Bonk Regains Traction Following Steep Drop in Mid-October

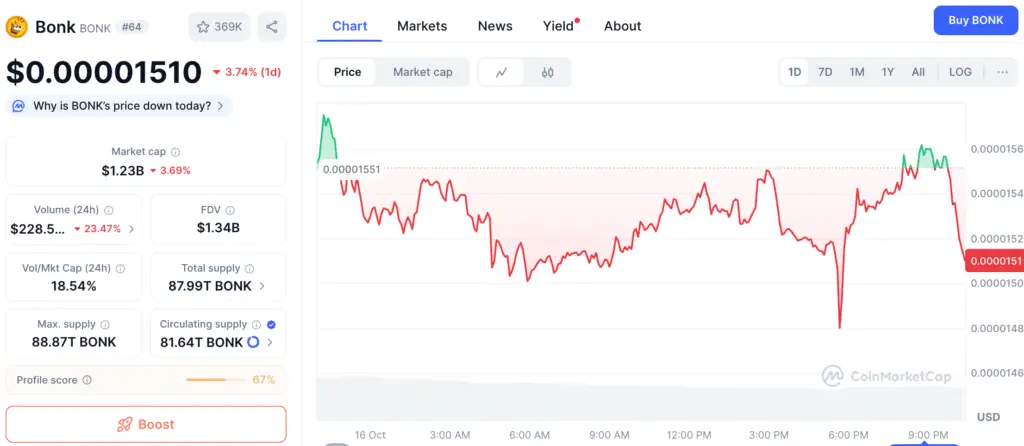

Bonk (BONK), the well-known meme coin on the Solana network, is making a comeback in the market after its recent decline. The token, previously dipping to approximately $0.000016, is now exhibiting evident signs of stabilization. Market participants and experts are optimistic about the possibility of a significant rally in November, backed by a combination of technical signals and positive sentiment indicators.

The fresh sense of hope arises from previously undervalued circumstances and increasing collective investment. Historical data indicates that November frequently ushers in significant recoveries for altcoins, suggesting that BONK is poised to take advantage of the upcoming bullish sentiment in the crypto market.

Altcoins Gain Strength Ahead of Potential Altseason

Recent trends show that broader market indicators, such as OTHERS (total crypto market cap excluding Bitcoin and Ethereum) and TOTAL3 (excluding BTC, ETH, and stablecoins), are on the rise once more. Experts interpret this as a preliminary indication that a phase of altseason could be on the horizon—a time when altcoins surpass Bitcoin in terms of relative gains.

The sentiment surrounding BONK is becoming more and more favorable. Social media analysts such as @uselesschad have observed that numerous traders are “not bullish enough” on BONK, indicating a potential for untapped optimism in the present market environment.

BONK Oversold as RSI and Wedge Pattern Signal Potential Major Breakout

Technical indicators indicate that BONK is currently in an oversold condition, as the Relative Strength Index (RSI) approaches historical support levels. Experts point out that these circumstances have often come before significant recoveries in meme coin trends. The daily chart reveals a falling wedge pattern, which further indicates the potential for an upcoming breakout.

Trader Nirvan (@Nir7ann) believes that BONK is “a very solid play here,” highlighting that he is “slowly scaling” his position in expectation of significant gains. The imminent SMA50 crossover, along with the increasing On-Balance Volume (OBV) metrics, strengthens this optimistic perspective, indicating a rise in accumulation by both retail traders and larger investors.

Recommended Article: Bonk Eyes 2024 Rally as Nasdaq Rebrand Boosts Investor Hopes

Fibonacci Targets Point to Multi-Stage Rally

Traders are paying close attention to Fibonacci retracement levels to pinpoint exit zones amid the anticipated rally. The first major target sits at $0.00001865, followed by $0.00002145, $0.00002600, and $0.00003220. Each signifies an important psychological threshold where profit-taking may happen prior to a move towards greater resistance.

Should the bullish momentum continue, experts predict that BONK could hit $0.00005000, a target that corresponds with previous Fibonacci extensions and historical price highs. This action would signify a remarkable 200% rise from existing prices, positioning BONK as one of the leading meme coins of Q4 2025.

Bonk’s 10,000% 2023 Rally Fuels Fresh 10x Forecasts Amid Solana Revival

Introduced in December 2022, Bonk allocated 50% of its total supply through a community airdrop, generating significant interest throughout the Solana ecosystem. The token’s reputation skyrocketed in 2023, achieving a remarkable 10,000% rally, which aligned perfectly with Solana’s significant resurgence in the DeFi space.

Market observers such as Zer0 (@degengambleh) are now forecasting another 10x increase by the end of the year, pointing to heightened network activity and speculation regarding Solana’s forthcoming updates. These predictions, though daring, align with BONK’s historical trend of significant surges after extended periods of consolidation.

Public Opinion Stays Strong

In the face of recent fluctuations, the community surrounding BONK continues to show remarkable engagement. Trader forums and Solana social channels consistently emphasize the token’s enduring meme allure and trading fluidity. Experts project that BONK’s monthly returns may fall within the range of 8% to 10%, considering the present accumulation rate and the advantageous chart configuration.

Nonetheless, it is essential for investors to remain vigilant. Meme assets are characterized by their speculative nature and high sensitivity to shifts in sentiment, frequently responding dramatically to external catalysts or changes in liquidity. Effective position sizing and risk management are essential when engaging in trading BONK or comparable assets.

BONK Price Action Confirms Bullish Reversal With Eyes on Higher Targets

With the bearish head-and-shoulders pattern from October now invalidated, BONK’s chart structure has shifted to a clear bullish trend. The existing support levels around $0.00001580–$0.00001600 present a compelling opportunity for accumulation, whereas resistance above $0.00001870 may act as a catalyst for a breakout.

If momentum continues to grow through early November, BONK may first surge towards $0.00002600 before attempting to reach $0.00005000 in a significant parabolic movement. The interplay of historical cycles, enhanced sentiment, and increasing activity on the Solana network all bolster the likelihood of a robust upward trend extending into Q4 2025.