Ethereum’s Ecosystem Expansion Positions It for Long-Term Market Dominance

Ethereum has positioned itself as the foremost blockchain for decentralized applications, the tokenization of real-world assets, and the adoption of institutional finance. The strong developer community consistently propels innovation, nurturing ecosystem expansion that draws in both capital and talent.

The Pectra upgrade significantly boosts scalability and usability by implementing account abstraction, which leads to lower fees and faster transaction speeds. The enhancements render Ethereum more appealing to financial institutions developing cutting-edge blockchain infrastructure for worldwide financial activities.

Real-World Asset Tokenization Boosts Ethereum’s Growth Prospects

One of Ethereum’s most promising growth avenues is the tokenization of real-world assets, which is projected to surpass $10 trillion in market size by 2030. Through the tokenization of traditional assets, Ethereum paves the way for financial markets that are more efficient, transparent, and accessible to investors and institutions around the world.

At present, public blockchains possess roughly $31 billion in tokenized assets, with Ethereum accounting for about $9 billion of that total market value. The early lead of Ethereum provides it with a crucial strategic edge in attracting institutional investments as the global adoption of tokenization continues to grow.

Developer Community Strengthens Ethereum’s Innovation Pipeline

Ethereum continues to be the primary center for developers of decentralized applications, playing a vital role in fostering ecosystem innovation and ensuring the creation of long-term network value. A substantial developer community fosters increased experimentation, a variety of products, and swift advancements in financial applications spanning DeFi, NFTs, and enterprise solutions.

This gathering of expertise creates a positive feedback loop: an increasing number of developers create more valuable protocols, drawing in additional users and liquidity. As time progresses, this dynamic strengthens Ethereum’s position as the essential foundation for blockchain finance, bolstering its investment potential.

Recommended Article: Ethereum Price Prediction: Dogecoin Latest News & Where Could You Turn $100 into $10,800 in Q1 2026

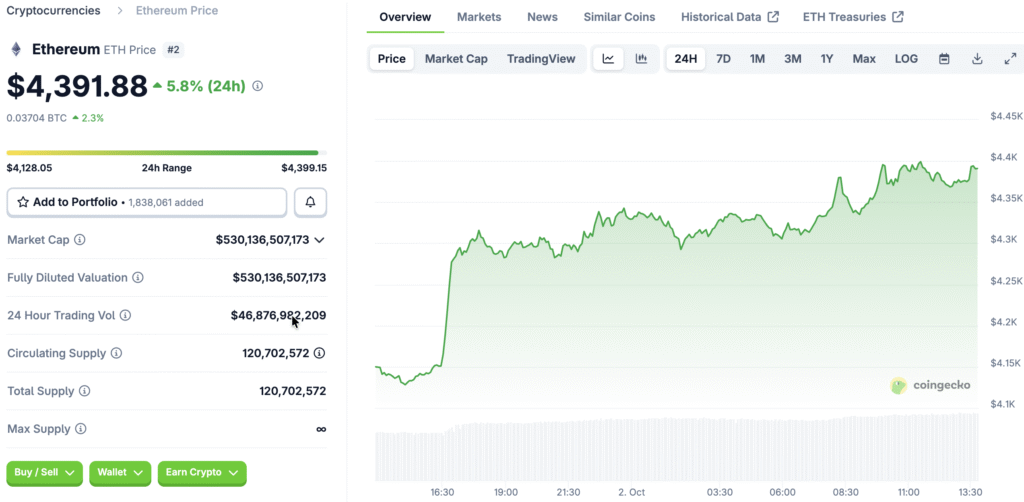

Market Cap Size Limits Ethereum’s Explosive Upside but Ensures Stability

Ethereum boasts a market capitalization of around $503.6 billion, positioning it as one of the largest cryptocurrencies in the world. This scale may limit the chances of achieving 100x returns, but it offers greater stability and resilience when compared to smaller, more speculative ventures.

While Ethereum might not transform a modest investment into millions overnight, its robust fundamentals and various independent growth drivers position it as an attractive long-term asset for consistent compounding. The influence of institutional adoption and the creativity of developers are significant forces that contribute to lasting value growth.

BNB’s Utility Focus Creates a Narrower Growth Pathway

BNB serves mainly as the gas and utility token within Binance’s ecosystem, providing users with reduced fees, staking options, and token burns. This utility has significantly contributed to BNB’s rapid growth, yielding impressive returns in recent years, yet its potential is still closely linked to the performance of Binance’s platform.

The value of BNB is significantly influenced by Binance’s ongoing market leadership, the regulatory framework, and the competitive dynamics within centralized exchanges. The reliance on a single platform restricts BNB’s potential to cultivate independent growth factors, especially when contrasted with Ethereum’s varied and decentralized ecosystem.

Supply Burns and Exchange Usage Sustain BNB’s Appeal Despite Constraints

BNB enjoys an auto-burn mechanism that consistently decreases supply, which aids in price appreciation for those who hold it long-term. The rapid transaction speeds, minimal fees, and seamless connection to Binance’s large user community establish a strong foundation for potential growth in the future.

Nonetheless, BNB continues to face risks tied to specific platforms, competition, and potential policy shifts. Although it may experience significant appreciation over time, its potential for growth is inherently restricted due to its narrow focus, making it less probable to yield transformative returns in the future.

Ethereum Offers a More Resilient Path for Wealth Accumulation

For those looking to enhance their long-term investment portfolios, Ethereum offers a stronger and more varied opportunity than BNB. The scale of its ecosystem, the level of developer engagement, the extent of institutional adoption, and its leadership in tokenization all contribute to various avenues for generating value.

BNB is expected to continue being a robust utility token within Binance’s ecosystem; however, its reliance on a single corporate entity limits its potential for strategic growth. Ethereum’s extensive market positioning enhances its suitability for consistent wealth growth over longer periods.