Chainlink Consolidates Near Crucial Support Levels

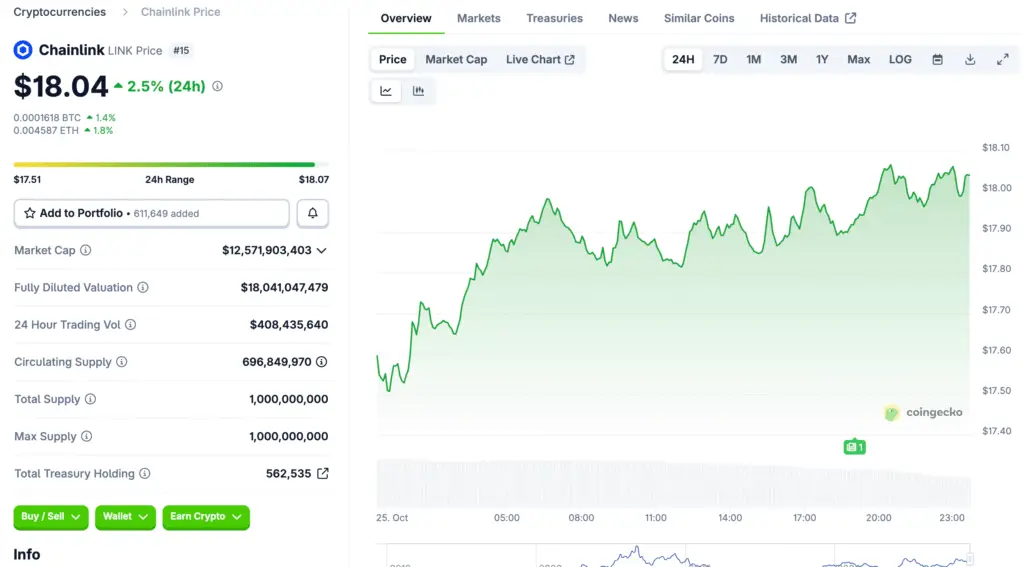

Chainlink’s price has remained steady near $17 following weeks of volatility across the crypto market. Despite a mid-October dip to $16, LINK quickly regained footing amid renewed investor confidence. Analysts note that its Fibonacci retracement support at $15 continues to serve as a strong defense zone. This resilience indicates a healthy consolidation phase that could precede the next major rally.

Whale Activity Surges as Accumulation Intensifies

Recent data from Santiment reveals a surge in large-wallet activity around Chainlink. Wallets holding between 100,000 and 1 million LINK have collectively accumulated 40 million tokens over the past year. In the last month alone, 13 million additional LINK were acquired, pushing total whale holdings to 54.5 million tokens. Such consistent accumulation historically signals long-term bullish intent.

On-Chain Indicators Suggest Upward Momentum

Chainlink’s supply distribution metrics highlight a steady migration of tokens from exchanges to cold storage. This trend reduces circulating supply, tightening liquidity on major trading platforms. When combined with increasing network engagement, these fundamentals strengthen the case for an upside breakout. Analysts interpret this as the early stages of a renewed accumulation cycle.

Recommended Article: Chainlink Targets $25 Breakout as Analysts Predict Bullish Turn

Technical Setup Points Toward a $25 Breakout Level

Chart patterns suggest a symmetrical triangle forming between $17 and $22, often a prelude to strong directional movement. A decisive breakout above $25 would confirm bullish continuation, potentially targeting the $53 mark in subsequent waves. The relative stability of support zones provides traders with defined risk parameters. Volume spikes near breakout thresholds will likely validate directional bias.

Long-Term Price Targets Extend Toward $100

Optimistic projections envision Chainlink testing $53 as an intermediate goal, with potential expansion toward $100 over longer horizons. These targets assume sustained institutional integration of Chainlink’s oracle infrastructure. As smart contracts increasingly rely on verified external data, demand for Chainlink’s services should compound. The network’s unique role positions it as a cornerstone of blockchain interoperability.

Institutional Partnerships Strengthen Market Position

Beyond price metrics, Chainlink continues to secure partnerships with major enterprises and data providers. Collaborations with traditional finance players have enhanced its credibility and scalability. These integrations validate Chainlink’s utility in real-world environments, distinguishing it from purely speculative assets. Institutional endorsement reinforces investor confidence and long-term network adoption.

Whale Behavior Reflects Market Maturity

Whales accumulating during consolidation phases often anticipate extended growth periods. Their gradual accumulation strategy indicates strategic conviction rather than short-term trading. This behavioral shift marks a maturing market dynamic where long-term value outweighs speculative momentum. As smaller investors follow, liquidity and volatility could rise in tandem.

Outlook: Building Momentum for the Next Chainlink Rally

Chainlink’s combination of solid fundamentals, whale accumulation, and institutional traction paints an optimistic picture. The $25 resistance remains the key threshold for triggering a sustained breakout. If buying pressure persists, LINK could challenge the $50–$100 range over coming quarters. With data infrastructure demand growing across decentralized finance, Chainlink appears poised for another major cycle.