Chainlink Rebounds After October Decline

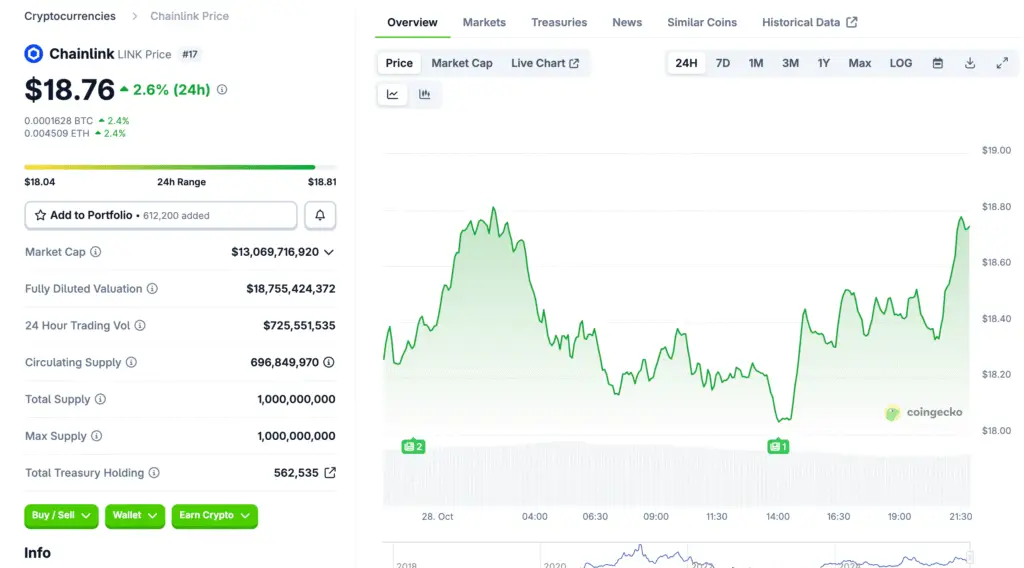

Chainlink’s price has rebounded to around $18.34 after a mid-October correction that temporarily dampened market sentiment. The recovery aligns with growing optimism across the crypto market as traders regain confidence. Rising open interest and consistent accumulation by large holders support the renewed bullish tone. Analysts suggest that if LINK holds above key support zones, further upside momentum could follow.

Whale Accumulation Reaches Nearly 10 Million LINK

On-chain data reveals that whales have accumulated 9.94 million LINK, worth approximately $188 million, since early October. This buying activity reflects confidence among institutional and high-net-worth investors. Analysts interpret these outflows from exchanges as a shift toward long-term holding. Historically, similar whale accumulation phases have preceded significant price appreciation events for Chainlink.

Open Interest Climbs as Market Sentiment Improves

Data from Coinglass shows open interest exceeding $692 million, marking a sharp increase from mid-year levels below $400 million. The rising open interest reflects growing leverage participation and bullish conviction. Analysts view this trend as a sign that traders are preparing for a larger move. As long as LINK maintains strength above $18, market momentum appears poised to expand.

Recommended Article: Chainlink Whales Accumulate as Analysts Predict 300% Rally Ahead

Technical Levels Indicate Short-Term Support and Resistance

Chainlink currently trades within a tightening range, bounded by the 100-day and 200-day exponential moving averages. Immediate support lies near $16.98, with resistance around $19.45 and $20.84. A breakout above $20.84 could extend the rally toward $23.70, the next major resistance level. Failure to hold above $16.98, however, may expose LINK to short-term downside risk.

Whale Outflows Strengthen Long-Term Structure

Exchange data indicates that large investors continue withdrawing LINK tokens to private storage wallets. These consistent outflows suggest diminishing sell pressure and reinforce Chainlink’s long-term accumulation narrative. Analysts note that similar withdrawal trends have historically coincided with the beginning of major uptrends. This behavior indicates sustained optimism among strategic investors anticipating future growth.

Rising Leverage and Consolidation Before Breakout

Chainlink’s technical structure reflects a consolidation phase often seen before major directional movements. The compression between moving averages implies volatility expansion is imminent. If price action breaks upward alongside increasing volume, it could signal the start of a new bullish cycle. The strengthening fundamentals add further credibility to this technical outlook.

Market Analysts Forecast Potential 25% Upside

Analysts project that a confirmed close above $19.50 could lead to a breakout toward $23.70 in the near term. CoinCodex forecasts support this view, anticipating a short-term increase of nearly 9%. Sustained whale accumulation and improving sentiment provide a solid foundation for this scenario. The growing convergence of technical and fundamental indicators favors continued recovery momentum.

Outlook: Chainlink Prepares for Sustained Bullish Reversal

With rising open interest, whale accumulation, and strong support levels, Chainlink appears ready for another bullish phase. The asset’s technical structure suggests limited downside risk if it maintains above current support. Traders are watching closely for confirmation of a breakout above $20.84 in November. If achieved, this move could establish Chainlink as a leading altcoin performer heading into 2026.