Bitcoin Expected to Correct Sharply Before New Highs

Bitcoin’s path to new record levels is unlikely to be smooth, according to market analyst Jordi Visser. He predicts that the cryptocurrency will undergo multiple corrections of 20% or more before establishing fresh all-time highs.

Despite Q4 traditionally being favorable for crypto, Visser cautions that investors should be ready for significant pullbacks. He emphasizes that volatility is a natural part of Bitcoin’s upward trajectory, not a sign of structural weakness.

Nvidia’s Bull Run Offers Insight Into Bitcoin’s Future

Visser drew parallels between Bitcoin’s market behavior and Nvidia’s remarkable rise since the launch of ChatGPT. Nvidia’s stock gained over 1,000% in under three years but experienced five corrections of 20% or more during that period.

He believes Bitcoin will follow a similar pattern — substantial rallies punctuated by sharp but temporary corrections. This comparison suggests that corrections are integral to the growth cycle, offering new entry points for long-term investors.

AI Revolution Strengthens Bitcoin’s Store-of-Value Role

As artificial intelligence reshapes industries and replaces human labor, Visser argues that traditional companies will face pressure. He believes this shift will push investors toward Bitcoin as a superior digital store of value.

According to his view, as AI accelerates economic disruption, Bitcoin’s fixed supply and decentralized nature will make it a preferred hedge against fiat debasement and technological upheaval.

Recommended Article: Samson Mow Predicts Bitcoin Nation-State Adoption Will Enter “Suddenly” Phase Soon

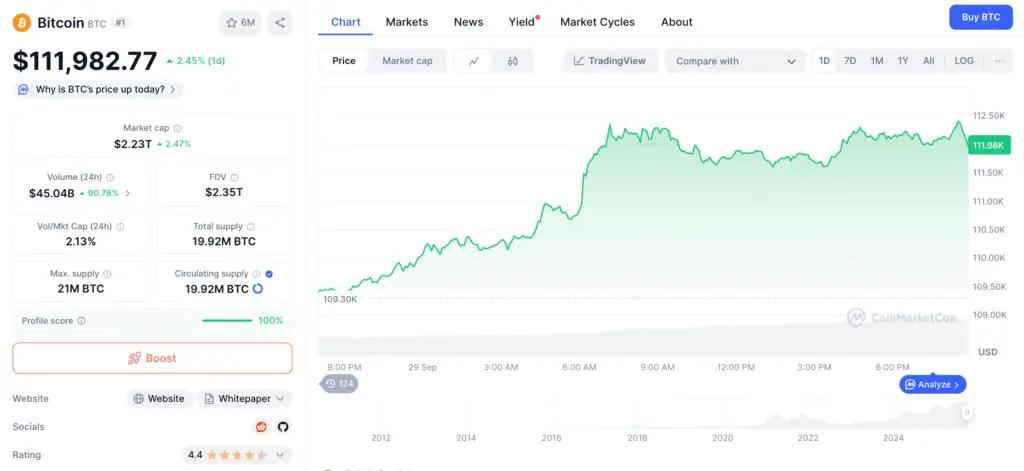

Analysts Debate Bitcoin’s Slow Performance in Q4

Market watchers have observed that while gold and major stock indexes have hit record highs, Bitcoin remains around $112,000 — about 11% below its peak above $123,000. This slower performance has fueled debate over BTC’s near-term direction.

Some experts expect new highs by Q4, potentially pushing prices toward $140,000. Others warn that the current drawdown could signal the start of a deeper correction phase that may take Bitcoin down to $60,000.

Macro and Regulatory Factors Shape Market Expectations

Analysts note that Bitcoin’s trajectory is also influenced by macroeconomic conditions and regulatory developments. Uncertainty around interest rates, inflation, and U.S. crypto policies plays a key role in shaping sentiment.

One significant factor is the lack of progress on a proposed U.S. Bitcoin strategic reserve that would involve periodic government BTC purchases. Some had forecast this as a major bullish catalyst, but delays have tempered optimism.

Corrections Viewed as Opportunities for Long-Term Holders

Visser’s perspective frames corrections not as threats but as opportunities for accumulation. Historically, Bitcoin’s most significant rallies have followed substantial market pullbacks that flushed out weak hands.

For investors with a long-term horizon, these corrections can present attractive entry points. Visser’s Nvidia comparison reinforces the idea that volatility often precedes explosive growth phases.

Investor Sentiment Split Ahead of Key Quarter

Investor opinions remain divided heading into the final quarter of the year. Bulls expect institutional inflows and macro tailwinds to drive Bitcoin toward new records, while bears focus on regulatory inertia and waning momentum.

This divergence underscores Bitcoin’s transitional moment in 2025: it is no longer a niche asset but a global financial instrument sensitive to broader economic forces. Volatility, both up and down, will likely define its journey toward the next all-time high.