Ethereum Gains Institutional Momentum Amid Renewed ETF Inflows

Ethereum (ETH) is experiencing a surge in bullish sentiment as institutional investors return to the market. Spot Ethereum ETFs saw $141.7 million in net inflows on October 21, 2025, a significant turnaround from previous outflows.

The inflows, primarily from BlackRock’s ETHA and Fidelity’s FETH funds, indicate increased confidence in Ethereum’s long-term future. Other issuers, such as VanEck, Bitwise, and Grayscale, also saw positive inflows, indicating demand for all nine U.S.-listed Ethereum ETFs.

ETF Inflows Suggest Growing Market Confidence

This big jump in inflows focused on Ethereum happens at the same time as a bigger market rebound in institutional investment products. Bitcoin ETFs also had $477 million in net inflows during the same time period, which shows that the overall mood in the digital asset markets is getting better.

In the past, when Ethereum ETFs had steady inflows, the price went up by 5–10% within a week, especially when liquidity was growing and exchange activity was steady. So, the most recent ETF data supports the positive trend that Ethereum has been on since it bounced back from its recent local lows.

Technical Structure Points to Classic Bull Flag Formation

Ethereum is forming a bull flag pattern on the weekly chart, typically before upward breakouts. Expert @EtherWizz_ believes Ethereum is holding support around $3,600, the bottom limit of the flag pattern. A breakout above resistance could start a move up to $6,000–$8,000 by the end of 2025.

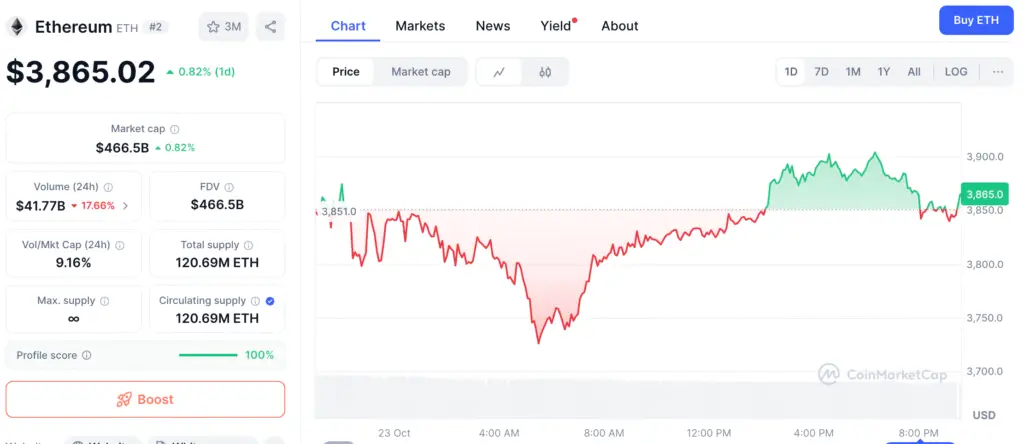

Ethereum is currently trading at $3,850, slightly down from the day before, but above its horizontal support. Technical models suggest a strong advance over $4,100–$4,200 might lead to the $4,500–$5,200 region in the immediate run.

Recommended Article: Ethereum Wallet Move Triggers $700M Profit-Taking Wave

Ethereum Holds Weekly Support as Staking Rises and Supply Tightens

Trader @CryptoGodJohn said that Ethereum is still technically strong, which is in line with the positive sentiment: “It’s hard to be bearish on ETH when weekly support is still holding.” If we hold these levels for a little longer, we might be moving into the next phase of price discovery toward $6,000.

This view is also backed up by on-chain measurements. Recent data suggests that staking is going up and exchange balances are going down. These are both signals that long-term holders are accumulating. This pattern usually comes before big bull cycles, when the quantity of coins in circulation is tighter and investors feel more confident.

Market Sentiment and DeFi Growth Reinforce Bullish Bias

People on X (previously Twitter) are feeling quite positive about the community. Traders say that ETF inflows, staking participation, and DeFi growth are all big reasons why. The Ethereum DeFi ecosystem keeps growing in terms of total value locked (TVL) and transaction volume. This shows that Layer-2 scaling solutions and cross-chain interoperability are becoming more popular.

However, analysts also say that there might be short-term volatility, especially when ETH gets close to resistance at $4,200. Technical signs that have gone too far and macroeconomic factors that aren’t clear, like possible U.S. Federal Reserve rate cuts, might dampen momentum for a while before the next big breakout.

Ethereum Holds Between $3,600 Support and $4,200 Resistance Barrier

The $3,600 support zone and $4,200 resistance barrier are still the major things that affect Ethereum’s price in the short term. If the price breaks out above the latter, it might make a measured climb above $5,000–$6,000, which is in line with the bull flag forecast.

On the other hand, if support isn’t kept, the price might drop back to lower levels between $3,200 and $3,400, where buyers are likely to come back. The overall uptrend will be in place as long as ETH stays above its 200-day exponential moving average (EMA).

Institutional Confidence Bolsters Long-Term Outlook

Ethereum’s renewed ETF inflows show that more and more institutions believe it will be useful in the long run as the backbone of the decentralized economy. Investors see Ethereum’s network enhancements, which include making it easier to scale and lowering transaction costs, as the building blocks for future development in DeFi, NFTs, and Web3 apps.

The $141 million ETF inflow increase, along with solid on-chain fundamentals, implies that Ethereum may be entering a long-term accumulation period, which may lead to a bullish continuation that lasts for months into 2026.

Conclusion: Ethereum Eyes $6,000 as Institutional Capital Returns

The price of Ethereum is still expected to go up a lot by the end of 2025. The asset might soon break through its long-term resistance structure because of the influx of funds from ETFs, strong technical patterns, and more people staking.

If Ethereum breaks out of a bull flag with heavy trading volume, analysts say it might rise above $6,000. This would show that institutions are once again confident in the second-largest cryptocurrency by market capitalization. If it can’t stay above $3,600, this rally may be delayed, but the general trend is still positive, and Ethereum is ready to lead the next wave of growth in the crypto sector.