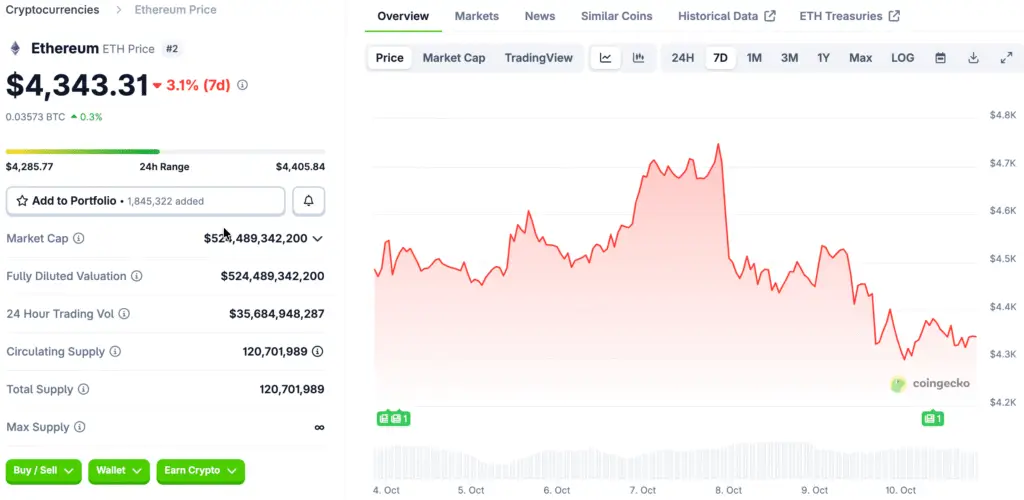

Ethereum Price Holds Above $4300 Amid Strong October Rebound

Ethereum is currently in a recovery phase, having made a significant rebound from its September lows to trade around $4370 in the early sessions of October. The altcoin momentarily reached $4738 before stabilizing, reflecting an 8% decline from its most recent high.

Even with short-term fluctuations, Ethereum demonstrates significant relative strength when compared to other prominent altcoins. Experts indicate that the purchasing activities of institutions via spot ETFs and treasury investments play a crucial role in maintaining price stability amid short-term market fluctuations.

ETF Inflows Strengthen Ethereum’s Institutional Growth Narrative

The total managed assets of Ethereum ETFs have exceeded $30 billion, with just a single day of outflows noted this month. The steady influx of investments highlights an increasing trust among institutions in the enduring worth and scalability prospects of Ethereum.

Market strategists emphasize that major asset managers are increasingly considering Ethereum as a means of diversifying their broader crypto portfolios. This trend reflects the initial phase of Bitcoin’s ETF adoption, characterized by consistent inflows that propelled price appreciation over several quarters.

Ethereum Foundation Expands Privacy and Security Initiatives

The Ethereum Foundation has recently established a 47-member Privacy Cluster aimed at enhancing data protection and minimizing the risks associated with on-chain surveillance. The group comprises engineers, cryptographers, and blockchain researchers dedicated to developing protocols that prioritize privacy.

Coordinator Nicolas Consigny highlighted that genuine digital trust necessitates the incorporation of privacy at the architectural level. This initiative highlights Ethereum’s goal to establish confidentiality as a key component of its developing ecosystem roadmap.

Recommended Article: Ethereum Foundation Launches Privacy Cluster for On-Chain Trust

Fusaka Upgrade Expected to Transform Scalability in December 2025

The forthcoming Fusaka upgrade, set for December 3, 2025, stands as a pivotal milestone on Ethereum’s roadmap. The block gas limit will rise from 45 million to 150 million, allowing for enhanced transaction throughput and improved efficiency.

It is the belief of developers that this change will enhance network scalability while maintaining decentralization. Increased gas limits facilitate a greater number of transactions within each block, thereby improving the efficiency of DeFi protocols, NFTs, and Layer 2 integrations.

Institutional Holdings Exceed 12 Million Ethereum Tokens

Participation from institutions in Ethereum has hit unprecedented heights, with treasuries and ETFs now holding more than 12.47 million ETH combined. Spot ETFs currently possess 6.81 million ETH, whereas corporate treasuries collectively hold 5.66 million ETH in their global portfolios.

Firms like Bitmine, BlackRock, and VanEck have consistently expanded their holdings. Bit Digital has recently increased its holdings to 150,244 ETH, which is valued at approximately $652 million, highlighting the ongoing trend of significant institutional adoption.

Technical Indicators Point Toward Renewed Upward Momentum

Ethereum maintains robust support around the $4300 level, where several short-term moving averages align. The Relative Strength Index is currently at 48, indicating a state of balanced momentum following a retreat from overbought levels.

The MACD readings continue to show positivity, as the histogram displays green bars that indicate ongoing buying interest. Experts view this consolidation as a positive sign, possibly setting the stage for a surge toward $5000 in the near future.

Experts Set $5500 As Ethereum Continues Its Upward Trend

Mark Newton from Fundstrat Global Advisors anticipates that Ethereum may reach $5500 by mid-October, provided the current momentum continues. He considers the recent pullback to be an essential recalibration within a larger upward trajectory.

Market analysts concur that ongoing ETF inflows and expectations surrounding the Fusaka upgrade could maintain a positive trend. Should Ethereum manage to close firmly above $4700, the technical targets ranging from $5000 to $5500 will become more achievable as we approach the end of the year.