Cardano Price Falls Into Confirmed Bear Market

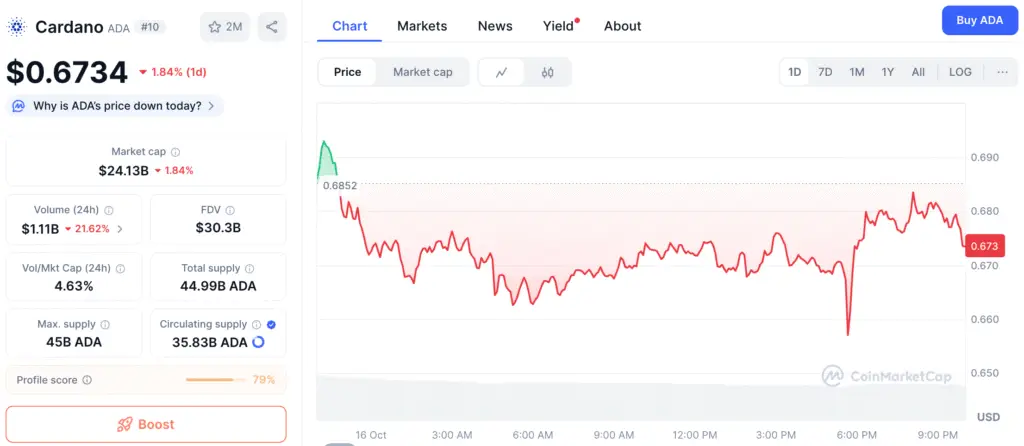

Cardano (ADA) has clearly entered a bear market this month, with its price dropping to $0.6680 after struggling to maintain gains above $1.0205 in August. The drop in the cryptocurrency reflects the overall market’s struggles, yet it is intensified by its weakening technical framework and slow on-chain engagement.

Experts caution that if purchasing activity does not pick up shortly, ADA may keep declining towards $0.48, indicating a possible 25% drop from present values. The interplay of technical failures and fragile network fundamentals has solidified negative sentiment regarding Charles Hoskinson’s blockchain.

Technical Breakdown Confirms Further Weakness

The daily chart reveals a distinct trend of ongoing selling pressure. ADA has dropped beneath the Murrey Math pivot point at $0.6836, indicating a shift from consolidation to a breakdown phase. The breakdown of the lower rising wedge boundary has negated earlier bullish patterns, signaling the beginning of a downward trend.

In line with this negative perspective, ADA has developed a head-and-shoulders pattern, which is a well-known signal of reversal. The 50-day and 200-day exponential moving averages (EMA) are nearing a crossover that could indicate a death cross, often suggesting extended weakness in price movement.

Essential Support Levels to Monitor

The upcoming significant support is positioned around $0.4883, corresponding with the double-bottom pattern observed in April and June. Neglecting to protect this area might lead to a prolonged drop towards $0.45 or potentially $0.40, especially if overall market volatility escalates.

On the other hand, a rise above $0.70 would disrupt the bearish trend, possibly enabling ADA to revisit $0.83. However, this outcome appears less probable considering the current momentum indicators.

Recommended Article: Cardano Whales Buy $140M as Breakout Momentum Strengthens

Cardano Faces ‘Ghost Chain’ Label as On-Chain Activity Hits Record Lows

The technical weaknesses of Cardano are further exacerbated by its lackluster fundamentals in comparison to other Layer-1 blockchains. Even with a market capitalization of $24 billion, the network exhibits little ecosystem activity, earning it the designation of a “ghost chain.”

In contrast to Solana, BNB Chain, and Tron, Cardano experiences lower transaction volumes and user engagement. The total value locked (TVL) has fallen to a mere $285 million, indicating a significant outflow of liquidity from DeFi protocols. The supply of the network’s stablecoin is a mere $36 million, underscoring its minimal presence in the decentralized finance landscape compared to rivals such as Ethereum and Solana.

Institutional and Developer Interest Remains Minimal

The excitement among institutions for Cardano is gradually diminishing. Despite several companies submitting applications for XRP and Solana ETFs, Grayscale stands out as the sole proposer of a spot ADA ETF, reflecting a lack of widespread investor confidence. The lack of prominent DeFi projects like Aave and Uniswap on the Cardano blockchain highlights its limited appeal to developers.

The separation from mainstream DeFi and ETF movements indicates that ADA might persist in trailing its counterparts in drawing investment and developing viable use cases.

Cardano Struggles to Deliver as Key Partnerships and Milestones Stall

Cardano’s leadership, guided by Charles Hoskinson, has encountered scrutiny for making ambitious promises that have not been fulfilled regarding significant milestones. The widely discussed partnership for blockchain education in Ethiopia, revealed in 2021, has not yet yielded significant outcomes. In a similar vein, the anticipated integrations with BitcoinOS and Chainlink have yet to come to fruition, despite numerous public declarations.

The inability to obtain Chainlink oracle support raises significant concerns, as it restricts Cardano’s ability to interact with the DeFi ecosystem. Numerous emerging chains, even with their limited user bases, have successfully integrated Chainlink, which is causing Cardano to feel more isolated in a competitive landscape.

Confidence in the Market Diminishes as Activity Decreases

The absence of strong use cases and delayed development updates have weighed on investor confidence. Throughout October, trading volumes in ADA spot markets have consistently declined, and whale accumulation has shown little activity. This indicates that institutional players are exercising caution, opting to direct their capital towards higher-growth ecosystems like Solana or Avalanche instead.

In the absence of a definitive trigger, Cardano may face the prospect of a steady downturn as we move into the fourth quarter. Experts suggest that a significant technical enhancement or substantial growth in the ecosystem may be necessary to change the current trajectory.

Cardano Bears Gain Control as ADA Targets $0.40 Amid Weak Market Support

Considering the present circumstances, the forecast for ADA in late 2025 appears pessimistic. Unless Cardano decisively breaks above $0.70, the likelihood of a correction toward $0.48 or lower stays significant. A continued decline beneath that level might push losses down to $0.40, wiping out the profits gained earlier this year.

Given the lack of strong DeFi engagement, minimal support from institutions, and ongoing delays in execution, the immediate outlook for Cardano seems bleak. Traders might consider reentering the market only when there are unmistakable indicators of stabilization or a resurgence in on-chain growth, both of which are currently hard to find.