Ethereum Encounters Unprecedented Supply Deficit Before Possible Surge

The circulating supply of Ethereum is decreasing swiftly, as on-chain data shows that over 40% of all ETH is now locked away. Staking, ETFs, and dormant addresses now together account for a substantial portion, greatly constricting the liquidity flow in the market.

Experts suggest that this unusual “triple vacuum” phenomenon stemming from institutional interest, validator lock-ups, and dormant wallets might drive Ethereum to reach new all-time highs as demand consistently surpasses the available supply.

Institutional Investors Absorb 12% of Ethereum Supply

Data from Ark Investments reveals that U.S.-based ETFs have amassed 6.84 million ETH, which is approximately valued at $28 billion. This accounts for approximately 5.6% of Ethereum’s overall supply, even prior to the official approval of staking within ETF frameworks.

Public companies have now secured more than 12% of ETH’s total supply, with Bitmine recently enhancing its balance sheet by adding $834 million worth of Ethereum. The company’s assets have now surpassed $12.5 billion, underscoring an increasing interest from institutions in this asset class.

Staking Locks Nearly 30% of Ethereum Circulating Tokens

Approximately 29.5% of Ethereum’s supply is presently staked on the proof-of-stake network, rendering it temporarily unavailable because of validator exit limits that average around 40 days. This mechanism successfully eliminates a significant amount of ETH from active circulation.

The ongoing staking activity indicates a robust belief among investors, as validators allocate their capital to enhance network security while earning consistent yield returns. Experts indicate that this consistent lockup fosters enduring price stability and mitigates speculative fluctuations.

Recommended Article: Ethereum Price Surge Renews Optimism Among Crypto Investors

Dormant Wallets and DAOs Add to Supply Vacuum

Alongside staking and ETF accumulation, approximately 3.4% of ETH is currently stored in inactive addresses or DAO treasuries. These tokens are viewed as illiquid, with numerous ones remaining untouched for years or permanently removed from circulation.

This trend further limits Ethereum’s liquid availability, resulting in a structural supply shortage that intensifies the effects of any new demand surges. The blend of sustained holding patterns and institutional involvement strengthens the optimistic outlook for the market.

Exchange Reserves Drop to Record Lows

According to CryptoQuant data, the exchange supply ratio of Ethereum on Binance has decreased to 0.33, marking the lowest point since May. This decline suggests that traders are moving their assets from centralized exchanges into private wallets or staking contracts.

In the past, low exchange balances have often been linked to price surges, as there are fewer coins available for quick sale. The trend showcases a growing sense of investor confidence and a movement towards decentralized custody solutions.

Analysts Forecast Ethereum Could Reach $8K–$10K

Investor Ted Pillows, along with other analysts, indicates that Ethereum could be significantly undervalued when compared to global liquidity benchmarks. There are projections suggesting that ETH might hit a range of $8,000 to $10,000 by early 2026, contingent on ongoing institutional inflows and staking approvals.

Crypto strategist Crypto Gucci shared this perspective, highlighting that Ethereum has yet to experience a bull cycle with all 3 supply vacuums staking, ETFs, and dormant wallets operating at the same time, setting the stage for a potential supply-driven rally.

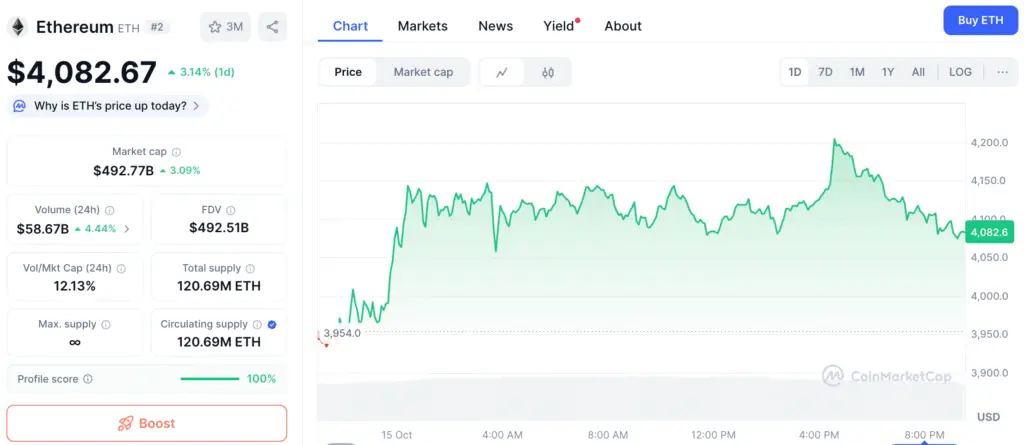

ETH Price Remains Steady Above $4K Support Level

Currently, Ethereum is trading at approximately $4,100 following a recovery from a dip to $3,900. Experts in technical analysis point out that $3,990 serves as a crucial support level, while resistance is observed around $4,600.

As long as ETH stays above $4,000, the outlook remains positive. As exchange reserves decline and long-term investors gather strength, Ethereum seems ready for a potential surge toward a new all-time high in the near future.