Ethereum Price Sees Sharp Pullback After Foundation Wallet Move

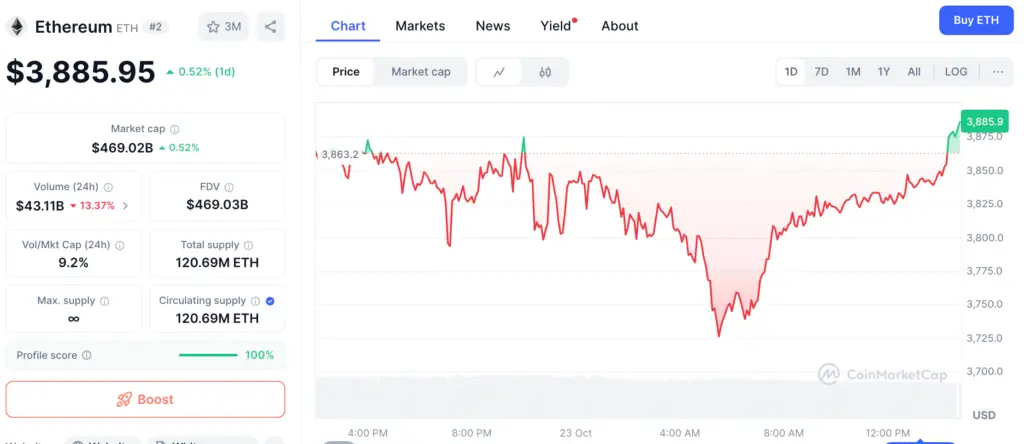

On Wednesday, Ethereum (ETH) temporarily dropped below $3,800 after a rapid rush of people taking profits. The drop happened when the Ethereum Foundation (EF), a nonprofit that keeps the blockchain’s core development going, shifted 160,000 ETH worth almost $650 million to a new multisignature wallet.

Even though the Foundation said this was a normal movement and not a sale, merchants were careful. When the EF makes big transfers, investors frequently worry and start selling more, as seen by past trends. Santiment data shows that ETH investors made over $700 million in gains in only 24 hours, which was one of the biggest profit-taking spikes of the quarter.

$700 Million Profit Realization Shows Market Worry

Profit-taking coincides with a significant increase in Ethereum’s “Age Consumed” indicator, indicating that older investors are moving their assets, potentially signaling the start of distribution stages.

This trend was observed alongside the Foundation’s wallet migration, causing ETH to circulate and causing traders to be cautious about potential market slowdowns. This trend is similar to past instances where EF purchases occurred before local pricing changes, prompting traders to be more cautious about wallet activity as early signs of a market slowdown.

Ethereum Foundation Clarifies Treasury Rebalancing

The Ethereum Foundation has moved its funds to a new multisig wallet for improved security and internal accounting. The group supports the Ethereum ecosystem through DeFi protocols like Morpho, where it invested 2,400 ETH and $6 million in stablecoins.

The Foundation’s treasury report from June 2025 outlines a decrease in expenditure from 15% to 5% over five years to ensure network research, development, and community projects continue to receive funding. Speculative traders remain cautious due to concerns about short-term price activity impacted by fund changes.

Recommended Article: Ethereum Price Struggles Below $4,000 as Breakout Nears $4,340

On-Chain Data Confirms Selling Pressure and Liquidations

The on-chain statistics for Ethereum support a pessimistic mood. Coinglass says that in the last 24 hours, ETH saw $169 million in total futures liquidations, with $119.1 million in long holdings being wiped out.

This wave of selling came after ETH tried to break out at $4,100 but ran into a lot of resistance and fell back to its 200-day Exponential Moving Average (EMA). Analysts say that the support zone between $3,470 and $3,800 is now very important for keeping the structure stable. If Ethereum loses these levels for good, it might start a bigger fall toward $2,850, which is where the bottom trendline of its declining channel pattern resides.

Ethereum Holds Above 200-Day EMA as Bulls Defend Key $3,470 Level

The daily chart indicates that ETH is holding steady just above the 200-day EMA after being turned down below $4,100. Momentum indicators like the Relative Vigor Index (RSI) and Moving Average Convergence Divergence (MACD) histogram are still below neutral levels, which shows that bullish vigor is diminishing.

If a daily candle closes below $3,470, it would likely mean that the market has changed direction, which would open the door for more downward volatility. On the other hand, getting back over the 50-day EMA and the $4,100 barrier might bring back bullish momentum and open the way to $4,520 and maybe even $4,960.

Market Sentiment and Broader Outlook

Ethereum’s long-term value is still strong, even though it has been volatile in the near term. There is still a lot of institutional demand for staking and yield-based products. More than $8.36 billion is tied up in DeFi protocols built on Ethereum.

Traders are being careful, though, since they are weighing their hopes for the future scalability enhancements against their worries about profit-taking cycles and declines induced by the economy. Analysts say that as long as Ethereum’s macro trendline is on the rise, the asset’s long-term bullish structure will stay in place, even if there are brief drops.

ETH Price Prediction: Important Levels to Keep an Eye On

- Immediate Support: $3,470 and the 200-day EMA

- $4,100 and the 50-day EMA are major resistance levels.

- Bearish Target: $2,850 if support fails

- Bullish Target: $4,520 if the breakthrough is verified

Traders are keeping an eye on Ethereum as it moves through the ups and downs of post-migration. They are waiting for a clear move in either way. In the next 48 hours, we will find out if ETH can go back on its bullish track or if it will go into a deeper correction before its next big rebound.