ETH Dips as ETF Outflows Shake Confidence

Ethereum’s recent price action has rattled traders, with ETH slipping below $4,100 for the first time in weeks. According to Binance market data as of September 30, ETH was trading at $4,099.54 USDT, representing a 1.14% decline over the previous 24 hours.

U.S. spot Ethereum ETFs saw their largest weekly redemption since launch, with $795.6 million in outflows by September 26, driven by macroeconomic concerns, technical issues, and liquidation pressure.

Spot Ethereum ETFs saw $547 million in inflows by September 29, showing renewed interest and institutional buying as prices held near $4,000.

Institutional Signals and Market Context

Ethereum demonstrates robust long-term adoption despite volatility, evidenced by increased exchange net outflows (117,900 ETH accumulation), E*Trade’s support for Ether trading, and SWIFT’s partnership with Consensys to integrate Ethereum for cross-border payments.

Uncertainties surround U.S. spot Ethereum ETFs, especially regarding staking and potential government shutdowns, leading to a mixed short-term ETH outlook despite institutional interest.

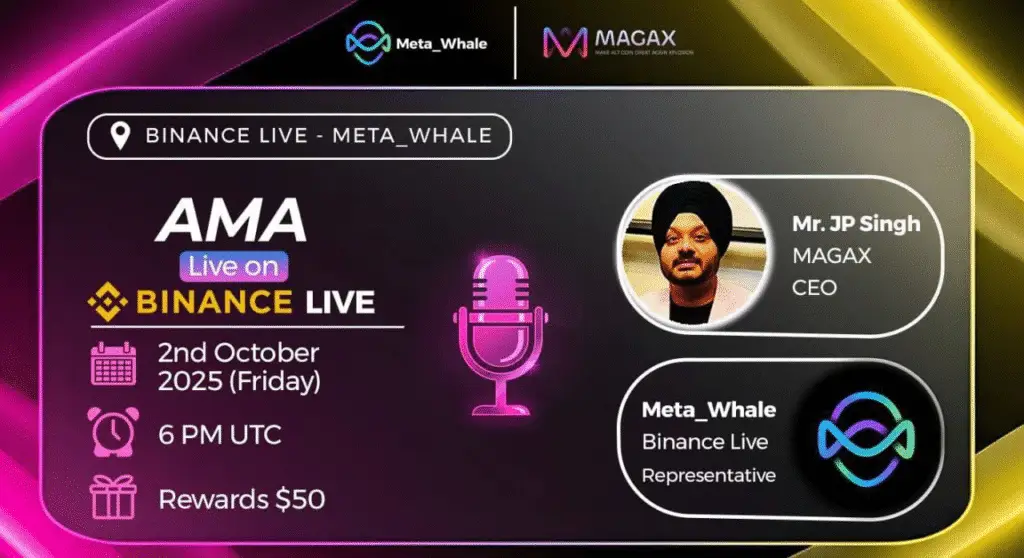

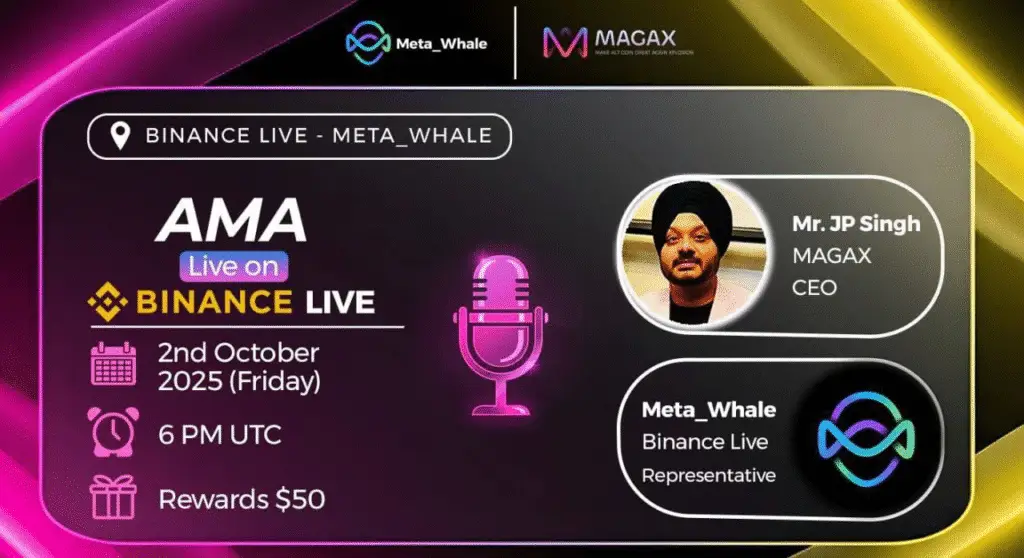

Live on Oct. 2, 2025, 6PM UTC: https://www.binance.com/en/live/u/30976012

MAGAX Emerges as Wall Street’s Meme Economy Pick

While Ethereum investors debate ETF flows and macroeconomic risks, a different narrative is gaining traction on Wall Street. Traders are increasingly tipping Moonshot MAGAX (MAGAX) as the breakout play of the week.

MAGAX is the first AI-powered meme-to-earn token. It uses Loomint’s AI engine to identify viral memes, rewarding creators and promoters, unlike traditional meme coins that rely solely on hype.

MAGAX, in Stage 3 of its presale at $0.000318, has raised over $115,674 of its $186,034 target. Analysts predict up to 141x ROI through 50 stages, with prices rising and supply decreasing at each stage, rewarding early adopters and creating scarcity.

Why Traders Are Watching MAGAX Now

MAGAX offers a timely, community-driven alternative to institutional products like Ethereum ETFs, powered by virality, incentives, and decentralized governance.

Key reasons traders are paying attention:

- CertiK-audited security with zero critical issues.

- Staking and governance features that allow holders to earn yield and shape platform policy.

- Referral and booster systems are designed to rapidly expand the community.

- Deflationary mechanics that burn or lock tokens to preserve long-term value.

For Wall Street desks hungry for upside beyond the ETF headlines, MAGAX represents a parallel narrative: structured meme tokenomics with viral upside potential.

Live on Oct. 2, 2025, 6PM UTC: https://www.binance.com/en/live/u/30976012

Closing Thoughts

Ethereum’s slide below $4,100 demonstrates the significant impact that ETF flows and macroeconomic signals can have on even the strongest blockchains. However, while ETH consolidates near its support level, traders seeking explosive returns are turning to MAGAX.

MAGAX, with AI-driven rewards, audited security, and presale scarcity, aims to redefine the meme economy as more than just another meme token.

Don’t wait until the next presale stage; secure your MAGAX tokens now and ride the breakout of the 2025 meme economy.