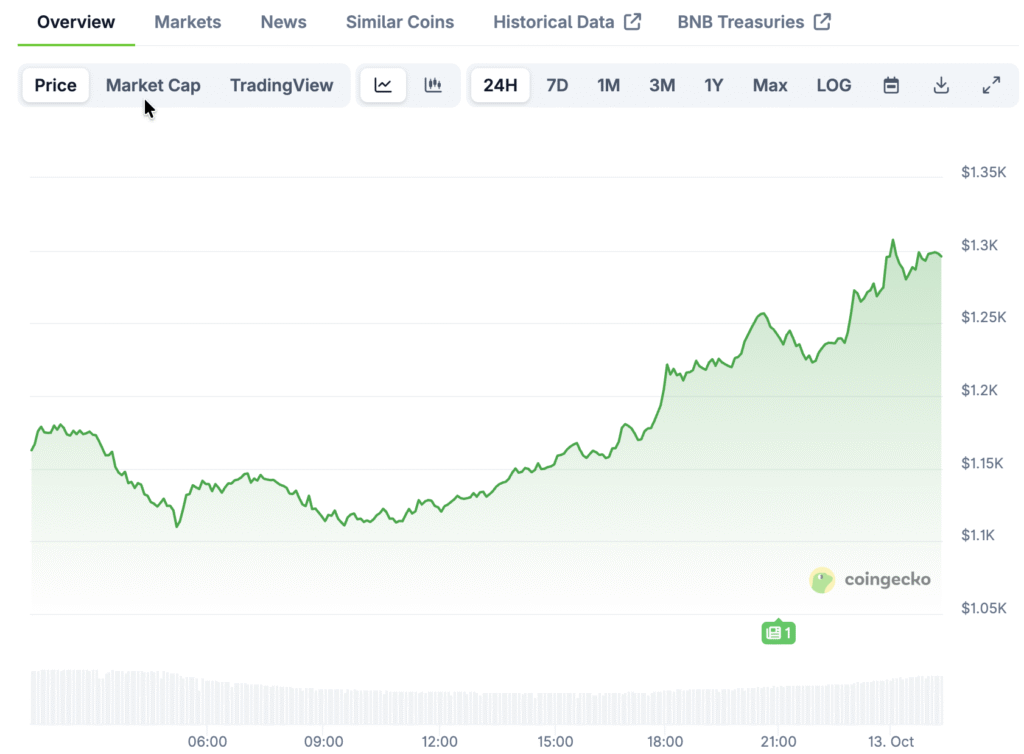

BNB continues to demonstrate resilience as other cryptocurrencies face renewed volatility and shifting investor sentiment across global markets. The token is currently trading around $1,160 and has shown a steady recovery since its midyear decline earlier in 2025.

This stability highlights BNB’s reputation as a dependable asset for investors seeking both functionality and reliability in their cryptocurrency portfolios. Even with periodic fluctuations, its underlying framework remains solid, supported by strong user participation and consistent network activity.

Consistent Utility Boosts Investor Assurance

As the backbone of the Binance ecosystem, BNB facilitates millions of daily transactions, provides trading fee discounts, and powers numerous DeFi integrations. Its extensive adoption reinforces long-term value, even amid growing competition from emerging blockchain technologies.

Analysts predict potential gains of up to 72% if momentum sustains above key support levels near $1,080. This blend of stability and gradual growth positions BNB as a foundational holding rather than a speculative investment for both retail and institutional participants.

BNB Ecosystem Expands With Layer Two Integration

The Binance ecosystem continues to evolve with ongoing Layer Two developments and cross-chain upgrades. These enhancements prioritize scalability, faster transaction settlement, and enhanced network security.

By improving transaction efficiency and lowering gas fees, BNB is becoming an increasingly attractive base layer for decentralized applications. This ongoing ecosystem expansion ensures BNB’s lasting relevance within DeFi environments and next-generation blockchain infrastructures.

Recommended Article: BNB Momentum Builds Toward $1500 As Bulls Defend Key Levels

Key Insights on Institutional Demand and BNB’s Market Maturity

Institutional investors are steadily incorporating BNB into their portfolios, viewing it as a strategic hedge amid global financial uncertainty. On-chain analytics show a consistent increase in wallets held by long-term investors.

This institutional activity contributes to greater liquidity and market stability. As investment trends shift toward assets with tangible use cases, BNB’s position as a utility-driven token solidifies its standing as a mature, resilient component of the broader crypto landscape.

Binance Smart Chain Continues to Dominate the DeFi Landscape

The Binance Smart Chain remains a dominant force in decentralized finance, processing over 12 million daily transactions. Its balance of scalability and affordability attracts developers building applications in sectors such as NFTs, gaming, and decentralized exchanges.

Each new integration strengthens network activity, thereby increasing the demand for BNB as the primary token for transaction fees and smart contract execution. This continued adoption reinforces BSC’s leadership position within the global DeFi ecosystem.

Long-Term Holders Benefit From Consistent Performance

Investors who held BNB throughout 2024 and 2025 have outperformed many short-term traders due to the token’s relative price stability. Compared to other altcoins, BNB’s lower volatility reflects investor confidence in its sustainable trajectory.

This consistency appeals to risk-conscious investors seeking predictable growth rather than speculative spikes. With strong fundamentals, ongoing innovation, and Binance’s strategic ecosystem management, BNB’s long-term outlook remains highly favorable.

BNB Technical Indicators Signal Bullish Continuation Toward $1,500 Target

Recent technical indicators suggest a bullish continuation pattern forming above $1,150, with momentum potentially driving prices toward the $1,400 to $1,500 range. Analysts identify $1,080 as the key support zone for maintaining upward movement.

If trading volumes continue to rise, BNB could revisit its previous all-time highs by year’s end. Such a development would confirm renewed investor confidence and reinforce BNB’s status as one of the most functionally strong and reliable digital assets in the market.