BitMine Enhances Its Ethereum Treasury Holdings

BitMine Immersion Technologies has expanded its Ethereum acquisition strategy, securing about 203,826 ETH in the past week. This move increases the company’s total Ethereum holdings to 3.24 million ETH, representing roughly 2.7% of the circulating supply.

This bold approach reinforces BitMine’s position as the leading digital asset treasury with a primary focus on Ethereum. Its treasury now includes 192 Bitcoin, $219 million in cash reserves, and $119 million in equity from Eightco Holdings, bringing the total combined asset value to about $1.34 billion.

$820 Million Acquisition Week Highlights Continuous Growth

The recent Ethereum purchases, worth nearly $820 million, continue a steady accumulation pattern that began during the summer. Blockchain data shows several large inbound transfers to BitMine-associated wallets, including a 104,000 ETH transaction that took place during last week’s market correction.

This accumulation strategy aligns with BitMine’s goal of eventually holding up to 5% of Ethereum’s total supply. Despite ongoing market volatility, the company has effectively taken advantage of price dips, describing its approach as “opportunistic buying” in the wake of liquidation events.

Tom Lee’s Optimistic Perspective on Ethereum

Chairman Tom Lee has repeatedly described Ethereum as a “truly neutral” blockchain, emphasizing its unmatched potential for institutional adoption. He believes Ethereum’s ability to support decentralized applications, layer-2 networks, and tokenized real-world assets will make it central to global finance.

Lee predicts that Ethereum is entering a “Supercycle” driven by staking dynamics, deflationary supply, and enterprise-level integration. “Given the expected supercycle for Ethereum, this price dislocation presents a compelling risk/reward opportunity,” he said, commenting on the market’s recent correction.

Recommended Article: Ethereum Surges as $205M Inflows Defy Market Volatility Fears

Market Landscape and ETH Value Trends

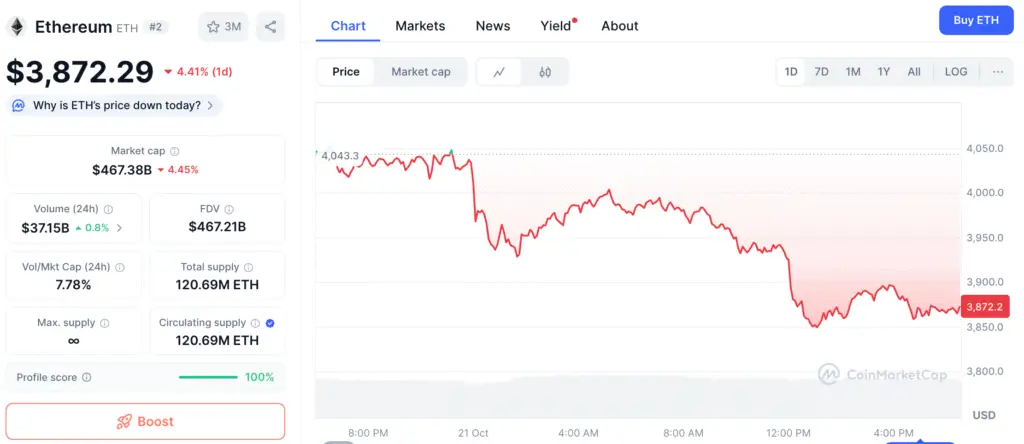

This week, Ethereum’s price has hovered around $4,000, reflecting a 10% decline in October during one of the most intense crypto deleveraging phases in recent history. The sell-off cleared excessive leverage on major exchanges, leading to short-term volatility before stabilizing near key support zones.

BitMine has shown precise timing in its accumulation efforts, strategically buying during market stress. This approach demonstrates strong conviction in Ethereum’s long-term potential and its continuing dominance in decentralized finance.

Institutional Adoption and Ethereum’s Network Resilience

Institutional demand for Ethereum remains solid despite the broader market’s challenges. The blockchain continues to serve as the leading foundation for tokenization, DeFi protocols, and NFT ecosystems.

BitMine’s growing ETH reserves signal increasing confidence among institutional investors in Ethereum’s fundamentals. The network’s deflationary token model, supported by EIP-1559’s burn mechanism, further strengthens ETH’s role as a long-term store of value in the digital economy.

BitMine’s Treasury Strategy Reflects Assurance

BitMine’s Ethereum-focused treasury distinguishes it from most corporate crypto investors that primarily favor Bitcoin. The firm’s strategy aims to mitigate volatility and capture future upside by maintaining diverse assets and strong liquidity.

Recent filings confirm that Ethereum now dominates BitMine’s crypto portfolio, underscoring its commitment to ETH’s growth trajectory. BMNR shares climbed 7% after the announcement, reflecting investor optimism toward the company’s accumulation strategy.

Ethereum Supercycle and Corporate Adoption

Analysts suggest BitMine’s large-scale ETH purchases could inspire other institutions to increase their exposure to Ethereum. If ETH maintains its current trend and institutional demand persists, network activity and adoption could accelerate through 2026 and beyond.

BitMine’s target of holding 5% of Ethereum’s supply may seem ambitious, yet experts consider it achievable given the company’s consistent buying and ample liquidity reserves. With ETH trading near $4,000, conditions appear favorable for a renewed wave of institutional accumulation and potential upward momentum in the coming quarters.