Chainlink Holds $18 Support Despite Market Fluctuations

Chainlink remains strong despite the volatile crypto market, with strong support at the $18.00 level. This level is seen as a key demand zone, where buyers continue buying even when sellers pressure them.

Since early October, this price point has been tested multiple times, confirming its position as a foundation for a possible bullish continuation. Traders are buying LINK during dips, seeing consolidation as a sign of a breakout. The $18 area has been consistently defended, signaling a solid re-accumulation pattern, setting the token up for upward momentum.

$20 Resistance Could Trigger the Next Market Shift

Chainlink’s future move is influenced by resistance at $20.00, with a clear closure above this level signaling a significant change in the structure. The Fibonacci retracement range of $18.3 to $19.6 indicates where LINK typically stops before moving up.

If trading activity increases and the price breaks over $20, it may reach $22.00 to $24.00, with the $18.00 zone serving as the pivot point between consolidation and a fresh upswing. Traders are monitoring volume spikes and momentum confirmations for the next rising phase.

Chainlink Builds Base at $18.80 as Analysts Eye Multi-Stage Recovery

Ali, a well-known crypto expert, says that if Chainlink breaks above $25, it might be the start of a long-term positive turnaround. His research shows that a symmetrical triangular pattern has been building since 2022, which is a sign that the market is about to explode. If LINK stays above $25 for a long time, it might start a multi-stage recovery pattern, similar to past LINK rallies.

Ali uses Fibonacci extension models to provide possible price targets of $32, $53, and $99. These goals imply that LINK might return to the triple digits in the long term if it starts a fresh macro rally. The coin is presently trading at $18.80, which is a hint that it is starting to build up in a strong technical structure.

Recommended Article: Chainlink Price Nears $17 Support Despite Fed Recognition

Technical Patterns Reinforce Bullish Market Structure

LINK is making higher lows in a rising channel, indicating strong buyers. This pattern aligns with bullish continuation setups, where smaller ranges precede faster breakouts. The technical story is supported by the positive sentiment towards DeFi integrations.

Analysts predict that if the price stays above $20 for a long time, it will complete the pattern’s confirmation phase and lead to more purchasing up to $25. Failure to hold $18 support may slow the rebound, but it won’t change the long-term bullish narrative until forcefully broken.

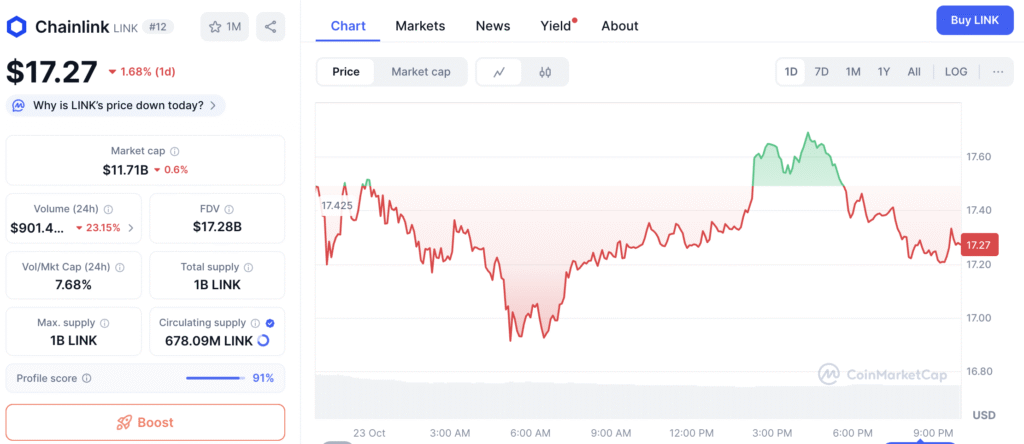

Chainlink Volume Surges to $1.35B as Investors Accumulate for Long Term

In the last 24 hours, Chainlink has traded more than $1.35 billion, which shows that the market is more active. With a market valuation of about $12.94 billion, the token is currently one of the top DeFi assets. The steady rise in volume while prices stay the same shows that both retail and institutional investors are actively participating.

Historical accumulation data shows that LINK’s on-chain holders are expanding their exposure, which means they believe in the asset’s long-term potential. As accumulation grows, the lack of supply might make subsequent breakout movements even stronger if resistance zones are broken.

Short-Term Consolidation Sets Stage for Expansion

Recent price movements show that Chainlink is developing a new short-term base in a consolidation corridor between $18.30 and $18.90. This kind of activity in a range usually happens before a change in direction, especially when the volume is rising. Analysts say that keeping this range up promotes bullish continuation possibilities, and the price might speed up toward $22.00–$25.00 in the next few days.

The Relative Strength Index shows that there is still potential for the market to go up before it becomes overbought. The setup shows that LINK is getting ready for a big breakout, as long as critical resistance levels match up with rising demand.

Chainlink Poised for Major Breakout Opportunity

Chainlink’s structural support, rising volume, and good technical formations all hint at a trend reversal that is about to happen. Analysts say that a closing over $20 would show that the market is positive, and a breakout above $25 that lasts might start a big surge.

Chainlink’s fundamentals continue to attract long-term investors as it plays a bigger role in DeFi infrastructure and the integration of real-world assets. If the present accumulation phase keeps going, LINK could be about to begin a new growth cycle, which could mean it tests higher Fibonacci goals and reestablishes its supremacy in the altcoin market.