Ethereum Whales Return With Renewed Confidence

Ethereum’s largest holders have begun accumulating again, sparking speculation of an impending market shift. Data from Alphractal indicates that wallets holding 10,000 to 100,000 ETH have steadily grown since April. This marks one of the strongest accumulation phases since 2021, a period that preceded a historic rally. Analysts view this renewed confidence as a strong signal that major investors expect further upside in the months ahead.

Institutional Accumulation Strengthens Market Outlook

These high-net-worth and institutional investors have historically aligned with Ethereum’s long-term price trends. When whale balances rose in both 2017 and 2021, ETH prices followed with substantial gains. The current trend appears to be following the same pattern, suggesting another potential bullish cycle forming. As retail traders hesitate amid uncertain macroeconomic conditions, institutional money continues to quietly build positions.

Solana-to-Ethereum Rotation Signals Market Sentiment Shift

A notable on-chain event involved a large investor selling 99,979 SOL valued at approximately $18.5 million and purchasing 4,532 ETH at $4,084. This cross-chain movement indicates that sophisticated investors are reallocating capital toward Ethereum’s ecosystem. Analysts believe the rotation reflects growing confidence in Ethereum’s technological foundation and its expanding role in decentralized finance. The move also demonstrates how institutional portfolios are diversifying away from higher-volatility assets toward more stable blockchain networks.

Recommended Article: Ethereum Faces $650M Short Pressure Ahead of Trump–China Tariff Talks

Analysts Highlight $3,700 as Key Support Level

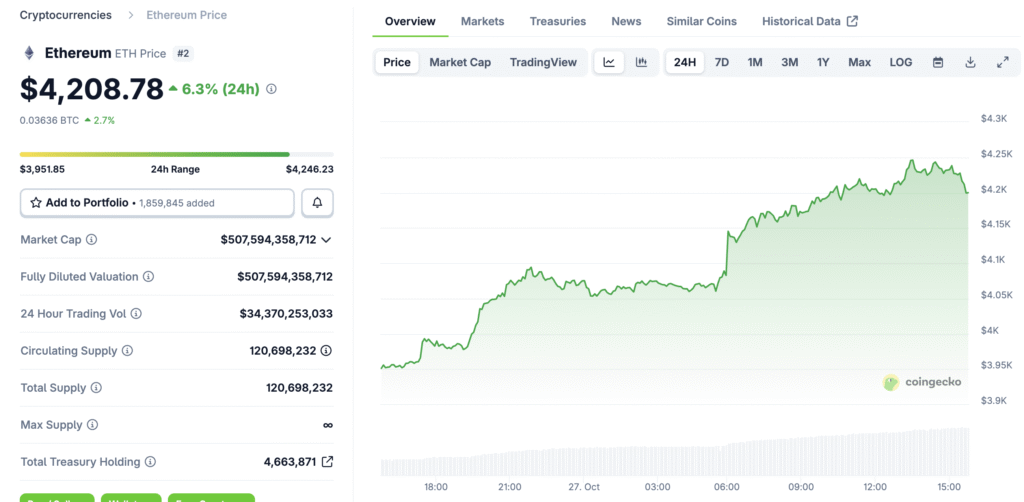

Market analysts emphasize the $3,700 level as a crucial support zone for Ethereum’s near-term price action. Ali Martinez, a prominent trader, noted that ETH must maintain above $3,830 to prevent deeper corrections. If the price breaks below $3,700, it could test $3,400 before finding new buying pressure. Conversely, a move above $4,100 would confirm a bullish reversal with possible targets between $4,500 and $4,800.

Bitcoin Consolidation Adds Pressure to Altcoins

Bitcoin’s stagnation near its 50-week moving average has cast uncertainty across the broader altcoin market. Analyst Mister Crypto warned that a drop below this key level could trigger extended downside momentum. Many investors have therefore concentrated their holdings in Bitcoin and Ethereum, the two most resilient digital assets. Meanwhile, smaller altcoins are seeing reduced liquidity as traders adopt a risk-off approach.

Wyckoff Re-Accumulation Suggests Institutional Preparation

Technical analysts point out that Ethereum’s recent behavior fits the Wyckoff re-accumulation model, which often precedes sharp rallies. This pattern typically occurs when large investors accumulate assets quietly during consolidation phases. On-chain data supports this theory, showing decreasing exchange inflows and rising wallet balances. If history repeats, Ethereum may be preparing for a powerful breakout phase similar to its 2021 surge.

Altcoin Market Faces Cooling Sentiment

While Ethereum benefits from strong accumulation, the wider altcoin market remains sluggish. Analyst Johnny Woo commented that the broader altcoin index, excluding BTC and ETH, continues to flash sell signals. The decline in speculative trading suggests that capital is concentrating in higher-quality projects with proven ecosystems. This market rotation strengthens Ethereum’s relative dominance and underscores investor preference for fundamentals over hype.

Long-Term Outlook Remains Bullish for Ethereum

Despite short-term volatility, Ethereum’s fundamentals remain intact, supported by its large developer base and robust infrastructure. Institutional adoption of decentralized finance and tokenization continues to expand globally. As whale accumulation intensifies, Ethereum’s next major breakout could coincide with improving macroeconomic conditions in early 2026. For long-term investors, this quiet accumulation may represent the calm before another wave of exponential growth.