Cardano Treasury Surpasses $1.6 Billion ADA Benchmark

The community treasury of Cardano has amassed 1.6 billion ADA, which is nearly valued at $1 billion, highlighting its status as one of the largest decentralized treasuries within the blockchain landscape. The fund is steadily expanding through staking rewards and transaction fees, enabling the ecosystem to support innovation independently of outside venture capital.

This self-sustaining model highlights Cardano’s strength in the face of fluctuating market dynamics. The treasury’s growth guarantees a sustainable future for research, infrastructure, and community-focused initiatives, strengthening its commitment to function as a completely decentralized and transparent system.

ADA Price Falls Even as Treasury Sees Gains

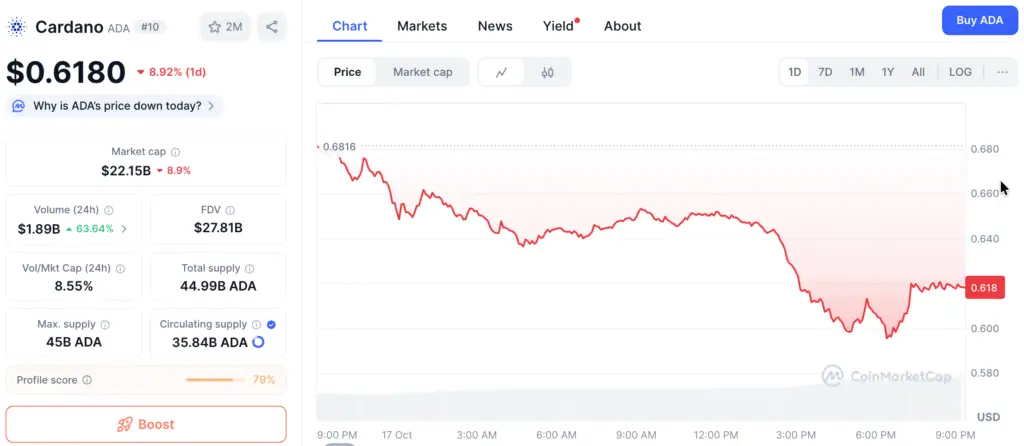

Currently, ADA is priced around $0.60, showing a daily decrease of 3.5% and a monthly decline of 22%. The token has faced challenges in sustaining support levels after a widespread market decline that affected both Bitcoin and Ethereum.

Even with temporary price declines, the growing treasury indicates sustained user involvement and network dynamics. Experts observe that an increase in treasury during economic downturns frequently indicates the robustness of the underlying ecosystem, despite the presence of selling pressure on token prices.

Treasury Funded by Fees and Staking Rewards

The treasury of Cardano expands autonomously via mechanisms embedded within the protocol. Every block allocates rewards to stake pools, delegators, and the treasury. Transaction fees are collected in the treasury wallet, linking growth directly to on-chain activity instead of relying on speculative fundraising.

This model mitigates inflationary supply surges and lessens dependence on outside financing. As network usage expands, treasury inflows rise, establishing a robust financial base for ongoing ecosystem growth.

Recommended Article: Cardano Faces 25% Decline as Bear Market Pressures Intensify

Governance Through Project Catalyst

The Cardano community oversees treasury expenditures through Project Catalyst, a decentralized funding framework that allows token holders to propose, discuss, and vote on various initiatives. Proposals that demonstrate success are granted ADA allocations to enhance development tools, educational initiatives, research efforts, and decentralized application projects.

This governance framework opens up funding opportunities, enabling smaller teams to bring forth impactful innovations. Every funded initiative is monitored with clarity, guaranteeing responsibility and quantifiable results throughout the ecosystem.

Treasury Model Connects Demand With Economic Expansion

Cardano’s unspent transaction output model monitors on-chain involvement. A significant volume of active UTXOs reflects robust transaction engagement and a well-distributed token ecosystem. Heightened user engagement leads to a rise in fees, subsequently speeding up the accumulation of treasury funds.

This feedback mechanism harmonizes economic motivations: increased adoption drives greater treasury inflows, which finance initiatives that enhance network utility even further. The iterative framework enhances Cardano’s enduring capacity for growth and resilience.

Cardano Encounters Resistance Near $1.13 as Downtrend Persists

Currently, ADA is facing significant challenges. The monthly chart indicates that the latest candle is positioned above the 50-period moving average; however, the overarching trend continues to exhibit bearish characteristics. Significant opposition is positioned at $1.13, a threshold that once acted as support prior to the decline experienced last year.

The daily chart indicates that ADA is currently trading beneath all significant moving averages, establishing a consolidation range around the $0.63 support level. A failure to maintain this level may result in a revisit to $0.52, whereas a surge past $0.75 could signal a resurgence in positive momentum.

ADA/BTC Pair and Its Historical Significance

In the current market landscape, ADA is positioned near its range lows against Bitcoin, yet it exhibits signs of potential mean reversion. Analysis of patterns from 2018 and 2021 indicates that extended periods of consolidation frequently set the stage for significant rallies when momentum resumes.

Cardano’s proof-of-stake consensus remains a focal point for delegators, fostering ongoing engagement within stake pools that authenticate transactions and allocate rewards. The project boasts a total supply of 45 billion, with 36 billion ADA currently in circulation, underscoring its significant market valuation of $30 billion when fully diluted.

Cardano Treasury Milestone Strengthens Path Toward Decentralized Growth

Despite the fluctuations in ADA’s short-term price, the achievement of the treasury milestone highlights a significant long-term benefit: the pursuit of financial independence via decentralization. Cardano’s capacity to generate funding through its own usage, rather than relying on external investments, bolsters its status as a self-sustaining blockchain ecosystem.

If the network continues to engage in activity and governance participation, the price of ADA may ultimately mirror this increasing on-chain value. Currently, traders are closely monitoring the $0.60–$0.63 range, which is seen as vital support. Meanwhile, developers and community members are concentrating on innovative projects backed by the treasury that will influence the next stage of Cardano’s development.