Ethereum Gains Momentum From Institutional Inflows

Ethereum’s price momentum is building as institutional inflows reach unprecedented levels across spot ETFs. Data shows that Bitcoin ETFs attracted $149 million on October 27, while Ethereum ETFs saw zero outflows and $134 million in net inflows. This consistent demand underscores growing investor confidence in Ethereum’s long-term viability. Analysts now view this accumulation as the catalyst for a renewed upward trajectory.

Institutional Appetite Signals Market Strength

The recent inflow surge follows weeks of stagnation in crypto ETF markets earlier this month. The return of positive momentum suggests renewed institutional interest in high-cap digital assets. Ethereum, in particular, benefits from its expanding DeFi ecosystem and staking yield opportunities. As funds rotate from smaller assets, ETH has emerged as the preferred choice for institutional exposure.

Technical Indicators Support a Breakout Scenario

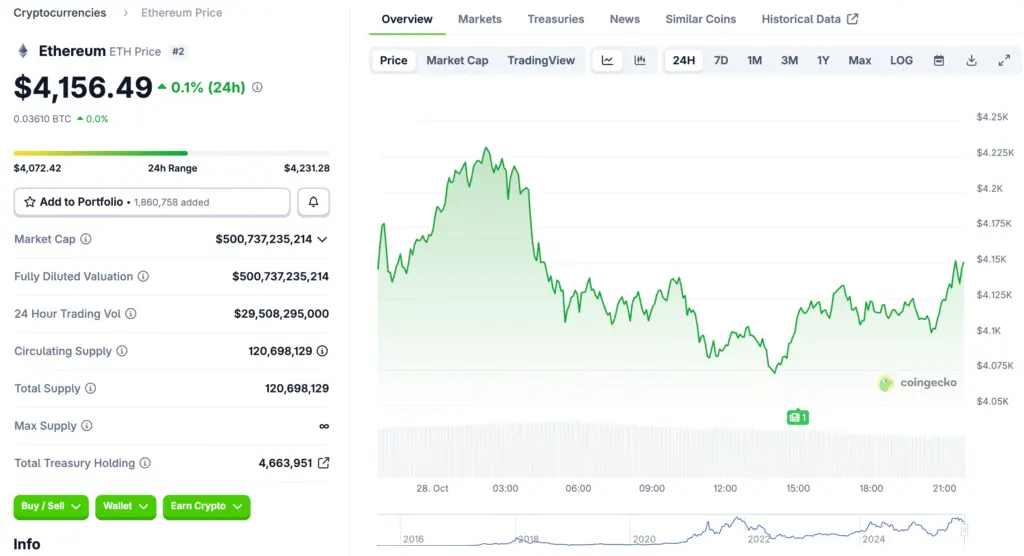

From a technical perspective, Ethereum’s price action remains in a consolidation phase below its 200-day moving average. The Relative Strength Index sits near 51, showing room for further expansion before overbought conditions. A breakout above the $4,200 resistance level could ignite a strong bullish move toward $5,000. Sustained ETF inflows could be the key trigger for this upward acceleration.

Recommended Article: Ethereum Whales Quietly Accumulate as Market Eyes Major Breakout

Market Rotation Highlights Ethereum’s Leadership

Capital rotation within the cryptocurrency market has strengthened Ethereum’s relative dominance. As Bitcoin stabilizes, liquidity is flowing into Ethereum and other major altcoins. This shift reflects growing investor preference for assets with strong network fundamentals and institutional adoption potential. Ethereum’s established infrastructure continues to attract capital from both retail and professional investors.

ETF Inflows Reflect Institutional Confidence

Zero net outflows from Ethereum ETFs demonstrate an exceptional degree of investor conviction. The combination of steady demand and limited selling pressure reinforces Ethereum’s role as a long-term store of digital value. Fund managers increasingly describe Ethereum exposure as essential in diversified crypto portfolios. This confidence supports the view that institutional participation will drive the next major price milestone.

Analysts Point to $5,000 as the Next Logical Target

Analysts and fund managers widely regard $5,000 as Ethereum’s next logical price objective. Breaking above $4,200 would likely trigger momentum-based buying among retail and algorithmic traders. The asset’s robust fundamentals and expanding on-chain metrics further validate these projections. If ETF inflows sustain current levels for another week, Ethereum could quickly retest previous all-time highs.

Macroeconomic Factors Enhance Crypto Appeal

The broader macroeconomic backdrop continues to favor digital assets as investors seek alternatives to traditional markets. With inflation pressures and monetary policy uncertainty persisting, Ethereum’s decentralized and yield-generating ecosystem offers attractive diversification. Institutional portfolios now treat ETH exposure as a hedge against fiat currency volatility. This environment enhances the probability of sustained demand over the coming quarters.

Outlook: Ethereum Positioned for Institutional Breakout

Ethereum’s confluence of technical strength, ETF inflows, and macroeconomic support paints a bullish outlook for Q4 2025. The $4,200 resistance remains the key level to watch for validation of the next leg higher. A successful breakout could propel prices toward $5,000 and attract further institutional inflows. With confidence returning to crypto markets, Ethereum stands at the forefront of this emerging institutional cycle.