A Huge Dogecoin Transfer Sparks Concern

A whale recently transferred a huge amount of Dogecoin. The transfer was 900 million DOGE. This raised a lot of concerns among investors. The amount was worth more than $200 million.

This transfer sparked fears of potential distribution. This is a possibility for long-term holders. Corporate treasuries are reducing their exposure. This is due to regulatory uncertainty and global macro headwinds.

Dogecoin’s Recent Price Action Summary

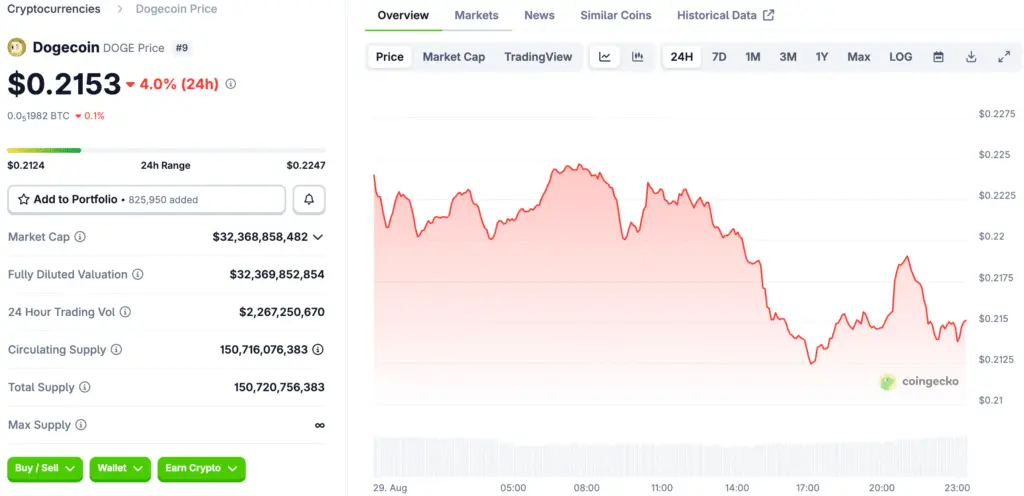

DOGE fell 5% during a 24-hour session. This was from August 28 to August 29. The price slid from $0.22 to $0.21. This shows significant selling pressure in the market.

The token traded within a narrow $0.011 range. It had a high of $0.23 and a low of $0.21. Institutional selling was very evident. The token had 626.3 million tokens transacted.

Technical Analysis of Support and Resistance

Initial stability around the $0.22 mark was lost. The price is now at the $0.21 level. This new level now serves as the immediate floor. The $0.23 level remains the near-term cap.

The token has repeatedly been rejected. The price has not been able to push past this level. This shows a significant resistance for the price. This is a very important level to watch.

Recommended Article: Pepe Rises Above Dogecoin and Shiba Inu in Trading Volume

Momentum and Volume Indicators

The RSI is hovering near the mid-40s. This is showing a neutral-to-bearish bias. It also shows very limited upside strength. Daily turnover exceeded 280.5 million tokens.

The institutional flows were concentrated during the peak selling phases. This shows that big players were behind the move. The volume confirms the strong selling pressure. This is a key sign to look out for.

Bearish Patterns on the Chart

The MACD lines are diverging in a bearish way. This suggests further downside risk is possible. The price would need to reclaim $0.22 to reverse. The corridor of $0.21 to $0.23 shows consolidation.

However, repeated lower highs point to a potential continuation. The pattern shows a clear bearish trend. Traders are watching this very closely. It suggests more dips are likely.

What Traders Are Watching Closely

Traders are watching the $0.21 level very closely. A break below this level is a risk. It could potentially expose the price to $0.20. A push through $0.23 could reframe momentum.

This would open the path toward $0.25 to $0.30. They are also monitoring whale exchange inflows. This is to gauge future selling pressure.

Looking Ahead at the Dogecoin Market

Futures open interest is a key metric. It is a gauge of speculative conviction. This has been trending down this week. This is another bearish sign.

The network security strength remains elevated. The hashrate is topping 2.9 petahashes per second. This reflects robust mining participation. This is a positive sign for the network.