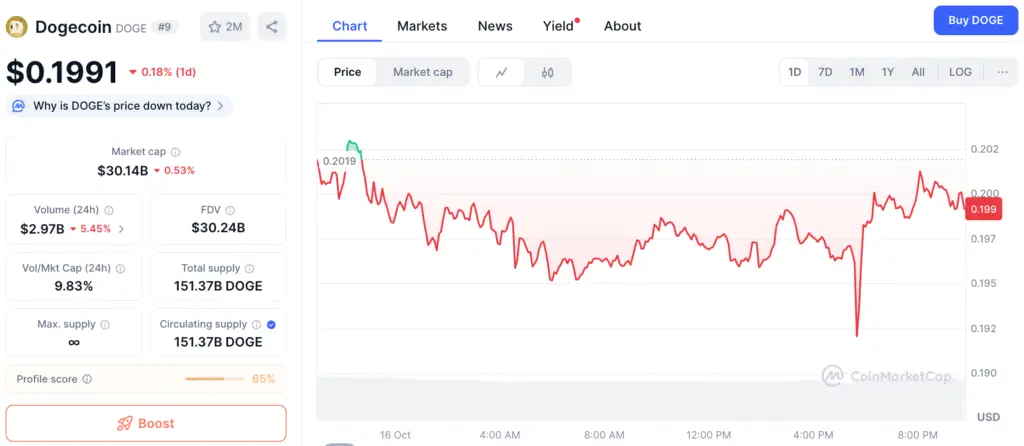

Dogecoin Price Holds Near $0.20 After Sharp Sell-offs

Dogecoin is displaying initial signs of recovery following a turbulent week that experienced a 5% decline in its price due to widespread market liquidations. The memecoin experienced a temporary decline from a weekly peak of $0.28 to approximately $0.20, influenced by the resurgence of U.S.–China tariff tensions sparked by President Donald Trump’s imposition of 100% import duties on Chinese products.

Data from TradingView indicates that DOGE fluctuated within a narrow 6% range, hovering between $0.21 and $0.20. On Thursday, trading volumes surged to 568.6 million before sellers took charge once again. Institutional desks noted that the token’s decline toward $0.20 sparked buying interest, indicating accumulation around this pivotal level.

Significant Liquidations Prompt Market Recalibration

On Friday, amidst the “crypto bloodbath,” Dogecoin faced the most significant wave of liquidations between 13:00 and 15:00 UTC, with a turnover hitting 920 million as the price dipped below $0.21. DOGE eventually found stability at $0.20, accompanied by a decline in trading volume, suggesting that sellers might be running out of steam.

Experts from CoinGlass observed that leveraged traders faced significant challenges, as cascading liquidations eliminated short-term positions. The recent cleanup phase has effectively eliminated excess leverage, paving the way for a possible base-building phase in the upcoming weeks.

Derivatives Open Interest Falls to Early September Levels

The open interest (OI) in Dogecoin futures has seen a significant decline, plummeting from $6.5 billion on September 14 to under $3 billion by October 15, a figure not seen since early September. The decrease signifies a significant cut in speculative leverage after the most recent market adjustment.

OI saw a brief resurgence to $5 billion in early October, but the crash on Friday wiped out almost half of those gains. When both OI and token price decline simultaneously but then stabilize, it typically indicates that weaker participants have been eliminated and that traders are starting to re-establish long positions.

Recommended Article: Dogecoin Accumulation Rises as On-Chain Data Flips Bullish

Experts Identify Possible Bottom Formation

Market analysts are progressively highlighting this OI reset as a positive structural change. Eliminating excess leverage can contribute to establishing a more robust price floor in the markets, which in turn minimizes volatility and sets the stage for enduring growth.

Technical traders observe that DOGE’s present support range of $0.18 to $0.19 has experienced significant accumulation activity, especially during periods of liquidation troughs. At the same time, resistance continues to exist between $0.21 and $0.214, marking the upper boundary of recent trading areas as indicated by prior reversal volume.

House of Doge’s $50M Nasdaq Listing Sparks Enthusiasm

In a significant advancement for Dogecoin’s wider ecosystem, House of Doge, a company focused on enhancing Dogecoin’s payment applications, is gearing up for a $50 million Nasdaq launch through a reverse merger with Brag House Holdings, a gaming firm based in the U.S.

Supported by notable investors such as Alex Spiro, who represents Elon Musk, House of Doge seeks to enhance the mainstream acceptance of Dogecoin by incorporating its token into practical payment solutions. CEO Marco Margiotta stated that going public “provides all the capital needed to ensure Dogecoin utility comes full circle.”

Technical Outlook: Signs of Stabilization Emerging

Dogecoin continues to trade beneath its 200-day moving average, indicating a persistent bearish outlook in the near term. Analysts point out that the recent volume compression near $0.20 indicates price stabilization, which is often a sign of base formation prior to recovery phases.

A successful reclaim of the $0.21 resistance may ignite renewed buying momentum, possibly driving DOGE toward the $0.22–$0.28 range, revisiting price levels observed on October 8. Traders are closely monitoring for consolidation and additional confirmation of accumulation patterns until that breakout takes place.

Dogecoin Accumulation Grows as Institutions View Current Prices as Value

Even with short-term fluctuations, there seems to be a growing positive sentiment among institutions regarding Dogecoin. Multiple trading desks have indicated purchases around $0.20, suggesting that professional traders perceive the current levels as undervalued when compared to historical averages.

If this accumulation persists and liquidity finds stability, DOGE could be on the verge of entering the initial phases of a trend reversal. With the impending Nasdaq listing and a decrease in derivatives exposure, the memecoin appears to be on track for a steady recovery leading into Q4 2025.