Chainlink Confronts Its 2021 Legacy Barrier

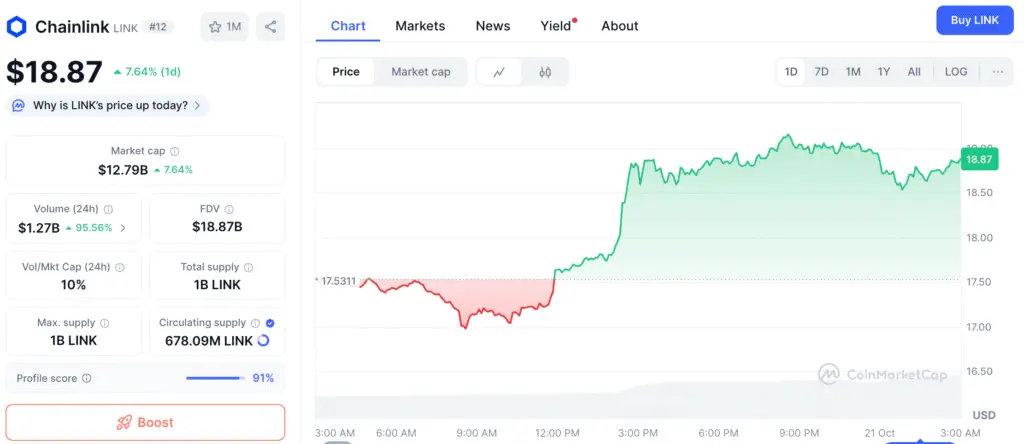

Chainlink (LINK/USD) is encountering a significant technical barrier—the $23.11 resistance level that has limited every major rally since May 2021. Even with solid fundamentals and a resurgence of investor interest, the decentralized oracle token continues to be confined below a long-term declining trendline that has characterized its price structure for several years.

Following a notable breakout effort in August 2025, LINK experienced a brief surge before reversing direction, resulting in a 38% decline from the peak of that movement. The inability to maintain momentum beyond the historical resistance level has solidified the $23 zone as the critical challenge for bulls aiming for a long-term breakout confirmation.

$16.50 Support Defines Chainlink’s Current Structure

Despite the significant fluctuations in the wider crypto market, Chainlink has managed to maintain its $16.50 support level through several daily closing prices. This assistance has now emerged as the crucial technical basis for regaining momentum. As long as LINK maintains its position above this threshold, the likelihood of sideways consolidation and gradual accumulation is greater than that of a more significant correction.

Experts in the field highlight a growing demand threshold near $16.50, indicating that long-term investors are persistently building their positions at these price points. Should this vital defense falter, the subsequent structural support level is positioned around $12.14, aligning with a previous ascending trendline from early 2023.

The 2021 Trendline: Why $23.11 Remains Chainlink’s Ceiling

Chainlink entered a prolonged decline starting in May 2021, after reaching its peak around $52. Since that time, every significant rally has encountered obstacles at the same descending resistance line, with several rejection points establishing a reliable barrier for price growth.

The trendline resistance currently intersects at approximately $24.11, indicating the next significant target zone for any potential bullish resurgence. Market participants are paying close attention to this level, viewing it as a critical breakout point; a definitive daily close above $24 may indicate a significant structural shift and potentially negate the prolonged bearish trend that has limited LINK’s price movement for more than four years.

Recommended Article: Chainlink Price Drops Below Key Levels, $14 Support in Focus

Consolidation Likely Before Major Trend Reversal

Market analysts observe that Chainlink’s recent activity aligns with a traditional consolidation pattern. The movement between $16.50 and $23.11 illustrates a compression range characterized by the back-and-forth of accumulation and distribution. These ranges frequently set the stage for significant directional breakouts when sufficient volume and liquidity align.

For Chainlink, ongoing lateral trading within this range could bolster market dynamics in anticipation of a forthcoming breakout effort. In the past, the token has experienced extended phases of consolidation before triggering significant rallies—a trend observed in late 2020, which preceded its remarkable surge in 2021.

Chainlink’s Network Activity Rises as CCIP Gains Institutional Traction

Even with prices holding steady, on-chain metrics indicate a rise in network activity and developer involvement. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is drawing significant attention from institutions, facilitating secure data exchanges across various blockchains and real-world APIs.

Furthermore, the transaction volume associated with Chainlink oracles has shown consistent growth, underscoring its position as the foremost decentralized data solution within the DeFi landscape. Experts indicate that an increase in network utility may ultimately lead to enhanced price stability as overall market conditions begin to recover.

Market Sentiment Remains Neutral but Stable

Investor sentiment regarding Chainlink is characterized by a careful sense of optimism. The token’s capacity to maintain a position above $16.50 amid recent market downturns highlights its resilience in contrast to other altcoins. Nevertheless, experts warn that the mood could shift rapidly if Bitcoin’s fluctuations impact the decentralized finance space.

The current outlook is neutral as the price stabilizes, with a bullish reversal only validated by a breakout and a close above the $23.11–$24.11 resistance zone. In the meantime, traders are expected to persist with strategies that focus on the $16.50–$22.00 range.

Chainlink Holds Above $16.50 as Accumulation Builds for Next Rally

The upcoming pivotal action for Chainlink will hinge on the price dynamics in relation to its historical thresholds. Provided that $16.50 remains intact, further accumulation is anticipated to persist. A confirmed breakout above $23.11 may pave the way for a medium-term rally toward $30–$32, indicating a potential conclusion to the 2021 downtrend.

On the other hand, if the daily close falls below $16.50, it could pave the way to $12.14, a level where more robust long-term buyers might re-enter the market. At this moment, LINK stands as a token for those who trade with patience, quietly consolidating ahead of a possible breakout that may shape its forthcoming significant cycle.