Cardano’s Goal as a Layer-1 Blockchain

Cardano wants to make sure it stays the top Layer-1 blockchain for research in the new era. The token is now trading close to a key support level. Analysts are hoping that a new breakout will start a rally that will take the price to a new target of one dollar. A lot of people find this to be a big mental block.

A lot of optimism has come into the market because of institutional interest, especially from Grayscale’s upcoming ADA ETF. If it gets the go-ahead, the ETF could bring in a lot of new money into the ecosystem. This would prove that ADA is a smart contract asset. It could speed up its journey to a new, much higher price.

The DeFi Revolution and Agility of Mutuum Finance

Mutuum Finance (MUTM) is becoming a disruptive force in the decentralized finance market. The project is using a new dual-lending model to change how easy it is to use DeFi. Its peer-to-contract framework makes lending easier by using smart contracts. These smart contracts change interest rates automatically based on how much people want them.

The project’s community-driven momentum is very impressive and is a big part of why it has done so well so far. The presale has already brought in a lot of money from thousands of token holders. A new bug bounty program and other security measures are building even more trust. This project is a lot more flexible than Cardano.

The Fight Between Stability and Quick Change

Cardano’s growth is being held back by problems in the economy as a whole and the slow pace of its efforts to become more decentralized. The project’s methodical approach is very different from the fast iteration that is common in many new DeFi projects. This is a very different way of thinking about how to build a new ecosystem. The emphasis on academic rigor is both good and bad.

Mutuum Finance, on the other hand, is doing well because of a new kind of flexibility. Its dual-lending model and focus on the community make it well-suited to take advantage of Ethereum’s consolidation phase. Its price is lower than other options, which makes it a great investment opportunity, even though it is volatile and has not yet proven its scalability.

Recommended Article: Mutuum Finance Gains Momentum Over Dogecoin

Cardano’s Market Volatility and Big Economic Problems

There has been a lot of new bearish sentiment and strong bullish fundamentals fighting over Cardano’s price action in 2025. Right now, the token is trading close to a key support level. Analysts say that if the price breaks above this level, it could start a new rally toward a much higher price target.

But the token’s growth is limited by problems in the economy as a whole and the slow pace of its efforts to become more decentralized. Whale accumulation, which means putting a lot of money into long-term holdings, shows that people really believe in ADA’s long-term value. But a lot of people are still worried about short-term price changes.

How Mutuum Finance Is Gaining Attention

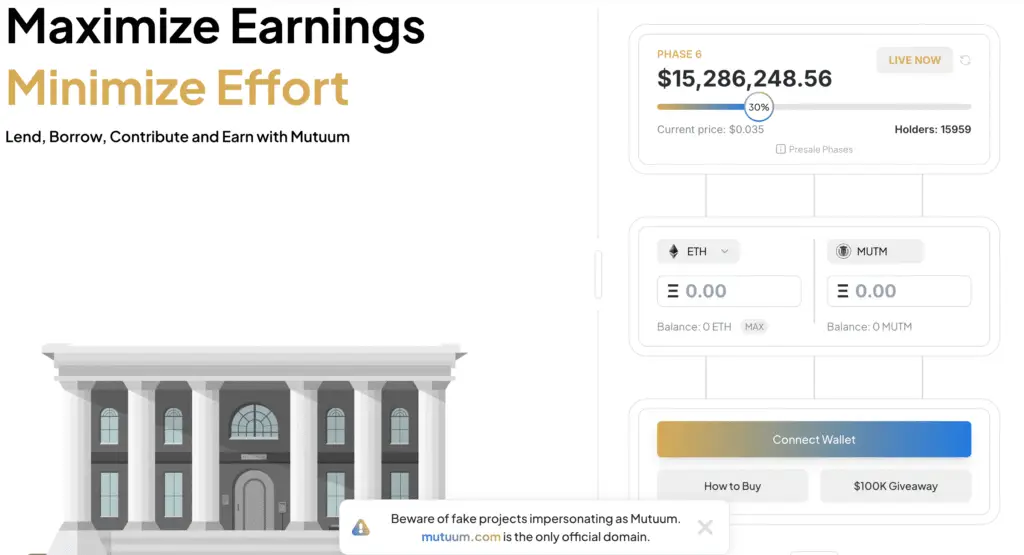

Mutuum Finance is getting a lot of attention from investors because of its groundbreaking and very successful presale. The presale for the project has already brought in more than $14.8 million, which is a very impressive amount. In the next phase, the price of the token is expected to go up to a new level.

This successful presale shows that investors are very confident and that their confidence is growing. Cardano is focused on institutions, but Mutuum Finance’s deflationary tokenomics and new USD-pegged stablecoin give its users a lot of immediate benefits. This makes it a very appealing option for investors who want to see a lot of new growth.

The Big Choice in the Altcoin Season

In the altcoin season of 2025, investors are now in a big bind. Cardano’s future depends on a lot of big companies using it and good macroeconomic conditions. If the Grayscale ETF gets the green light, there could be a huge increase in demand for ADA. But its methodical way of doing things might take a lot longer.

On the other hand, Mutuum Finance is doing well because of a new kind of flexibility. It is in a good position to take advantage of the market’s consolidation because of its dual-lending model and focus on the community. Mutuum’s volatility and lack of proven scalability do pose some risks, but it makes a strong case for people who want to get in on the next big thing.

Cardano’s Credibility vs. Mutuum’s Potential

Now, investors in 2025 have to think about Cardano’s credibility with institutions and Mutuum Finance’s potential to shake things up. ADA’s goal of one dollar is still possible if a lot of things go right, but its method may not work as well in a market that moves quickly. MUTM token is riskier, but it makes a strong case for people who want to be on the cutting edge.

As the year goes on, the relationship between these two very different paths will shape a lot of the altcoin world. In the end, the decision will depend on how much risk a person is willing to take and what their long-term investment goals are. A lot of people in the market today need to make this choice.