Chainlink Price Surges on S&P Global Collaboration

Chainlink’s (LINK) price surged to $18.47 following the announcement of an innovative partnership with S&P Global Ratings. The partnership unveils risk assessments for on-chain stablecoins utilizing Chainlink’s DataLink oracle infrastructure.

Even in the face of wider market challenges, this development has ignited a sense of optimism among investors, who see this partnership as a significant advancement in the journey toward institutional blockchain adoption. Experts anticipate that the agreement will greatly enhance Chainlink’s position in the realm of regulated finance.

Live Assessments of On-Chain Stablecoin Risks

Through this collaboration, S&P Global will provide assessments of credit, market, and custody risks for stablecoins directly on blockchain networks. The initial rollout of these reports will take place on the Base network, with plans to extend to additional chains thereafter.

Over 2,400 financial institutions will now have access to standardized metrics for stablecoins through Chainlink’s secure oracle system. The initiative seeks to improve transparency and foster trust in both decentralized finance and institutional markets.

Growing Institutional Interest Bolsters Chainlink’s Relevance

Chuck Mounts, S&P Global’s Chief DeFi Officer, characterized the partnership as a significant achievement in the integration of conventional finance and decentralized technology. He highlighted the organization’s dedication to delivering dependable on-chain data infrastructure to its clients.

The stablecoin sector has now surpassed $300 billion in total value, and this collaboration may significantly boost mainstream adoption. By integrating risk assessments directly into smart contracts, Chainlink strengthens its role as the connector between decentralized finance and traditional finance.

Recommended Article: LINK Price Prediction Targets $195 by 2030, Say Analysts

Experts Establish Optimistic Projections After Breakout Formation

Technical analyst Ali Martinez has pinpointed Chainlink as operating within a favorable long-term buying range, forecasting a possible ascent towards $100. The token is presently moving within a symmetrical triangle formation, showing support at $15 and encountering resistance around $21.

Martinez anticipates that a surge past $21 will initiate upward movements toward $37, $55, and ultimately $100. He observed that LINK’s technical configuration corresponds with a wider accumulation phase, indicating robust institutional buying activity.

Chainlink Broadens Collaborations with Major Financial Players

Sergey Nazarov, co-founder of Chainlink, emphasized that the integration with S&P Global enhances the oracle network’s footprint in traditional finance. He emphasized that leading financial institutions are currently utilizing Chainlink for data connectivity.

The oracle network safeguards almost $100 billion in total value locked within DeFi and has handled more than $25 trillion in transaction value. The current collaborations feature notable names such as Swift, Fidelity, UBS, Mastercard, and J.P. Morgan, highlighting the growing influence of Chainlink’s ecosystem.

S&P Global Expands Its Influence in DeFi Markets

S&P Global has been broadening its blockchain efforts since 2021, when it introduced its inaugural cryptocurrency index series. In 2023, the dedicated DeFi group, under Chuck Mounts’ leadership, created the Stablecoin Stability Assessments framework.

In August 2025, S&P Global released its inaugural on-chain credit rating for Sky Protocol, signaling a significant shift in the regulation of decentralized finance. The collaboration with Chainlink advances the integration of traditional ratings into blockchain ecosystems.

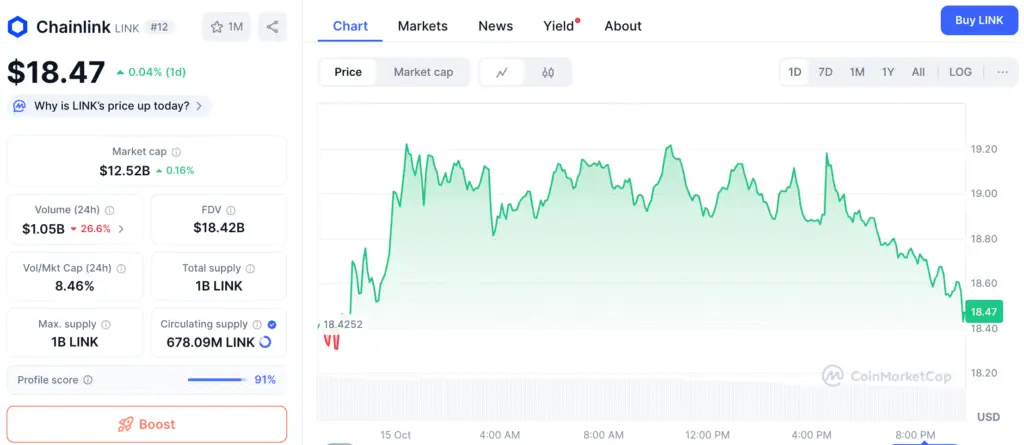

Chainlink Holds Near $18.60 as Investors Stay Bullish Despite Daily Decline

After the announcement, LINK stabilized near $18.60, recovering from earlier session lows of $18.22. Even with a 5% drop each day, the outlook among investors stays optimistic because of the partnership’s potential benefits in the long run.

Should the market momentum persist, experts suggest that the LINK price may regain higher resistance levels beyond $21 and possibly surge towards the $30 area. With Chainlink’s increasing institutional adoption, it is poised to emerge as one of the leading DeFi assets as we approach 2026.