A Look at the August Inflow Momentum

Global crypto investment products are back in the black. Last week, they had net inflows of $2.48 billion. This comes after a time when a lot of money was taken out. Renewed momentum pushed up the total net inflows for August. This year, commitments have reached $35.5 billion.

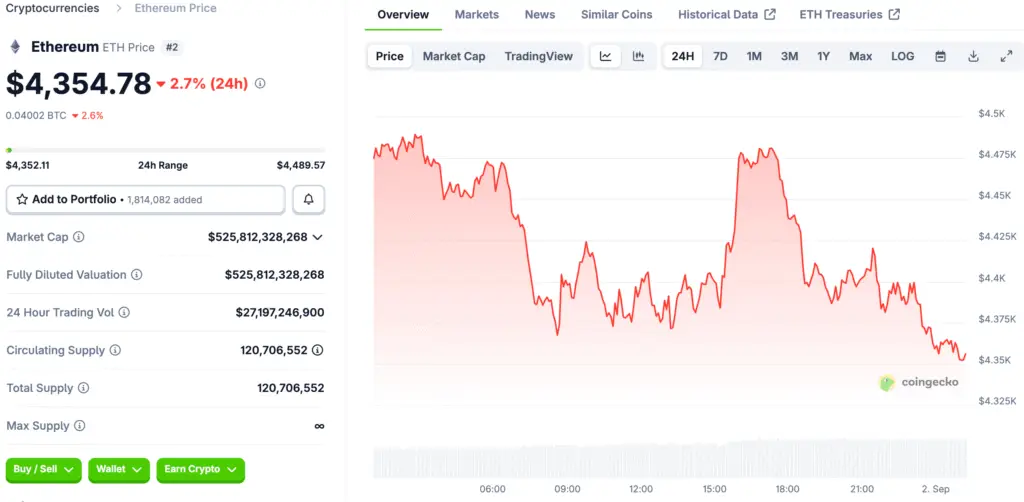

The head of research at CoinShares said that there were a lot of new investments coming in. But after the core PCE inflation data came out, people’s feelings changed. That disappointment hurt the market as a whole. This caused the total amount of assets under management to drop by 10%.

Ethereum’s August Lead Over Bitcoin

Last month, most of the new investments went to Ethereum. Investors seemed to love the second-largest digital asset. Last week, funds that focus on ETH brought in $1.4 billion in new money. This is almost twice as much as Bitcoin.

Month-to-date flows show a big gap. Last month, Ethereum got $3.95 billion in new flows. At the same time, Bitcoin had $301 million in net outflows. CoinShares says that investors are moving their money around on purpose.

Tactical Reallocation and the Rise of Altcoins

This change is also helping other altcoins. Solana made $177 million from sales. XRP also got $134 million in new money. This was helped by the growing excitement about new spot ETF approvals. Together, these two assets brought in almost $700 million in August.

But Cardano and Chainlink got smaller amounts. Sui, on the other hand, had a lot of money leave. The trend of reallocating assets shows that investors are looking for new chances. This is a big change from the market before.

Recommended Article: Tom Lee Predicts Ethereum Price Can Recover Quickly

Why the US Is Getting the Most Money

Most of the investments are still in US-based crypto investment products. CoinShares data showed that US funds got $2.29 billion of the flows last week. People who put money into stocks in Switzerland, Germany, and Canada came next. This shows that the US is still a big deal.

The wide range of inflows suggests that the drop on Friday was probably just a way to make quick money. This was not the beginning of a bigger pullback. This is a good sign for the future health of the market.

Price Drops and Global Market Sentiment

The Crypto Fear & Greed Index is now in the “fear” zone. This shows that investors are becoming more cautious. The broader market has been hurt by prices that are going down. This made the total amount of assets under management go down.

People were also upset about the Fed’s possible rate cut. But these dips can also be a normal part of a market cycle. They can give investors new chances to buy.

The Difference in How BTC and ETH Perform

The most recent market data shows that Bitcoin and Ethereum are not doing well together. Bitcoin’s outflows suggest that interest is fading, but Ethereum’s inflows show that people are still very interested. This difference shows that the market’s mood has changed. This is a sign that the market is getting older.

Investors no longer think that all cryptocurrencies are the same. They are moving things around on purpose. Now they are looking for projects that have strong fundamentals. This is a good sign for all of crypto.

August’s Total Net Inflows

The renewed momentum raised the total net inflows for August. This is a very good sign for the market. The US is in the lead with a lot of new money. It looks like crypto will have a very bright future.