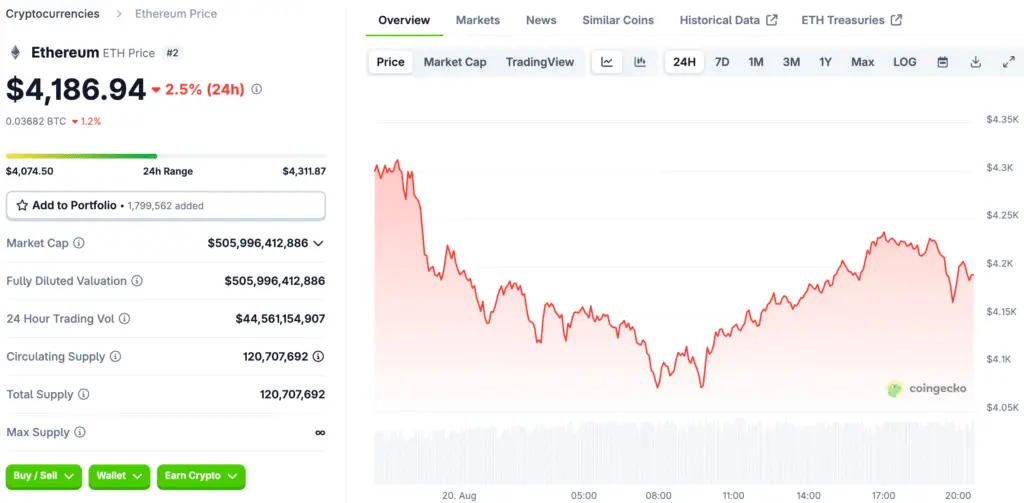

Ethereum Price Declines to a Two-Week Low

Ethereum has entered a period of turbulence, with its price dropping to a two-week low of $4,150. This marks a 4.5% decline from its recent high of $4,350, as the second-largest cryptocurrency by market capitalization struggles against multiple pressures. The drop comes at the same time Bitcoin corrected to $112,000, suggesting broader weakness across the digital asset market.

For Ethereum, however, the pullback appears more concerning due to structural factors such as a record-high unstaking queue and declining on-chain activity. This combination has raised questions about whether Ethereum will consolidate or face deeper losses in the short term.

Record-High $3.91 Billion Unstaking Queue Raises Concern

At the heart of Ethereum’s latest challenge is its Proof-of-Stake exit queue. Currently, 910,461 ETH—valued at approximately $3.91 billion, is waiting to be unstaked. This marks the largest exit queue in Ethereum’s history. The queue reflects investor profit-taking as Ethereum trades near its all-time high of $4,900, last seen in 2021. Xu Han, a partner at HashKey Capital, explained that many stakers are seizing the opportunity to lock in gains while also being influenced by rising borrowing rates on lending platforms like Aave.

Leveraged staking, once a popular strategy, has become less viable as borrowing costs increased, forcing traders to unwind their positions. The 15-day waiting period before these unstaked tokens re-enter the market provides some buffer, but analysts warn that a large supply influx could add short-term selling pressure.

Ethereum ETFs Face Outflows After Strong Inflows

Another source of market unease has been Ethereum exchange-traded funds (ETFs). After two weeks of consistent inflows, ETFs experienced consecutive days of outflows last week and earlier this week. This reversal suggests that institutional appetite for Ethereum is cooling, at least temporarily.

The timing is no coincidence. Investors are de-risking ahead of the U.S. Federal Reserve’s Jackson Hole meeting, where Chairman Jerome Powell is expected to provide signals on interest rate policy. A hawkish tone could dampen risk assets further, including cryptocurrencies like Ethereum.

Federal Reserve Uncertainty Adds Pressure

Macroeconomic factors are compounding Ethereum’s troubles. The Federal Reserve’s upcoming decision on whether to cut rates in September has investors on edge. Recent economic data has increased the possibility of a more cautious approach by the Fed.

According to OTC trader Jake Ostrovskis, many traders have “de-risked before Friday’s Jackson Hole” to avoid exposure to potential volatility. A hawkish speech by Powell could weigh heavily on risk-sensitive markets, further pressuring Ethereum.

Ethereum Network Activity Drops 28% Since July

Beyond market flows, Ethereum’s fundamentals are showing weakness. Active addresses interacting with the network have declined from 841,000 on July 30 to around 600,000 today—a 28% drop. Similarly, new addresses joining the network fell by 28% to 138,000.

This decline signals waning retail and developer activity, both critical for sustaining Ethereum’s long-term growth. Reduced network engagement often corresponds with lower transaction volumes and diminished demand for ETH, exacerbating bearish sentiment.

Technical Outlook for Ethereum Price

From a technical perspective, Ethereum is struggling below $4,250 and the 100-hourly Simple Moving Average. Resistance remains at $4,320–$4,350, while immediate support is near $4,065. Should Ethereum fail to reclaim resistance, analysts warn the price could fall further toward $4,000 or even $3,850.

However, experts like Arthur Azizov of B2 Ventures expect Ethereum to consolidate between $3,900 and $4,400 until macroeconomic clarity emerges. This consolidation range may provide stability, though it will likely remain vulnerable to broader market movements.

Ethereum’s Bullish Long-Term Trajectory

Despite short-term challenges, many industry experts remain optimistic about Ethereum’s trajectory. Institutional interest through ETFs, coupled with the exit queue’s role in preventing a validator exodus, provides some safeguards against systemic risks. HashKey’s Xu Han believes Ethereum can absorb the supply shock thanks to robust inflows from institutional treasuries and long-term holders.

Some analysts even project Ethereum could reach $6,000 to $8,000 by the end of the year once current uncertainties clear. The combination of regulatory clarity, continued development on scaling solutions, and Ethereum’s dominance in decentralized finance (DeFi) could reignite demand. For now, however, the market appears to be bracing for more short-term turbulence.

Read More: Ethereum Positioned to Outperform as Bernstein Predicts Bitcoin at $200K