Dogecoin Builds Strength After Liquidity Sweep Against Bitcoin

Dogecoin recently reclaimed lost ground against Bitcoin after a liquidity sweep that removed weak holders, signaling renewed investor confidence. This recovery helped the DOGE/BTC pair strengthen above crucial technical levels that analysts have monitored closely for several months now. Market participants see this as the beginning of momentum potentially driving Dogecoin into another extended rally within broader altcoin market cycles.

The liquidity sweep allowed institutional investors to accumulate Dogecoin at discounted prices before the rebound, strengthening the overall technical outlook significantly. Dogecoin’s survival above the reclaimed support area now reassures traders, particularly after weeks of downward movement against Bitcoin. This technical resilience builds anticipation among the community that Dogecoin is positioning itself for sustained upside compared to Bitcoin.

Analysts Predict Dogecoin Could Triple In Value Soon

Leading analysts like Trader Tardigrade believe Dogecoin could experience a substantial pump against Bitcoin, potentially tripling in value quickly. Charts highlight the possibility of Dogecoin reaching 516 sats, which reflects a strong continuation pattern observed after liquidity recovery. If momentum sustains, investors could see Dogecoin reclaim major price levels, reminding markets of its historical ability to surprise massively.

Projections suggest intermediate checkpoints near 280 sats and 360 sats, giving traders clear milestones during Dogecoin’s ongoing bullish recovery phase. These price levels, if achieved, would represent significant gains from current positions, attracting more attention from speculative and institutional participants. Strong resistance exists at higher levels, but technical indicators imply a growing likelihood that Dogecoin will retest them sooner than expected.

Dogecoin Momentum Aligns With Potential Altcoin Season

The market is increasingly discussing the possibility of a new altcoin season, historically occurring after Bitcoin consolidation periods. Dogecoin’s rally appears timed to coincide with this narrative, potentially making it a trigger for broader altcoin performance improvements. This connection excites traders who view Dogecoin as a bellwether for meme coin and broader alternative asset trends.

If altcoin season returns, Dogecoin’s market capitalization could expand significantly, supported by surging retail demand across cryptocurrency exchanges globally. Such events usually coincide with renewed social media attention, bringing waves of fresh investors eager to participate in explosive market cycles. Altcoin seasons typically provide outsized gains compared to Bitcoin, positioning speculative tokens like Dogecoin as major beneficiaries within the cycle.

Recommended Article: Dogecoin in Focus: Thumzup Acquires Dogehash in Trump-Backed Nasdaq Deal

Short Term Patterns Suggest Temporary Dogecoin Pullback

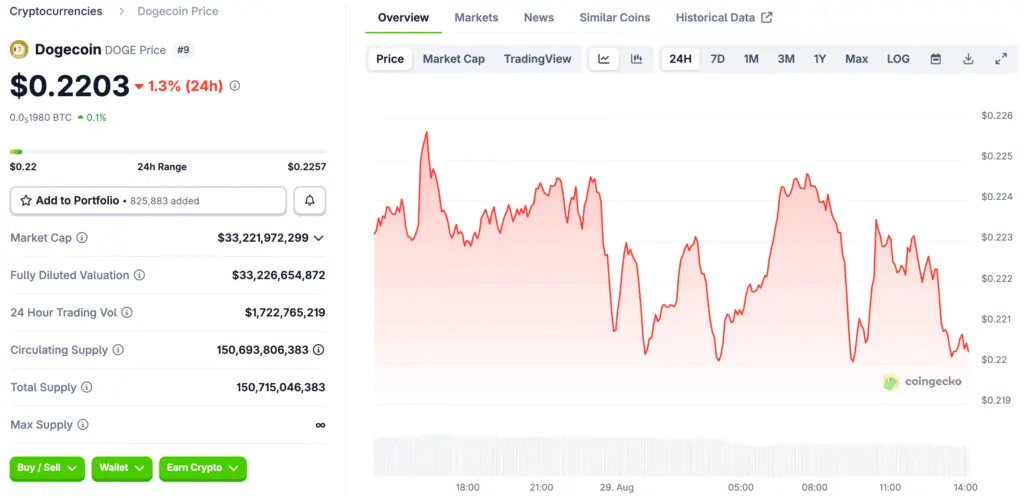

Ali Martinez suggests Dogecoin might experience a minor pullback before breaking out, reflecting symmetrical triangle formations on shorter timeframes. This technical structure implies consolidation, which often precedes explosive moves, offering traders opportunities to enter positions before significant rallies. If Martinez’s projection holds, Dogecoin could dip near $0.22 before surging toward higher targets, continuing its bullish trajectory.

Martinez sets near-term price targets at $0.26, $0.28, and $0.31, depending on momentum strength after potential retracement occurs. These targets align with broader technical setups, offering traders confidence in both short-term strategies and longer-term investment horizons simultaneously. Such patterns are common in Dogecoin’s trading history, making analysts confident the coin’s upward breakout remains increasingly likely despite fluctuations.

Dogecoin Cycles Mirror Historical Price Accumulation Phases

Dogecoin has historically followed multi-year cycles of accumulation and breakout, with notable examples recorded during 2014, 2017, and 2021. Each cycle began with prolonged consolidation before sudden explosive surges that rewarded early participants with extraordinary returns on investment. Today’s setup closely resembles those historical patterns, giving traders optimism Dogecoin could repeat similar trajectories in the coming years.

These historical cycles emphasize patience for long-term holders who often benefit most when Dogecoin exits its extended accumulation zones. By recognizing these recurring structures, analysts argue current technical conditions are highly favorable compared to previous cycle beginnings. If history rhymes again, Dogecoin could surpass its $0.7396 all-time high, delivering major gains for loyal holders.

Market Sentiment Shifts As Dogecoin Gains New Momentum

Investor sentiment toward Dogecoin has improved noticeably as technical indicators point toward recovery against Bitcoin and broader altcoins. Retail traders are increasingly optimistic, posting bullish projections across social platforms, which reinforces community-driven demand dynamics. Such sentiment-driven cycles often generate rapid gains as excitement translates into higher volumes and renewed speculative interest.

Institutional traders also monitor Dogecoin’s activity, recognizing that meme coins can outperform traditional altcoins under favorable liquidity conditions. This intersection of retail enthusiasm and institutional observation creates unique trading environments rarely available in traditional financial markets. The result is heightened volatility that many investors view as an opportunity to profit from unpredictable yet rewarding market behavior.

Dogecoin Outlook Suggests Bright Future Against Bitcoin

Dogecoin’s ongoing recovery from the liquidity sweep highlights its resilience compared to other meme coins that failed under similar conditions. The combination of bullish technical patterns, community enthusiasm, and favorable altcoin season timing supports strong forecasts from experienced analysts. Dogecoin’s trajectory remains uncertain, but the probability of triple-digit gains appears higher today than earlier this year.

If projections materialize, Dogecoin could become one of the top-performing cryptocurrencies, reinforcing its place as the king of meme coins. Such recognition would attract new investors who once dismissed Dogecoin as a speculative fad, reshaping narratives around its legitimacy. The upcoming months will determine whether Dogecoin solidifies this recovery into an extended rally or reverts to continued consolidation.