Bonk’s Correction and the Cup and Handle Pattern

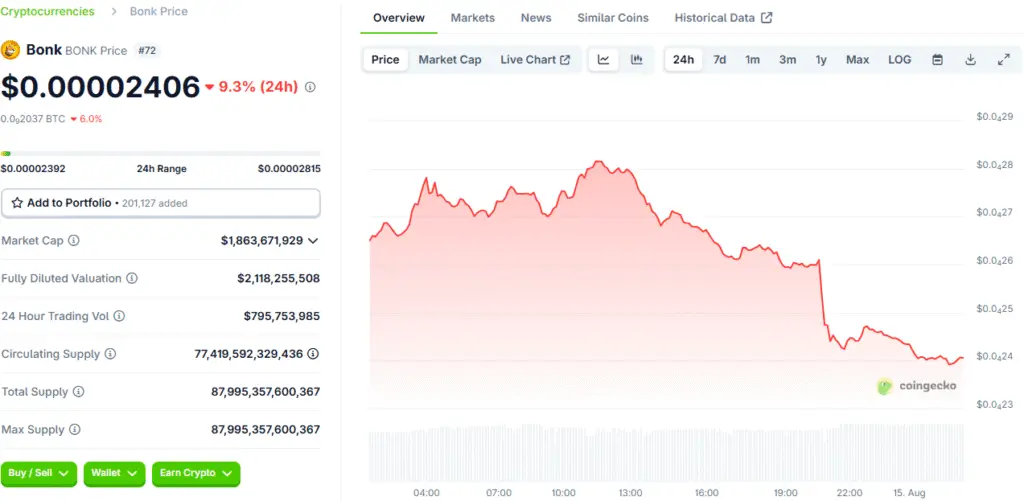

After reaching a July peak of approximately $0.00004070, the Bonk token has been in a correction phase, extending its decline by 35%. This downward movement, which has seen the price trade around $0.00002606, is a direct result of a shaky sentiment in the broader cryptocurrency market. However, a closer look at the technical charts reveals a subtle bullish picture.

Bonk is currently retesting the neckline support of a classic cup and handle pattern, a formation that often precedes a strong upward movement. This pattern indicates that while the token has faced a significant correction, it is now at a crucial point where it could rebound and reverse its recent losses. The ability of Bonk to defend this key support level will be a major factor in determining its future price trajectory.

The Role of Open Interest and Market Sentiment

The recent price decline in Bonk has been accompanied by a significant drop in its derivatives market. The futures open interest (OI), which measures the notional value of outstanding futures contracts, has shrunk from its July peak of approximately $73 million to just $38 million. This persistent decline in OI implies that market sentiment and interest in the Solana-based meme coin have been subdued.

However, despite this drop, the futures-weighted sentiment remains positive, suggesting that traders are still leveraging long positions in BONK. This is an interesting dynamic, as it shows a disconnect between the overall market’s declining interest and the bullish positioning of active traders. The market is now at a pivotal point, with the direction of the next move dependent on whether this subtle bullish sentiment can overcome the recent decline in open interest and volume.

Technical Outlook and Key Support Levels

The technical outlook for Bonk is a subtle but clear bullish picture. The price is currently upholding a critical support level at $0.00002563, which is provided by the 50-day Exponential Moving Average (EMA). It is also holding above the cup and handle pattern’s neckline support at around $0.00002500. These levels will serve as tentative support if the decline extends.

The meme coin also sits significantly above the 100-day EMA at $0.00002306 and the 200-day EMA at $0.00002174, further reinforcing its bullish picture. This technical foundation suggests that the token has a strong base to build on. A rebound from this neckline support could lead to a bullish breakout aimed at the July peak of $0.00004074. Conversely, if this support level gives way, the token could see an extension of its down leg.

The Crucial Role of the Relative Strength Index

As traders watch the price action around the neckline support, another key indicator to watch is the Relative Strength Index (RSI). The RSI, which is a momentum oscillator, continues to decline below the midline. This indicates a reduction in buying pressure and suggests that the sellers still have control of the market.

For a bullish reversal to take hold, the RSI would need to turn upward and cross back above the midline. This would signal a shift in momentum and an increase in buying pressure. The RSI is a crucial tool for traders, as it provides a clear picture of the market’s strength and can help to confirm whether a price move is a genuine trend reversal or just a short-term blip.

Read More: Solana Ecosystem Growth Bonk Notcoin MoonBull Trends

Two Potential Outcomes: A Breakout or a Down Leg

As Bonk tests the neckline support, there are two likely outcomes. The first is a bullish breakout. If the token can successfully hold this support level and buying pressure returns, it could begin a new rally aimed at reclaiming its July peak of $0.00004074. This would be a powerful signal to the market that the correction is over and that a new upward trend is beginning.

The second outcome is an extension of the down leg. If the neckline support gives way, the token could see a further decline, potentially testing the 100-day and 200-day EMAs. This would be a bearish signal and could lead to a longer period of consolidation. The coming sessions will be crucial for Bonk as the market decides which of these two outcomes will prevail.

Bonk’s Resilience Defending Key Support Amid Market Uncertainty

Bonk’s price decline is happening in the context of a broader crypto market that has been experiencing shaky sentiment. While Bitcoin recently hit a new all-time high, its subsequent pullback has caused a ripple effect across the altcoin market. This volatility highlights the interconnected nature of the market, where a major move in one asset can have a profound impact on others.

However, the ability of Bonk to defend its key support levels in the face of this broader market uncertainty is a testament to its underlying resilience. It suggests that while the token may be in a period of correction, it has a strong base of holders and a dedicated community that is providing a floor for its price.

A PIVOTAL Moment for Bonk’s Future

The current moment is a pivotal one for Bonk’s future. The price is at a critical technical level, with a bullish chart pattern and key support levels to defend. The market’s subdued interest, as reflected by the decline in open interest, is a concern, but the bullish positioning of some traders provides a glimmer of hope.

The coming sessions will be a major test for the token, as it must either rally and confirm the bullish breakout or succumb to the selling pressure and extend its decline. The outcome will have a significant impact on Bonk’s price trajectory and will provide valuable insight into the broader sentiment of the meme coin market. For traders and investors, all eyes are on the chart, waiting to see if Bonk can hold its ground and begin its next ascent.