A Bold Bet on Ethereum’s Future

In a move that signals a new level of institutional confidence in cryptocurrency, BitMine, one of the largest corporate Ethereum (ETH) holders, has announced an ambitious plan to raise a staggering $24.5 billion through a new stock sale. The proceeds from this sale will be used to significantly expand the company’s ETH treasury, building on its already market-leading holdings.

This aggressive accumulation strategy mirrors the playbook that has been famously used by Strategy (formerly MicroStrategy) with Bitcoin. By raising capital at scale, BitMine is making a massive bet on Ethereum’s long-term value and its central role in the decentralised finance ecosystem. This is a clear indicator that the crypto treasury model, which was once limited to Bitcoin, is now being applied to Ethereum in a big way.

BitMine’s Market-Leading Ethereum Holdings

BitMine has already established itself as a heavyweight in the corporate crypto space. With current holdings of 1.15 million ETH, valued at over $5 billion, the company is the single largest corporate Ethereum holder. This gives it a significant stake in the network and positions it to benefit directly from the cryptocurrency’s price appreciation. The new stock sale, as detailed in a filing with the U.S. Securities and Exchange Commission (SEC), outlines a plan to dramatically increase these holdings.

The company’s strategy is to use the newly raised capital to multiply its ETH stash by four, further cementing its position as a dominant player. This aggressive push to acquire more ETH is a powerful vote of confidence in the cryptocurrency’s future, and it is a key reason why BitMine’s stock price has performed so well, rising over 750% this year alone.

The Surge in Corporate and Institutional Demand

The actions of BitMine are not an isolated event but are part of a broader trend of surging corporate and institutional demand for ETH. While Bitcoin treasuries became the norm in 2020, Ethereum has only emerged as a serious corporate treasury asset in 2025. This new wave of demand has been a major factor in driving Ethereum’s recent price surge.

BitMine’s aggressive strategy is not unique; Sharplink Gaming, the second-largest corporate ETH holder, is also planning to raise nearly $500 million to bolster its Ethereum reserves. This scramble among public companies to secure ETH has created short-term supply squeezes on over-the-counter (OTC) desks and exchanges, pushing prices higher. This indicates that the market is now being driven by demand dynamics, rather than just development timelines or technical upgrades.

ETH Price Nears Record Highs

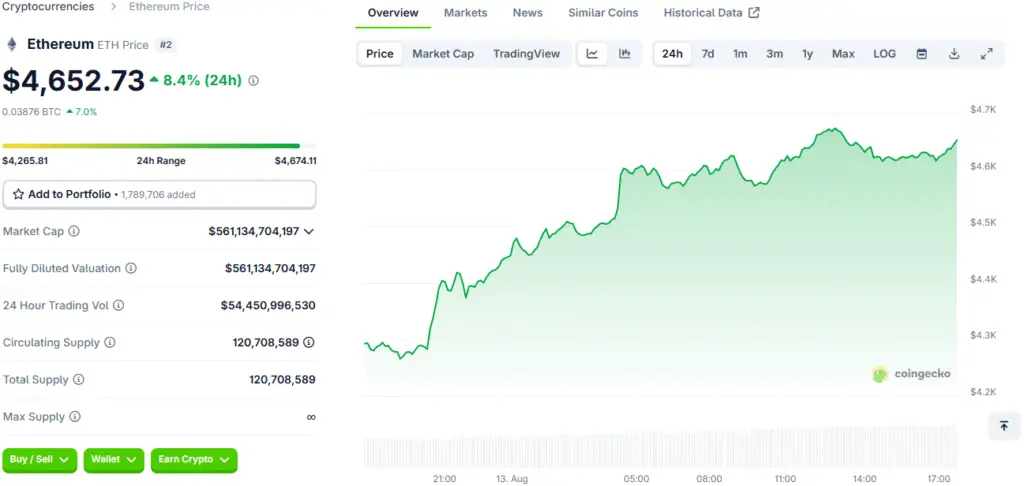

The influx of institutional and corporate capital has had a direct and dramatic impact on the price of Ethereum. The cryptocurrency has surged to a four-year high of over $4,600, bringing it within striking distance of its all-time high. This impressive price performance is particularly noteworthy because it comes despite some delays in technical upgrades, a sign that the market is responding more to fundamental demand than to short-term news.

While ETH spent much of the last bull run stuck under $3,000, its recent surge over the past two months demonstrates a new level of maturity and strength. Some analysts now see a clear path for ETH to reach $10,000 in the current bull run, with BitMine CEO Tom Lee going even further with a long-term prediction of prices above $80,000. These price targets, whether they are ultimately reached or not, reflect a new level of bullish sentiment and confidence in the cryptocurrency’s future.

Following the Strategy Playbook for Ethereum

BitMine’s strategy is a clear and direct parallel to the playbook that was famously executed by Michael Saylor’s Strategy (formerly MicroStrategy) with Bitcoin. The core idea is to use common stock sales to raise capital, which is then used to buy and hold a significant amount of cryptocurrency on the corporate balance sheet. This approach allows a company’s stock to act as a proxy for the underlying digital asset, giving traditional investors exposure to the cryptocurrency without having to buy it directly.

By issuing common stock at a price of $0.0001 per share, BitMine is raising a massive amount of capital with a clear and aggressive goal. This strategy, which has proven successful for Bitcoin, is now being tested at a new scale with Ethereum, and its success will likely have a profound impact on how other companies view the crypto treasury model.

The Mechanics of a Massive Stock Sale

The plan to raise $24.5 billion through an at-the-market (ATM) stock sale, with shares priced at $0.0001 each, is a massive undertaking. This follows a previous stock offering that raised $4.5 billion, highlighting BitMine’s rapid and aggressive pivot toward ETH over the past three months. The ATM offering allows the company to sell shares directly into the open market at prevailing prices, providing a flexible and efficient way to raise capital.

This method is particularly useful for companies that need to raise a large amount of money over a period of time, as it minimises the market impact of a single, large offering. The SEC filing provides a detailed look into the company’s plans and its financial strategy, giving investors a clear picture of how BitMine intends to execute its vision to multiply its Ethereum holdings by four.

BitMine and ETH: A Virtuous Cycle of Demand and Price Appreciation

BitMine’s massive bet on Ethereum signals a new era of corporate crypto adoption. The company’s aggressive strategy, combined with the surging institutional demand for ETH, is a powerful indicator of the cryptocurrency’s growing legitimacy and its central role in the future of finance. The success of this model, and the subsequent rise in Ethereum’s price, will likely encourage more companies to adopt a similar strategy, creating a virtuous cycle of demand and price appreciation.

While the road ahead will undoubtedly have its challenges, BitMine’s actions are a clear and decisive statement that the company is fully committed to the future of the Ethereum network. This will have a lasting impact on how both traditional and crypto-native companies view their treasuries and their role in the evolving digital asset landscape.

Read More: The Fight for Ethereum’s Soul: A Cointelegraph Documentary