BONK Price Momentum Grows as Market Interest Revives

The BONK price is gaining attention once more as both technical and market indicators converge, suggesting a possible breakout on the horizon. The latest price movements indicate that buyers are becoming more confident, bolstered by robust structural patterns and external factors.

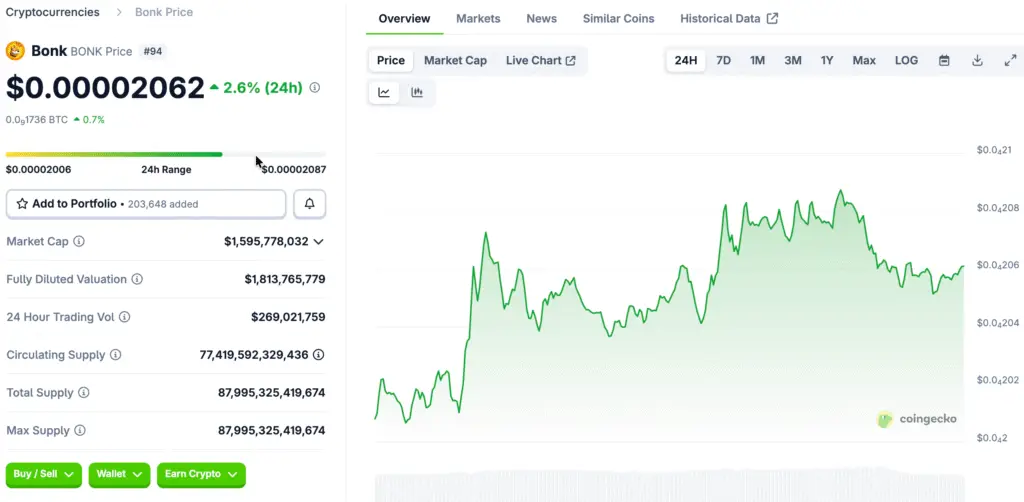

The token is presently trading at approximately $0.00002061, maintaining its position above an important support level. Experts are paying close attention to its bullish pennant flag formation, which frequently signals significant continuation rallies in times of revived market excitement and increasing momentum.

A Bullish Pennant Flag Indicates a Possible Breakout Pattern

Chart analysis reveals the emergence of a bullish pennant flag, indicating a potential continuation to the upside should the price surpass resistance levels. BONK has successfully consolidated without major disruptions, indicating a trend of accumulation rather than distribution among traders.

A significant advance past $0.00002775 might validate this optimistic pattern and pave the way for a powerful breakout. Should this be achieved, analysts predict a potential surge towards $0.00004000, mirroring the positive technical perspective held by numerous BONK enthusiasts today.

TD Sequential Buy Signal Boosts Technical Assurance for Bulls

The TD Sequential indicator has recently signaled a significant buy opportunity, which has historically been linked to market reversals, adding strength to this setup. This tool has demonstrated its effectiveness across various assets, pinpointing momentum shifts ahead of significant price movements.

The signal emerged as BONK held its support at $0.00001850, indicating that bulls are regaining control. Should historical trends hold true, this indicator could signal an impending rally, particularly when combined with solid structural consolidation and positive sentiment.

Recommended Article: BONK Holds Key Support After Heavy Selling Hits Solana Meme Token

Emerging Open Interest Insights Expanding Derivatives Placement

According to CoinGlass data, open interest for BONK derivatives has increased by 10.46%, reaching $27.24 million. This rise indicates a heightened involvement and financial dedication in futures markets.

Increasing open interest during periods of consolidation frequently suggests that leveraged positions are being built in anticipation of upcoming directional shifts. The combination of bullish technical formations with this dynamic often enhances the probability of a notable breakout occurring soon.

ETF Application Boosts BONK’s Market Credibility

BONK has gained a significant boost in confidence following Tuttle Capital’s filing for an ETF focused on the token with the U.S. SEC. This surprising turn of events has ignited hope among traders, indicating an increase in institutional interest and broader acknowledgment in the mainstream.

Filings for ETFs frequently lead to heightened liquidity, greater visibility, and enhanced investor confidence, particularly in a speculative area such as meme coins. BONK’s connection to a regulated financial product strengthens its optimistic outlook and broadens its attractiveness to a wider audience.

Bullish Case Strengthened by Multiple Converging Indicators

A bullish pennant flag, coupled with a TD Sequential buy signal and increasing open interest, presents a compelling bullish scenario. When several independent indicators come together, they frequently result in high-probability trade setups that draw interest from both retail and institutional participants.

The combination of these factors and ETF-related news sets BONK up for a possible surge in momentum if the current trend continues. Traders are currently paying close attention to resistance levels to determine if this setup leads to a lasting rally toward anticipated targets.

BONK Stands Out as an Attractive Option for Speculative Investors

BONK’s present market structure offers an intriguing scenario for optimistic traders seeking early breakout chances. The convergence of technical indicators, derivative activity, and external catalysts is setting the stage for a promising rally.

Despite the ongoing risks, particularly in the unpredictable meme coin markets, BONK emerges as a noteworthy option for those looking to capitalize on short-term momentum opportunities. A confirmed breakout may pave the way for notable price increases in the weeks ahead, attracting even greater market interest.