Dogecoin Leads Market Recovery With Strong Early Gains

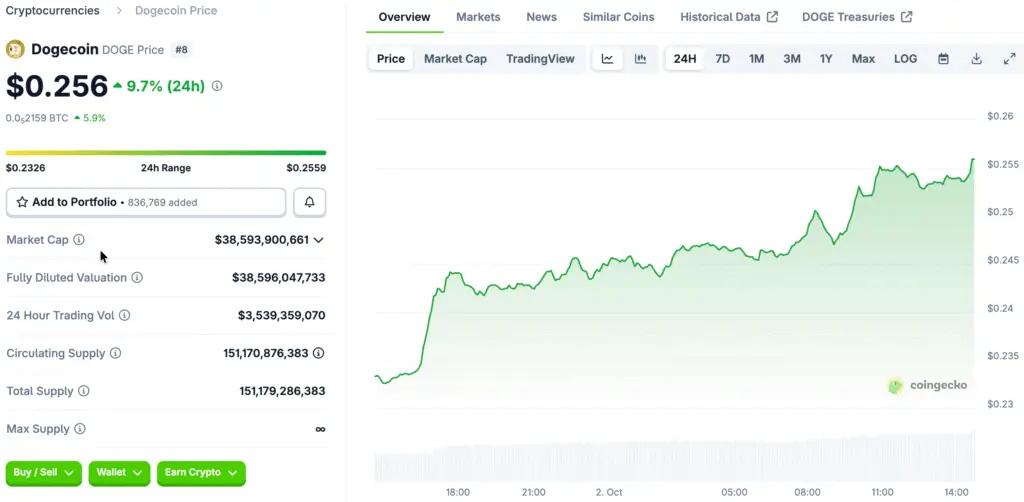

During Wednesday’s trading session, Dogecoin experienced a remarkable 7.7% surge, outperforming the overall crypto market, which saw a 3.3% increase in total market capitalization. This rise coincided with significant daily gains in Solana and Cardano.

Market participants viewed Dogecoin’s rally as an indication of increasing risk appetite despite political uncertainties, with traders keen to re-establish positions after previous consolidation among digital assets. The active Dogecoin community and its liquid markets have positioned it to take advantage of the renewed optimism.

Shutdown Concerns Fail To Dampen Crypto Market Optimism

On Tuesday, U.S. Congress failed to pass a continuing resolution, raising concerns about a potential government shutdown, which historically impacts the release of economic data and financial markets. Experts warn that prolonged uncertainty could hinder consumption and investment, affecting economic growth.

However, the crypto markets largely dismissed these risks, viewing the situation as temporary. Past shutdowns had minimal lasting effects on risk assets, and traders focused on technical setups and seasonal trends in their digital asset decisions.

Federal Reserve Expectations Support Risk Asset Sentiment

The excitement building around the forthcoming Federal Open Market Committee meeting has propelled crypto markets forward. According to the prediction platform Myriad, seventy-four percent of users anticipate a twenty-five basis point rate cut this October. Traditionally, reduced interest rates promote the movement of capital towards riskier assets such as cryptocurrencies and stocks.

Jerome Powell, the Chair of the Federal Reserve, has recently recognized a growing uncertainty surrounding inflation and employment trends. This strengthens market expectations for a more lenient policy, particularly if economic data experiences delays due to a shutdown. For Dogecoin traders, these circumstances set the stage for enticing speculative rallies and the potential for trend continuation as we move into the fourth quarter.

Recommended Article: Ethereum Price Prediction: Dogecoin Latest News & Where Could You Turn $100 into $10,800 in Q1 2026

Bitcoin Surges Past $117,000, Igniting a Wider Altcoin Surge

The significant 4.5% surge of Bitcoin past $117,000 signifies a crucial turning point for the broader cryptocurrency sentiment. In the past, Bitcoin breakouts frequently led to or aligned with heightened momentum phases for altcoins. Once again, this dynamic unfolded as Dogecoin, Solana, and Cardano swiftly mirrored Bitcoin’s movements during Wednesday’s trading sessions.

Proponents of Bitcoin highlighted that October, often referred to as “Uptober,” has a history of showcasing impressive performance. The prominent cryptocurrency’s seasonal resilience, coupled with enhanced macroeconomic outlooks, led to the liquidation of short positions. As reported by Coinalyze, around sixty million dollars in shorts were eliminated during the morning session in London, further enhancing the bullish momentum throughout the sector.

Dogecoin’s Technical Position Strengthens After Recent Consolidation

Prior to this breakout, Dogecoin had been consolidating for several weeks within the range of $0.21 to $0.23, establishing a solid technical foundation. The recent phase of sideways trading has led to a decrease in volatility, enabling market participants to build their positions with patience. Technical analysts interpreted this consolidation phase as a possible springboard for renewed upward momentum when broader market catalysts come into play.

Wednesday’s breakout above $0.24 signals a clear bullish shift for Dogecoin’s near-term outlook. Traders are currently focusing on former resistance levels as possible upside targets, should the momentum continue. Consistent buying momentum and encouraging macroeconomic factors may propel Dogecoin into elevated price ranges throughout October, a month typically known for its advantageous trading conditions.

Institutional Developments Add Confidence to Market Outlook

Recent developments in cryptocurrency institutions have bolstered Dogecoin’s surge, notably with attention on Solana exchange-traded funds, which Bloomberg analysts deem likely to be approved at a full 100%. CoinShares reported inflows of $291 million into Solana products last week, reflecting growing institutional confidence in digital assets despite macroeconomic uncertainties.

While Dogecoin itself has not benefited from ETF inflows, the positive sentiment towards altcoins is enhancing overall market liquidity, as investors often reallocate funds among large-cap altcoins, leading to indirect support for various assets.

Seasonal Trends and Market Dynamics Favor Continued Upside

October historically yields strong returns in the crypto market, notably with Bitcoin showing gains in ten of the last twelve years. This trend influences trader behavior, leading to proactive strategies in anticipation of price surges. Favorable macroeconomic conditions are contributing to a positive outlook for altcoins like Dogecoin, which is heavily affected by social sentiment and Bitcoin’s price movements.

With growing institutional interest and easing challenges, experts believe Dogecoin may sustain its upward momentum. Continued monitoring of market volume, resistance levels, and conditions will be crucial in determining whether this rally signifies a more substantial trend.