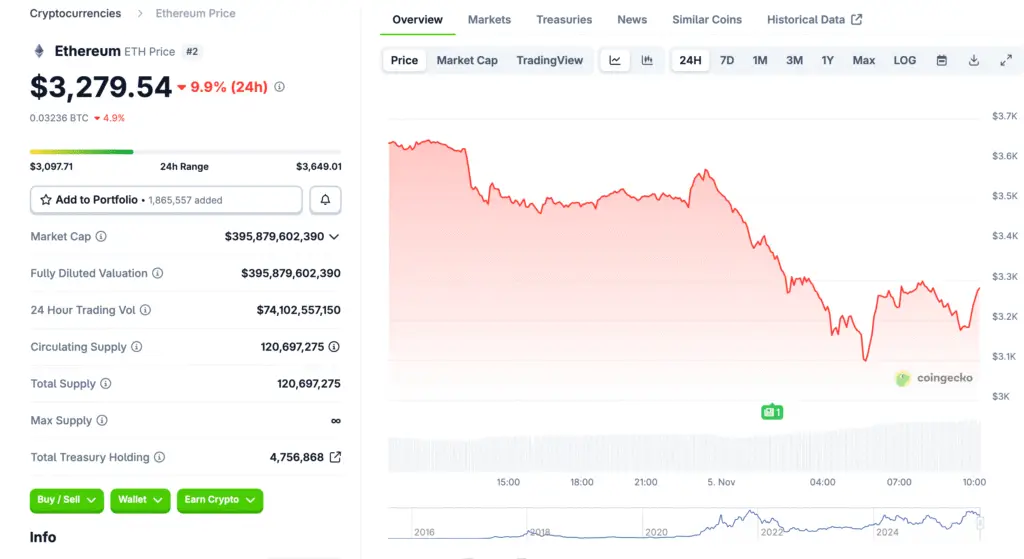

Ethereum Sees Sudden 6% Drop in Market Value

Ethereum’s price fell sharply, losing over 6% in 24 hours as bearish sentiment overtook markets. The decline came despite recent bullish catalysts, including institutional buying and strong fundamentals. Investors appear increasingly wary amid renewed fears of security vulnerabilities across the Ethereum network.

Security Breach Sparks Investor Caution

A newly reported exploit targeting Ethereum-based assets wiped out approximately $128 million. The Balancer protocol suffered the brunt of the attack, raising questions about network security. This event intensified risk aversion, with many traders opting to liquidate holdings as precautionary measures.

Sentiment Overshadows Positive Catalysts

While some institutional investors increased exposure, broader market psychology remains defensive. BitMine’s recent purchase of 82,000 ETH failed to offset selling pressure. Analysts suggest that fear-driven behavior often outweighs fundamentals during volatile periods.

Recommended Article: Ethereum Price Optimism Signals Broader Shift Toward Decentralized Payroll Infrastructure

Market Commentators Fuel Downward Momentum

Notable figures in the crypto space, including author Robert Kiyosaki, have issued bearish remarks about Ethereum’s outlook. Their warnings appear to have amplified investor hesitation. As social media commentary spreads, short-term sentiment continues to deteriorate, leading to deeper corrections.

Ethereum’s Long-Term Case Remains Intact

Despite near-term weakness, analysts stress that Ethereum’s fundamentals remain strong. The network continues to dominate decentralized finance and smart contract ecosystems. Long-term investors view price dips as buying opportunities amid the platform’s ongoing technological upgrades.

Broader Market Context Adds Pressure

Ethereum’s slump coincides with a broader crypto sell-off, with several top tokens losing between 5% and 10%. Traders cite macroeconomic uncertainty, high interest rates, and shifting liquidity conditions as contributing factors. Risk appetite remains fragile across both traditional and digital markets.

Technical Picture Shows Deepening Correction

Charts indicate Ethereum has dropped more than 25% from its August highs. RSI levels point toward oversold conditions, suggesting a potential technical rebound. However, sustained recovery may require improved sentiment and reduced volatility.

Outlook: Buying the Dip or Caution Ahead?

Analysts remain divided on Ethereum’s short-term trajectory. Some predict a rebound once security concerns subside, while others warn of further downside risk. For long-term holders, Ethereum’s innovation and institutional integration continue to justify cautious optimism amid current turbulence.