Satoshi-Era Bitcoin Wallet Awakens After Long Dormancy

A Bitcoin wallet holding roughly $44 million worth of BTC has moved its funds for the first time in 12 years, according to blockchain analytics platform Lookonchain. The transfer took place on Sunday, marking another high-profile awakening of an early Bitcoin-era address.

This event adds to a growing list of old wallets becoming active again as Bitcoin’s price hovers near record levels. These movements often generate speculation about motivations, ownership, and their impact on the market.

$44 Million in BTC Transferred in Multiple Batches

Data from Arkham Intelligence shows that the wallet, identified by the address “1ArUG…zwaWT,” transferred approximately 400 BTC across multiple new addresses. The transactions were mostly structured in equal batches of 15 BTC, effectively emptying the original wallet.

The source of these coins traces back to 15 years ago, when miners funded the address. Neither the identity of the wallet owner nor the reason for the transfer has been disclosed, leaving analysts and traders guessing about the motives.

Bitcoin Value Surged 830x Over Dormant Period

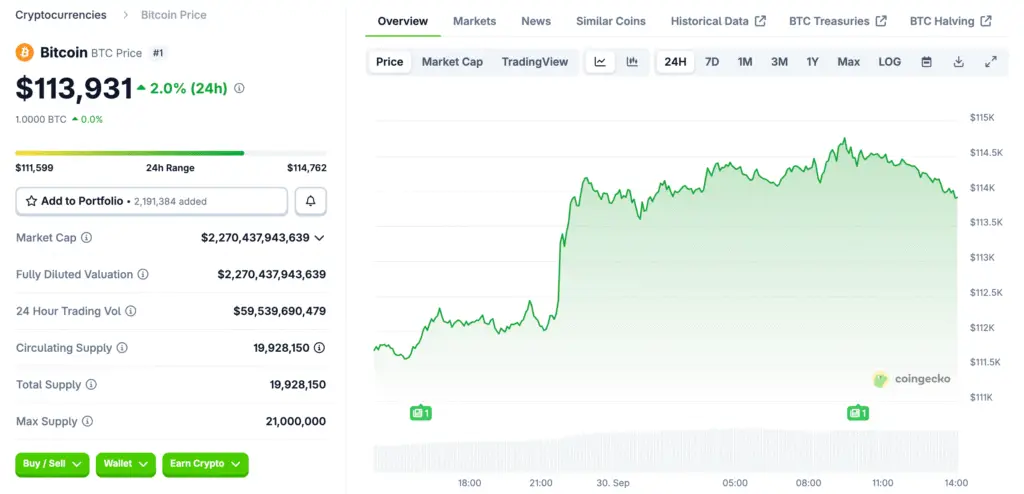

When this wallet last moved funds, Bitcoin traded around $135. Over the 12-year dormant period, BTC’s price has skyrocketed to $113,000 — an 830-fold increase in value.

This immense appreciation highlights the enormous unrealized gains held by early adopters and miners who obtained Bitcoin in its earliest years. Such holdings can represent generational wealth when eventually moved or liquidated.

Rising Trend of Satoshi-Era Wallet Activations

This transfer reflects a broader trend of Satoshi-era wallets coming back online in recent months. Many early addresses have shown signs of activity as Bitcoin reached new all-time highs this year, prompting speculation that holders are capitalizing on market strength.

These wallet activations often trigger market discussions about supply shifts, profit-taking, and potential impacts on price dynamics. Analysts watch such moves closely for clues about long-term holder behavior.

Recommended Article: Samson Mow Predicts Bitcoin Nation-State Adoption Will Enter “Suddenly” Phase Soon

July Saw Massive $9 Billion Early Investor Liquidation

One of the largest recent examples came in July, when Galaxy Digital executed a $9 billion sale of over 80,000 BTC on behalf of a Satoshi-era investor’s estate. This sale was one of the biggest early Bitcoin liquidations ever recorded.

The transaction demonstrated how dormant holdings can suddenly impact market liquidity when large quantities of Bitcoin enter circulation after years of inactivity.

Early Holders Rotate Portfolios Into Ether

Earlier this month, another OG investor moved billions from Bitcoin into Ethereum. Roughly $5 billion in BTC was rotated into $4 billion worth of ETH, signaling diversification strategies among early adopters.

This shift from long-term BTC holdings into ETH showcases evolving investment approaches as the crypto ecosystem matures, with some early investors seeking exposure to newer blockchain platforms.

More Dormant Wallets Reactivate Amid Bull Market

On September 11, another Bitcoin address holding 444 BTC (worth $50 million) became active after nearly 13 years of dormancy. These patterns suggest that early miners and investors may be strategically moving funds to secure profits or diversify holdings.

As Bitcoin maintains historically high valuations, analysts expect more long-dormant wallets to awaken. Such activity could continue influencing liquidity flows and market sentiment throughout the ongoing bull cycle.

Market Watches Closely for Potential Sell Pressure

While many of these movements remain mysterious, they often spark debate about potential sell pressure on exchanges. Not all transfers lead to sales, but the reactivation of old wallets signals that long-term holders are paying close attention to market conditions.

Traders will continue monitoring blockchain activity for signs of additional large movements, as Satoshi-era wallet awakenings often coincide with key market turning points.