Analyst Predicts Deep Correction for Ethereum

Prominent crypto analyst Ali Martinez has issued a stark warning about Ethereum’s price outlook. According to his analysis, ETH could face a near 50% correction under worst-case conditions. The projection highlights growing bearish sentiment across the cryptocurrency market.

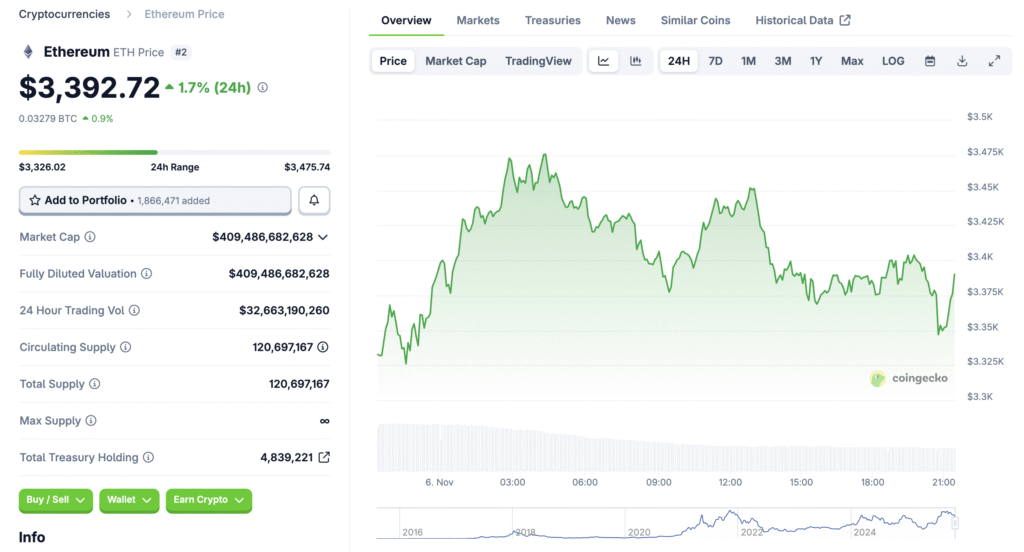

Ethereum Slips Amid Ongoing Market Weakness

Ethereum fell more than 4.5% to trade around $3,332 as of early November 2025. The broader crypto market also declined 1.5% to $3.4 trillion in total capitalization. These losses come after a turbulent October that saw steep declines across Bitcoin, Ethereum, and major altcoins.

Technical Breakdown Suggests Deeper Losses Ahead

Martinez’s chart analysis shows that Ethereum may struggle to reclaim the $4,000 resistance zone. Failure to maintain the $3,800 support could trigger cascading sell-offs. If confirmed, Ethereum could slide to $2,400 or even $1,700 by mid-2026, representing a full retracement of recent gains.

Recommended Article: Ethereum Slips Below $3,500 Amid Mounting ETF Outflows

Ethereum’s Security Concerns Add to Bearish Pressure

The bearish outlook is compounded by recent exploits within the Ethereum ecosystem. Multiple DeFi protocol breaches have undermined investor confidence. Analysts warn that continued security vulnerabilities could accelerate withdrawals and dampen network growth.

Positive Fundamentals Provide Long-Term Support

Despite short-term risks, Ethereum remains the leading blockchain for decentralized applications. The network recently achieved record throughput exceeding 3,400 transactions per second. Founder Vitalik Buterin reaffirmed that Ethereum’s scaling roadmap remains on track, emphasizing its long-term incorruptibility.

Market Sentiment Divides Traders and Investors

Some traders view the recent dip as an entry opportunity, citing Ethereum’s strong fundamentals. Others fear that macroeconomic headwinds could prolong the decline. High interest rates and falling liquidity continue to suppress speculative activity across digital assets.

Historical Performance Suggests Cyclical Resilience

Ethereum has endured multiple 50% drawdowns in prior bull markets, often rebounding strongly afterward. Analysts believe current weakness mirrors previous mid-cycle corrections rather than structural failure. This historical resilience offers some reassurance for patient investors.

Outlook: Volatility Ahead but Long-Term Potential Remains

While Ethereum faces near-term downside risk, analysts argue that its core ecosystem remains strong. Should Ethereum hold above $3,000 and regain $4,000 resistance, recovery momentum could follow. Still, the path forward will likely involve sharp fluctuations before the next sustained rally.