The Market’s Post-Peak Pullback

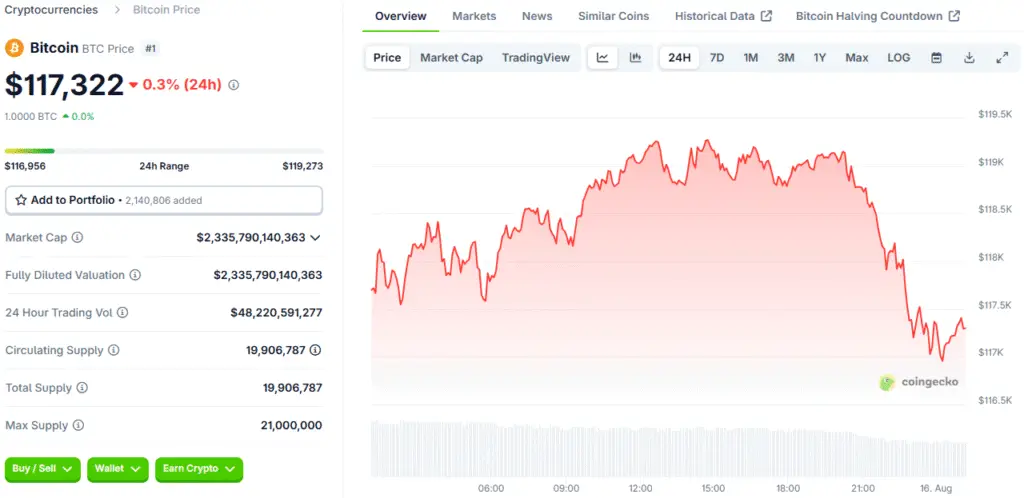

The cryptocurrency market recently experienced a period of intense volatility, with Bitcoin (BTC) hitting a new all-time high of over $124,000 before a sharp, short-lived drop below $118,000. This pullback was triggered by a combination of factors, including higher-than-expected wholesale inflation figures that dampened hopes for a cut in U.S. interest rates.

The euphoria that had sent Bitcoin to new records, fueled by rumours of a new “treasury” firm buying hundreds of millions of dollars’ worth of tokens and suggestions of a new round of quantitative easing, quickly dissipated. This event underscores the market’s continued sensitivity to macroeconomic data and the shifting sentiment around the Federal Reserve’s monetary policy.

Conflicting Signals from the US Treasury

The market’s confusion was exacerbated by conflicting statements from U.S. Treasury Secretary Scott Bessent. During an appearance on Fox Business, Bessent initially stated that the federal government would “not be buying” more BTC for the country’s Strategic Bitcoin Reserve. He clarified that the reserve would be built using “confiscated assets,” not through open-market purchases. This comment directly contradicted the hopes of Bitcoin maximalists who had expected government purchases to “light a fire” under Bitcoin’s price.

However, in a later tweet, Bessent seemed to backtrack, stating that the Treasury is “committed to exploring budget-neutral pathways to acquire more Bitcoin to expand the reserve.” This reversal of messaging left the market in a state of confusion, as it became clear that even the officials in charge of the reserve were not fully aligned on its future.

The Google Wallet Controversy

In a separate but related development, Google recently stepped into a “crypto wallet minefield” with a new policy for its Play marketplace. The company announced that digital wallet apps would only be allowed if the developers were registered as a Money Services Business (MSB) with FinCEN or as a state-chartered bank. This policy, which appeared to target non-custodial wallets, caused an immediate panic in the crypto community, with many fearing a new wave of regulatory overreach.

However, Google quickly issued a clarification, stating that non-custodial wallets were “out of scope” of the new rules. This incident highlights the ongoing tension between regulatory bodies and the decentralised nature of crypto, as well as the need for clearer guidelines on how new technologies are implemented and regulated.

The Rise of Crypto-Related IPOs

Despite the volatility, the crypto market is seeing a surge of interest from new publicly traded companies. Bullish Global (BLSH), a digital asset exchange and media company, made a stunning debut on the Nasdaq, with its shares closing at nearly double their IPO price. This success, along with that of other recent crypto IPOs like stablecoin issuer Circle (CRCL), has inspired other companies to prepare for their own public offerings.

Exchanges like Gemini and Kraken are among a number of prospective filers who are now looking to capitalise on this investor excitement. This trend suggests that a growing number of institutional players see a long-term future in the crypto space, and they are using the traditional financial system to gain access to a new class of investors.

The Debanking Debate and a New Executive Order

The political landscape is also having a direct impact on the crypto world, particularly in the ongoing debate over “debanking.” President Trump’s sons, Eric and Don Jr., have been vocal about the alleged debanking that the Trump family endured, and this has pushed the family into the arms of crypto through the DeFi project World Liberty Financial (WLF).

In response to these concerns, President Trump issued a new executive order that prohibits federal agencies from enacting policies that allow banks to deny services to clients. This order, which was intended to be a strong signal of the administration’s support for the crypto sector, is a key piece of the regulatory puzzle that will shape the future of banking and digital assets in the United States.

Justin Sun’s Lawsuit Against Bloomberg

On the legal front, TRON founder Justin Sun has filed a lawsuit against the Bloomberg news agency for publishing details of his vast crypto wealth. The suit, which alleges that the publication of his financial information will make him a “considerable target” for theft and physical attack, is an attempt to stop Bloomberg from what he calls “prior restraint.”

Sun’s legal team claims that the publication of his specific cryptocurrency holdings, including his vast amounts of TRX and other tokens, will cause him irreparable harm. While Bloomberg has responded by saying that Sun failed to show irreparable harm, the lawsuit is an interesting case that will test the limits of freedom of the press and the privacy rights of crypto billionaires.

The Interconnected World of Crypto and Politics

The events of this week highlight the interconnectedness of the crypto world and the broader political and financial landscapes. The market’s reaction to a single inflation report, the conflicting statements from the Treasury Secretary, the new executive orders on debanking, and the legal battles over privacy all show that crypto is no longer a niche, isolated industry.

It is now a central part of the global conversation, with its fate tied to the decisions of governments, central banks, and major corporations. This new reality means that for investors, understanding the political and macroeconomic forces at play is just as important as understanding the technical fundamentals of a given cryptocurrency. The coming months will be a crucial test for the industry as it navigates a complex and rapidly evolving world.

Read More: Bitcoin Volatility Strikes as Hot PPI Data Spurs Dollar Rally