Cardano Rebounds as Whale Activity Accelerates

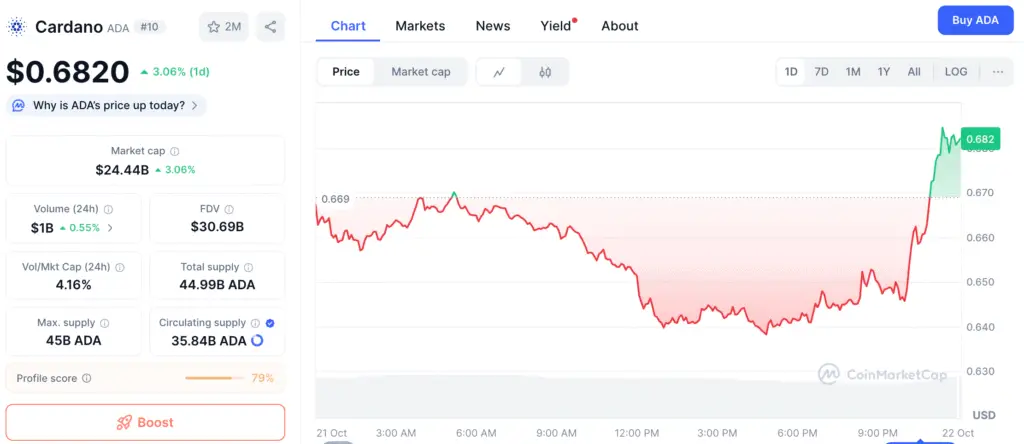

Cardano (ADA) has made a big comeback, climbing 2.2% to $0.70 as big investors start buying again before the Berlin Summit in November. On-chain data shows that whales bought more than 200 million ADA, which is worth around $140 million, in the previous 48 hours. This eased selling pressure by 51% and strengthened short-term support between $0.70 and $0.80.

After weeks of volatility that sent ADA down below $0.61, this increased activity has raised worries about further losses. But the arrival of large institutional purchasers has changed people’s minds, suggesting that a rebound may be on the way as traders get ready for what is likely to happen at the Berlin event.

Whale Accumulation Strengthens Market Confidence

The most recent on-chain data shows a big increase in wallets with 10 to 100 million ADA, as well as an increase in addresses with more than 1 billion ADA. This pattern of distribution suggests that whales are working together to buy up stocks, which is a positive indicator that frequently comes before the market as a whole starts to rebound.

Analysts say these changes show that long-term investors are becoming more sure that Cardano’s price levels are too low. The revival fits with recent news regarding eToro’s U.S. staking integration, which gives 40 million users access to staking and makes the circulating supply tighter.

Cardano Tests $0.73 Resistance as Traders Watch $0.70 Support Zone

There are both chances and risks in Cardano’s current pricing setting. ADA is still recovering, but it is having trouble getting over $0.73, which is the first level that needs to be broken to indicate that the trend is going higher. If the breakout goes well, the token might move toward $0.86, which is the next big resistance zone on daily charts.

On the other hand, if support at $0.70 isn’t maintained, selling pressure might rise again, which could bring prices down below $0.50. Analysts say that the momentum around the Berlin Summit might be the key factor in deciding which way ADA will move next.

Recommended Article: Cardano Price Rebounds 5% as Bulls Target a Breakout Toward $1

Berlin Summit Spurs Ecosystem Anticipation

The Cardano community is very excited about the Berlin Summit, which will take place on November 12 and 13, 2025. The event is anticipated to show off progress on projects like Midnight, Cardano’s privacy-focused sidechain, and Leios, a framework for scalability that aims to improve the speed of block processing.

These projects show that Cardano is serious about creating a safe, decentralized infrastructure that can compete with the best smart contract platforms. People who watch the industry say that Berlin may set the tone for ADA’s next development phase by focusing on how mature the ecosystem is and how likely businesses are to embrace it.

DeFi Integration and Staking Fuel Network Growth

Cardano’s DeFi ecosystem keeps developing quickly, thanks to more liquidity and activity on the blockchain. The addition of staking solutions to centralized platforms has increased the amount of ADA that is locked up, which has slowed down the market. This tightening impact helps keep prices stable, even when the market as a whole is going through corrections.

The Marlowe smart contract architecture is also helping to create new decentralized financial apps in the areas of lending, borrowing, and tokenization. When you add in Hydra’s scaling solutions, these changes show that ADA’s fundamentals are still solid even though the price has gone up and down in the near term.

Cardano Gains Momentum as Traders Shift Toward Mid-Cap Accumulation

Cardano’s rise happens amid a larger crypto market that is mixed. Traders are moving money into mid-cap cryptocurrencies that are exhibiting signs of accumulation since Bitcoin is staying around $108,000 and Ethereum is moving about $3,900. ADA’s comeback, which was backed by whales, is one of the more natural ones in the top 10 market sector.

But volatility is still high, and macroeconomic variables like U.S. inflation statistics and government rates are still affecting how much risk investors are willing to take. Analysts say to be cautiously optimistic because ADA has to keep up its momentum after events like the Berlin Summit that are all for show.

Berlin Could Define Cardano’s Q4 Trajectory

As the Berlin Summit approaches, Cardano’s market view is cautiously positive. The whale-driven bounce has restored faith in ADA’s strength, but for it to keep growing, people will need to keep buying and the ecosystem will need to work.

If ADA stays over $0.70 and goes through $0.73, experts think it will keep going up to $0.86, which might be the start of a bigger surge in Q4. However, if Cardano can’t hold on to its current levels, it might go back to the $0.50–$0.55 region before settling down. In the short term, whale accumulation, staking growth, and network innovation are the main things that might change ADA’s momentum as the year comes to a close.