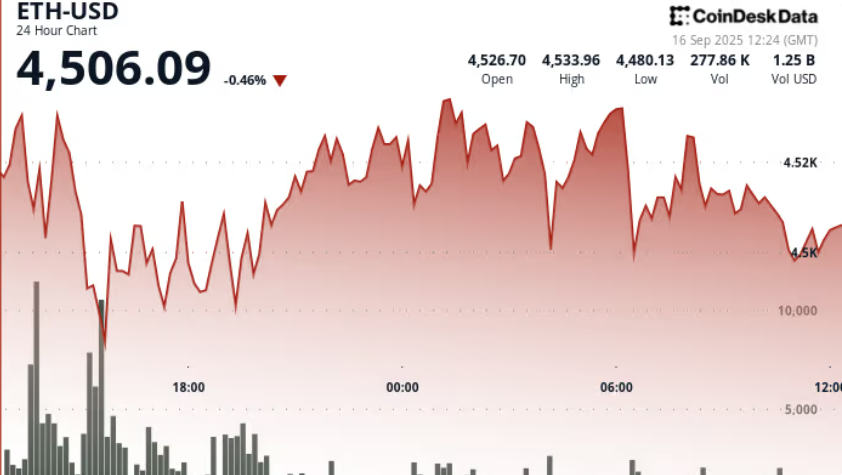

Ethereum’s Outlook: Will it Break New Ground?

Ethereum is consolidating around $4,000 after a brief dip below support. Analysts suggest a breakout could push prices toward $5,500 soon, while some bullish forecasts see potential between $10,000 and $15,000 if institutional demand and tokenization accelerate.

Risks remain, as a break below $3,800 or weaker macro conditions could trigger downside. Still, Ethereum holds its place as the second-largest crypto and a leading long-term growth asset.

Source: Coindesk

#1: Solana (SOL) — Scaling Powerhouse in Demand

Solana remains one of the strongest altcoin contenders, thanks to its dominance in DeFi and NFTs. Its network can handle tens of thousands of transactions per second at minimal cost, making it a top choice for developers.

Recent whale activity has boosted momentum, signaling confidence from large investors. If SOL clears resistance near current levels, analysts believe it could trigger another strong rally fueled by broader altcoin inflows.

#2: Chainlink (LINK) — Infrastructure & Oracle Dominance

Chainlink has become a core pillar of Web3 by delivering reliable real-world data to smart contracts. Its oracles power countless DeFi platforms and decentralized applications, making it essential infrastructure.

Recent staking upgrades and network improvements have boosted investor confidence and strengthened its ecosystem. With growing cross-chain integrations and rising adoption, analysts see LINK as a long-term favorite that could return 3× to 5× in the coming years if momentum continues.

#3: MAGAX — Presale Star Turning Heads

MAGAX is quickly emerging as one of the most exciting projects of the year. The token has now entered Stage 3 of its presale at $0.000318 after earlier rounds sold out in record time. This surge of demand shows how strongly retail investors are backing its vision.

Unlike most meme coins, MAGAX uses a Meme-to-Earn model powered by Loomint AI, which rewards community-created content while filtering out fake activity and bots. This ensures genuine adoption and sustained momentum.

On top of that, the project has already passed a CertiK audit, adding a layer of trust that most meme tokens cannot offer. Analysts are now attaching projections of up to 18,880% ROI, positioning MAGAX as one of the most hyped presale opportunities going into 2026.

#4: XRP — Institutional Corridor & Utility Focus

XRP continues to be a favorite for institutions seeking efficient cross-border payment solutions. Its strong utility in global settlement systems has kept it relevant despite past regulatory hurdles. With clarity in regulations improving, many analysts believe XRP could revisit $5 and potentially move even higher.

Unlike speculative meme coins, XRP provides a more stable, utility-driven option for investors who prefer reduced volatility while still capturing solid returns. This dual appeal makes it one of the foundational bets in the current crypto landscape.

Why MAGAX Might Outpace Even Ethereum

Ethereum still anchors DeFi, but its size means gains come in smaller multiples unless huge new catalysts hit.

MAGAX, by contrast, is early and expanding fast — its Stage 3 presale is live at $0.000318, with the price rising each stage, creating built-in scarcity. Its Meme-to-Earn model and strong retail traction give it higher percentage upside than ETH at this point in the cycle.

If an Ethereum breakout sparks broader altcoin rotation, MAGAX could benefit disproportionately. That’s why early participation in Stage 3 is critical for maximizing potential returns.