The Rise of Ethereum Accumulation Wallets

Long-term Ethereum holders are stacking coins. On-chain data shows this trend is unprecedented. Accumulation addresses now control 24.3 million ETH.

This is nearly triple the amount seen earlier. This was before the U.S. spot ETF approvals. It fuels speculation that big money is buying. This is a new wave of conviction.

Understanding Conviction Buying Trends

A CryptoQuant analyst has shared data. It shows how accumulation wallets ballooned. They went from 8.9 million ETH in May 2024. This is a very sharp rise.

The average cost basis of these holders is $2,500. They are about 80% in profit right now. Historically, this strengthens long-term conviction. It does not trigger large-scale selling.

Institutional Capital Fuels Market Growth

Inflows into accumulation wallets have accelerated since June. Some days recorded more than 500,000 ETH transferred. This points to big money funding this trend. It is reshaping the market structure.

Analysts argue Ethereum is challenging Bitcoin dominance. This is happening in investor portfolios. This narrative is reinforced by corporate treasuries. They are buying large amounts of ETH.

Recommended Article: Ethereum Is the Wall Street Token, Says VanEck CEO

Spot Ethereum ETFs Attract Billions

Ethereum ETFs have attracted huge inflows. They brought in over $4 billion in 30 days. Bitcoin ETFs saw significant outflows. This rotation is a major signal.

This capital rotation is very important. It shows a clear shift in investment. More money is moving into Ethereum. The ETF products are a key driver. This highlights the growing appeal of ETH.

Big Corporate Players Are Acquiring ETH

A recent report revealed a mining firm. BitMine holds at least 1.7 million ETH. This is worth about $8 billion. It shows corporate confidence in Ethereum.

Arkham has identified more investors. Nine deep-pocketed investors were found. They bought nearly half a billion dollars’ worth. They used custodians like BitGo and Galaxy Digital.

Policy and Wall Street Support for the Network

Ethereum has caught Wall Street’s attention. The network could serve as a backbone for banks. This is for adapting to new stablecoin transactions. This follows the U.S. GENIUS Act.

A VanEck CEO stated his view. He believes the network is the future. This policy support is a big step. It shows growing mainstream acceptance.

ETH’s Relative Strength Amid Volatility

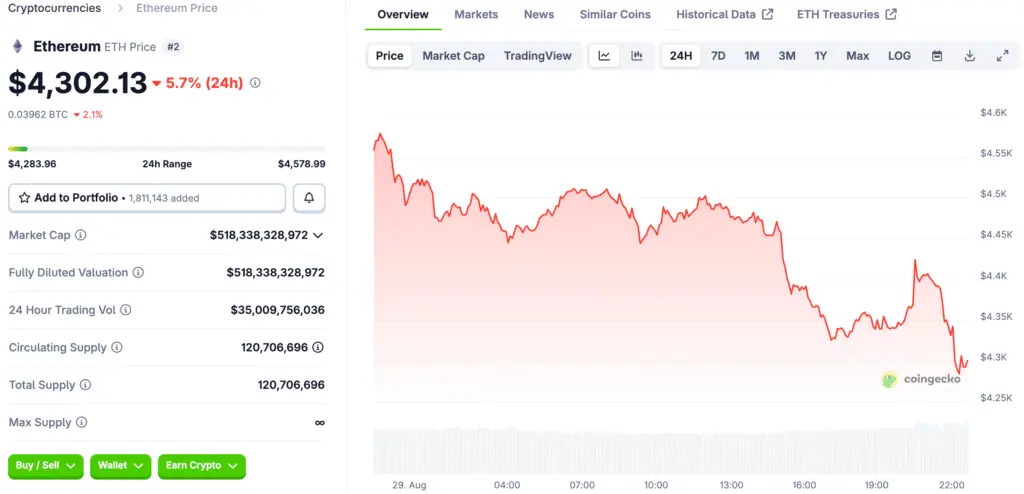

ETH is trading around the $4,329 mark. It is down over the last two weeks. But it is still up 13% over 30 days. This shows relative strength.

Analysts expect some near-term volatility. The price is between $4,355 and $4,958. Clearing the upper boundary is a key test. This could set the stage for a new rally.