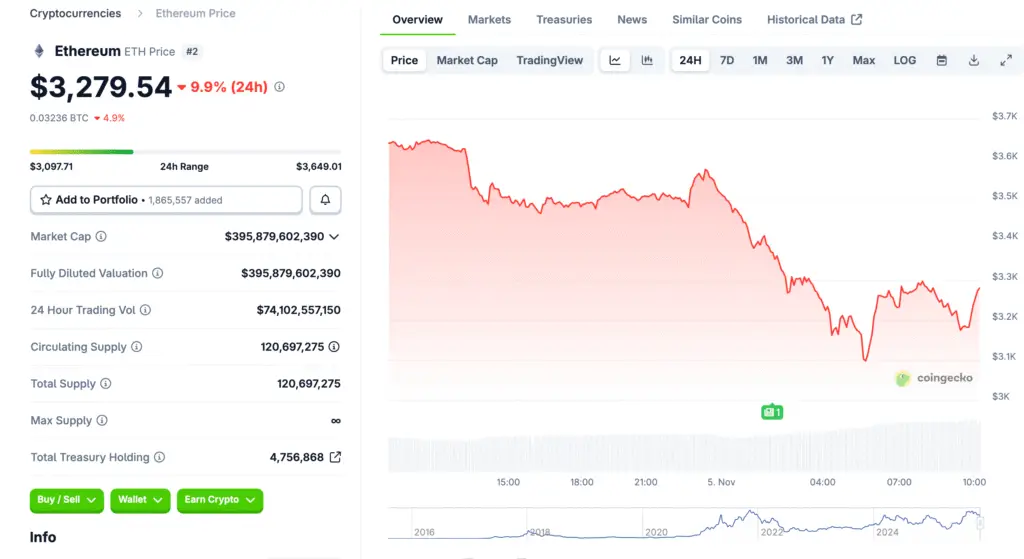

Ethereum Faces Renewed Selling Pressure

Ethereum’s price decline continues as bearish sentiment dominates the market. The token slipped below $3,500 on Tuesday, marking its second consecutive day of losses. Analysts attribute this weakness to heavy ETF outflows and reduced investor participation from both institutional and retail traders.

Institutional Outflows Weigh on Market Confidence

Data from SoSoValue shows U.S.-listed Ethereum ETFs recorded $136 million in outflows on Monday. BlackRock’s ETHA and Fidelity’s FETH led the withdrawals, shedding $82 million and $25 million respectively. These movements pushed total net inflows to $14.23 billion, reflecting a sharp reversal in institutional sentiment.

Retail Demand Weakens as Futures Market Contracts

Retail investors have scaled back participation in Ethereum derivatives trading. Futures open interest has fallen to $44.72 billion, down from October’s $63 billion peak. The persistent decline highlights a lack of bullish conviction, with traders increasingly closing long positions and shifting toward short exposure.

Recommended Article: Ethereum Slumps 6% Amid Hack Concerns and Market Sentiment Shift

Funding Rates Signal Growing Bearish Bias

CoinGlass data reveals that Ethereum’s OI-weighted funding rate has dropped to 0.0038%, further confirming market pessimism. As short positions accumulate, the downward momentum strengthens, making any immediate recovery less likely without renewed demand or positive catalysts.

Technical Indicators Confirm Bearish Momentum

Ethereum’s daily chart shows clear bearish signals. The MACD continues to flash a sell signal, with the blue line positioned below the red. Meanwhile, the RSI has dropped to 33, approaching oversold territory. These indicators suggest the potential for additional downside before stabilization occurs.

Key Support and Resistance Levels to Watch

If Ethereum fails to hold the $3,500 psychological level, analysts expect further declines toward $3,350—a previously tested support from August. Conversely, a sharp rebound above the 200-day EMA at $3,606 could attract new buying interest and trigger short covering among traders.

Market Mood Turns Risk-Off Across the Board

The broader crypto market’s fear-driven tone has compounded Ethereum’s losses. With Bitcoin also under pressure, traders are moving capital into stablecoins and sidelined assets. This flight to safety reflects uncertainty about how long the current correction may last.

Outlook: Path to Recovery Remains Challenging

Ethereum’s near-term outlook remains fragile as selling pressure persists across both ETFs and futures markets. However, a potential rebound could form if macroeconomic conditions stabilize and liquidity returns. For now, the $3,500 level serves as the critical line separating short-term weakness from a possible recovery.