Chainlink’s Rebound Gains Strength Amid Whale Accumulation

Chainlink has regained momentum from the $16 support zone, attracting significant investors and establishing a new wave of bullish momentum. Blockchain data shows that over 54 million LINK tokens were bought at this price, boosting trust in the asset’s medium-term prospects.

This accumulation stage is common before significant market changes, and the large purchases indicate long-term holders’ belief in future price increases. As these groups strengthen their positions, the market is becoming more hopeful about Chainlink’s recovery chances in the last quarter of 2025.

Declining Exchange Supply Signals Bullish Pressure

Data from exchanges suggests that LINK’s circulating supply has dropped significantly, which makes the case for upward momentum even stronger. Chainlink saw $16.57 million in net outflows on October 21, which was one of the biggest single-day withdrawals in weeks. Whales shifting assets to cold wallets is a sign that they want to cling onto them for a long time.

When a lot of money leaves exchanges, the pressure to sell right away goes down a lot. There may be supply shortages if there aren’t enough tokens available for open-market transactions. This might cause prices to rise as demand slowly increases. This pattern fits with times in the past when prices kept going up after whales bought a lot of stock.

Chainlink Nears Apex of Multi-Year Triangle as Breakout Momentum Builds

Chainlink’s price is settling into a symmetrical triangular pattern, with trendlines convergent, price ranges decreasing, and consistent higher lows. This suggests a breakout is imminent. The top of the triangle is nearing, indicating increased volatility.

Analysts believe $19.95 is the crucial resistance level for a positive turnaround. If successful, it could accelerate the move towards $23.60 and potentially reach $27 before December. Triangular breakouts have historically led to quick rallies when momentum is right.

Recommended Article: Chainlink Price Nears $17 Support Despite Fed Recognition

Whale Activity Reinforces Strong Support Base

Whale accumulation is still one of the strongest signs that Chainlink is going higher. The 54 million tokens bought for about $16 show that experienced investors are making smart moves to take advantage of low prices. This buildup has happened at the same time as prior turning points in LINK’s price cycles.

These big holders tend to buy more when the market is scared or consolidating, which lowers the danger of losing money and takes supply from weaker hands. As ordinary traders follow these moves, the market typically gets a new burst of energy that leads to a long-term rally that pushes prices over important resistance levels.

Chainlink Builds Momentum as Triangular Pattern Signals Major Breakout

The triangular consolidation that is still going on shows that Chainlink is slowly getting ready for a big move. Each slump has led to a higher low, which shows that more and more people are buying in the market. Analysts say that if LINK breaks over the upper limit, it might quickly go toward its next resistance cluster at $25.

A confirmed breakout would confirm a long-term bullish continuation pattern. If this rise goes over secondary resistance, Fibonacci projections point to an extended technical objective near $100. This is a long-term aim that would mean a full recovery from prior cycles.

Market Sentiment Shifts as Fundamentals Strengthen

People’s feelings about Chainlink have changed for the better as on-chain measurements and technical charts point to a good future. The token’s inherent value keeps going up as more people use the network and more oracles are added. These changes add to the positive activity on the blockchain, making it a good place for prices to go up.

Traders think that Chainlink might soon do better than its competitors since it has good fundamentals and its exchange reserves are getting smaller. The combination of investor accumulation, market structure, and real-world usefulness makes a strong argument for further recovery.

Chainlink Poised for Potential $27 Rally by December

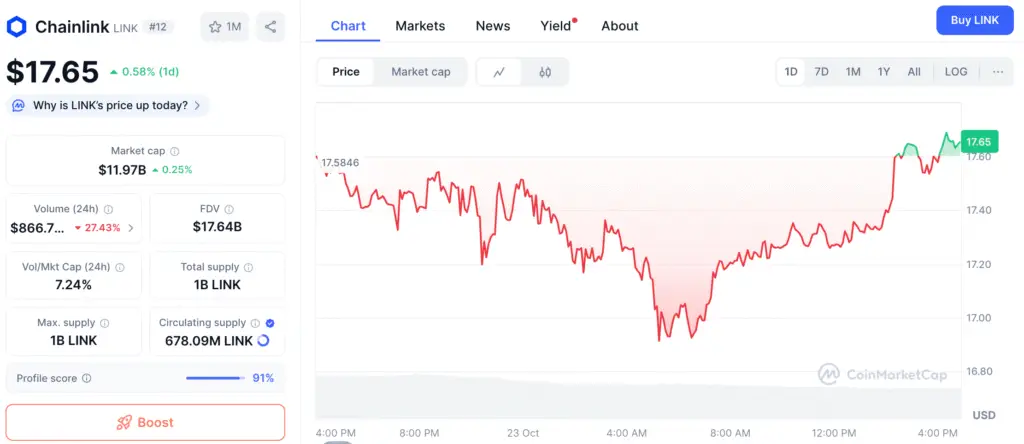

Chainlink is now trading close to $17.56, and it has been moving steadily after bouncing back from support at $16. Analysts think that whales buying more and less supply on exchanges might lead to a breakthrough over $19.95 in the next few weeks.

If the trend keeps up, LINK might hit its $27 goal by December, which would mean the start of a new bullish cycle. Chainlink seems like it’s in a good position to regain its place as one of the top assets in the decentralized data ecosystem, since previous accumulation patterns are repeating.