The Promise of Tokenized Real-World Assets

Ondo Finance is at the forefront of a significant shift in the crypto space, aiming to make traditional financial assets like stocks, bonds, and ETFs as easily tradable as stablecoins. This is the core of the Real World Asset (RWA) narrative, which many analysts believe could be one of the most powerful trends of this market cycle. The project’s token, ONDO, is central to this vision, leading many to question if it has the potential to see a 10x price increase by 2026.

Ondo Finance’s Unique Position in the Market

According to Matty from Altcoin Buzz, Ondo Finance has established itself as a clear leader in the RWA sector. Unlike other projects that offer broad infrastructure services, Ondo has narrowed its focus almost entirely on tokenizing securities. This clarity of purpose and singular focus on bringing traditional assets on-chain is a key factor that distinguishes it from its competitors.

A Game-Changing Liquidity Model

A major upcoming development, the launch of Ondo Global Markets, is highly anticipated. This platform will enable hundreds of publicly traded stocks, bonds, and ETFs to be brought on-chain. The platform’s unique value proposition lies in its approach to liquidity, as Ondo is designing its system for instant, zero-cost minting and redemption.

This mechanism ensures that the price of the tokenized asset remains closely aligned with its real-world counterpart, avoiding common issues like low liquidity and de-pegging that plague other platforms.

Read More: Ondo Bridges DeFi and Traditional Finance with RWA Innovation

How Ondo Finance Is Like a Stablecoin

Ondo Finance’s strategy is similar to what stablecoins have done for fiat currency. Just as stablecoins turn cash into tokens that can move easily across blockchains, Ondo plans to do the same for securities. For instance, an investor could use stablecoins to purchase exposure to a stock like Tesla.

The actual share is then bought in the real world, and the investor receives a TSLAON token that is fully backed by the share. An arbitrage mechanism is in place to keep the token’s price in sync with the actual stock, preventing spread issues.

Strategic Partnerships and Acquisitions

The project is also building a strong network through its Global Market Alliance, which includes exchanges, custodians, and DeFi platforms. This alliance aims to create industry standards for RWA tokenization. Key acquisitions, such as blockchain infrastructure firm Strangelove and SEC-registered broker-dealer OasisPro, further demonstrate the team’s strategic focus on both innovation and regulatory compliance. These moves suggest a long-term plan for expansion and legitimacy.

What the Experts Are Saying About ONDO

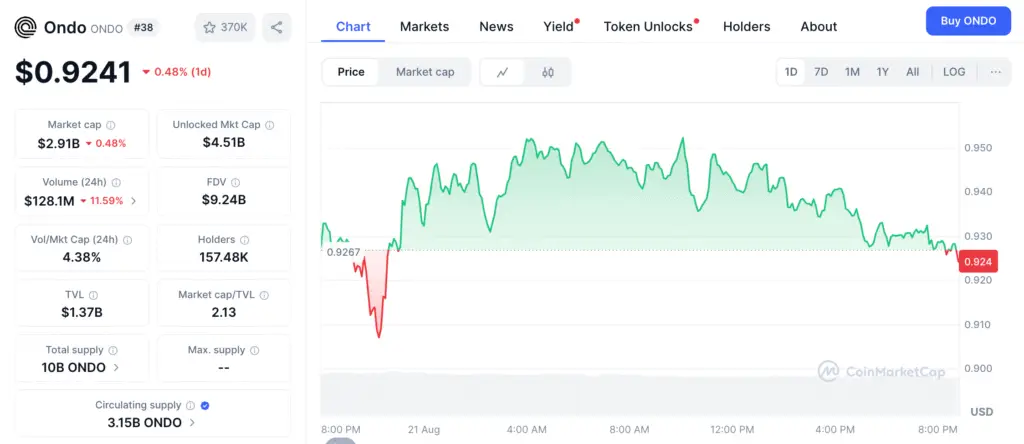

Analysts are offering a range of price targets for ONDO. The token is currently trading just under $1, with a market cap around $3.1 billion. A key factor limiting potential sell pressure is the absence of major token unlocks until January 2026. Specific price predictions from analysts include:

- Ali Martinez: A possible move toward $2.80.

- ETH Signals: A short-term target of $3.

- Kyron: A cycle top around $10.

- Jolly Green Money: A prediction that ONDO could hit $20.

Matty himself argues that a 10x to 11x move is possible this cycle, given the growth of the RWA sector, the strength of Ondo’s products, and the broader crypto bull market.

Ondo Finance: A Significant Player in RWA

Ondo Finance’s clear focus on tokenizing securities, combined with its strategic partnerships and a strong technological foundation, positions it as a significant player in the RWA space. While the market is always volatile, the project’s efforts to create a liquid and compliant platform for traditional assets on the blockchain are attracting considerable attention from analysts and investors. The alignment of infrastructure and market demand suggests a promising path for ONDO, making it a token to watch as the RWA narrative continues to unfold.