Cardano Regains Traction Following Extended Period of Stability

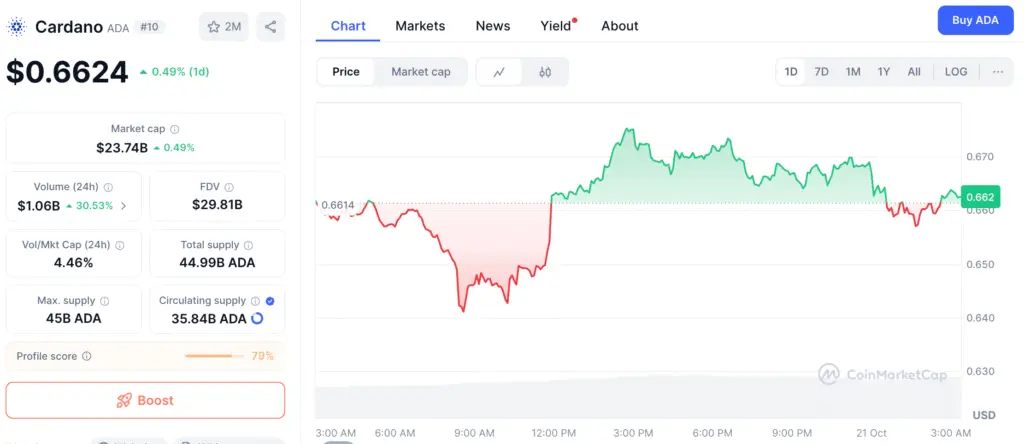

Cardano (ADA) is demonstrating a resurgence in momentum following a prolonged period of stability, indicating fresh interest from investors. The token experienced a notable increase of 5.6% over the past 24 hours, currently trading at approximately $0.67, as reported by BraveNewCoin data. This action elevated its market capitalization to over $24.4 billion, indicating enhanced liquidity and greater involvement from investors.

The rebound comes after multiple periods of constrained trading around the $0.60 mark, where purchasers reliably upheld support levels. Experts suggest that this rebound may pave the way for a more significant upward trend as momentum indicators start to align with bullish sentiment.

Analytical Indicators Point to Additional Growth Opportunities

If ADA maintains its upward trajectory, the first points of resistance are at $0.70 and $0.75, with more significant targets set at $0.80 and $1.00. The levels align with previous rejection points from early 2024, highlighting crucial benchmarks for any ongoing recovery effort.

However, experts pinpoint $0.63 to $0.64 as a crucial support range. Keeping this range intact is essential to avoid renewed selling pressure and preserve ADA’s medium-term positive trend as we move into Q4 2025.

Cardano Forms Symmetrical Triangle Pattern Signaling Possible Breakout

A recent technical update from Top Gainer Today reveals that ADA’s price has developed a symmetrical triangle pattern, a formation that frequently signals significant directional shifts ahead. Cardano has recently surpassed its short-term downtrend and is currently revisiting the breakout line near $0.65 to validate support.

If the bulls maintain their position in this area, experts anticipate a surge toward $1.00–$1.20, which corresponds with the calculated movement from the triangle formation. This optimistic pattern mirrors configurations from previous cycles that resulted in swift increases following confirmation.

Recommended Article: Cardano Gains Momentum as ETF Talks and DeFi Usage Surge

Historical Fractals Indicate a Potential Repeat Rally

Renowned analyst Sssebi observed that Cardano’s present market dynamics closely resemble historical patterns identified during earlier bullish phases. Historically, ADA has undergone significant downturns, often followed by rapid recoveries and phases of stabilization before substantial upward movements.

The current recovery indicates a similar setup, implying that ADA may be preparing for another surge. Sssebi’s projection suggests the upcoming rally could first aim for the $0.80 mark, paving the way for a potential breakthrough past $1.00.

Cardano Builds Momentum as RSI Recovery Aligns With Market Optimism

Technical indicators bolster the rising optimism. The Relative Strength Index (RSI) has bounced back from oversold levels, signaling renewed buying interest. Meanwhile, a consistent rise in trading volume indicates that accumulation is taking place across prominent exchanges.

These conditions frequently precede larger rebounds, particularly when paired with growing optimism throughout the broader cryptocurrency landscape. The correlation between higher volume and a strengthening RSI reinforces the case for a bullish breakout.

Community Sentiment Strengthens Future Perspective

The community surrounding Cardano remains steadfast in its belief in the project’s future prospects. Analyst Crypto Jebb highlighted that ADA is strategically positioned to recover and surpass its previous all-time highs in the upcoming cycles.

Amid market fluctuations, Cardano’s holders, renowned for their loyalty, continue to demonstrate confidence in the network’s long-term vision. Their dedication to Cardano’s development roadmap and governance model has kept progress steady even during extended consolidation phases.

Cardano Eyes $1 Target as Renewed Market Confidence Fuels Momentum

Cardano’s resurgence reflects a wave of renewed confidence in the digital-asset landscape as macroeconomic uncertainties begin to subside. The robust support around $0.65, coupled with the validated breakout pattern, establishes a technical basis for a potential ascent to $1.00.

Should ADA sustain its position above $0.63 and continue attracting consistent inflows, experts anticipate a revisit to the $1 psychological threshold in the coming months. A successful breakout beyond that mark could extend the rally toward $1.20, signaling a full recovery from this year’s prolonged consolidation phase.