A Dormant Ethereum Whale Awakens to Buy the Dip

In the dynamic world of cryptocurrency, the movements of large holders, known as “whales,” are often seen as powerful indicators of market sentiment. Recently, a significant event has sent ripples of bullish chatter throughout the Ethereum community. A whale wallet that had been dormant for four years suddenly came to life, making a massive purchase of $28 million worth of Ether (ETH). This move occurred as the price of ETH had dropped by more than 13% since Sunday.

For many market analysts, this was not a random transaction but a deliberate strategy to “buy the dip,” or to accumulate assets at a lower price point in anticipation of a future price rebound. This kind of accumulation by a long-term holder is a strong signal of conviction, suggesting that a major player sees the recent price decline as a fleeting opportunity rather than a sign of a fundamental breakdown.

The Significance of On-Chain Whale Movements

On-chain data, which tracks cryptocurrency transactions on the blockchain, provides invaluable insights into the behavior of large investors. When a whale moves a significant amount of crypto off of an exchange and into a private wallet, it is typically viewed as a bullish signal. This is because such a move suggests the whale intends to hold the assets for the long term, reducing the immediate sell pressure on the market.

The opposite action, moving large amounts of crypto onto an exchange, is often seen as a bearish signal, as it suggests the whale may be preparing to sell their holdings. The recent transaction by the dormant Ethereum whale, along with other similar movements, indicates a broad trend of accumulation by major addresses, reinforcing the idea that the market is in a phase of strategic buying rather than panic selling.

Institutional and Corporate Accumulation of Ether

The recent whale activity is not an isolated event; it is part of a larger trend of institutional and corporate accumulation. The cryptocurrency market is no longer solely driven by retail investors. Major players are now entering the space, bringing with them substantial capital and a long-term investment horizon. For instance, the company BitMine has made a significant push into the Ethereum ecosystem, adding a staggering $252 million in Ether to its holdings in the past week alone.

This corporate accumulation, which has brought BitMine’s total ETH holdings to an impressive 797,704 ETH, is a powerful sign of confidence. The fact that BitMine has additional reserves set aside for further purchases suggests that they believe in the long-term growth trajectory of Ethereum, and they are prepared to continue accumulating on future price dips.

The Impact of Spot Ethereum ETF Inflows

The growing institutional interest is further amplified by the performance of Spot Ethereum ETFs. These investment vehicles provide a regulated and accessible way for traditional investors to gain exposure to ETH without having to directly purchase and manage the cryptocurrency themselves. According to recent data, Spot Ethereum ETFs have attracted more than $1 billion in inflows since August 21.

These inflows are particularly significant as they almost completely erased a substantial amount of outflows witnessed just a few days prior. The steady influx of capital into these ETFs, combined with the on-chain whale and corporate buying, reinforces the view that the recent price dip is being treated as an entry point for both new and existing investors.

The V-Shaped Recovery Pattern: A Bullish Signal

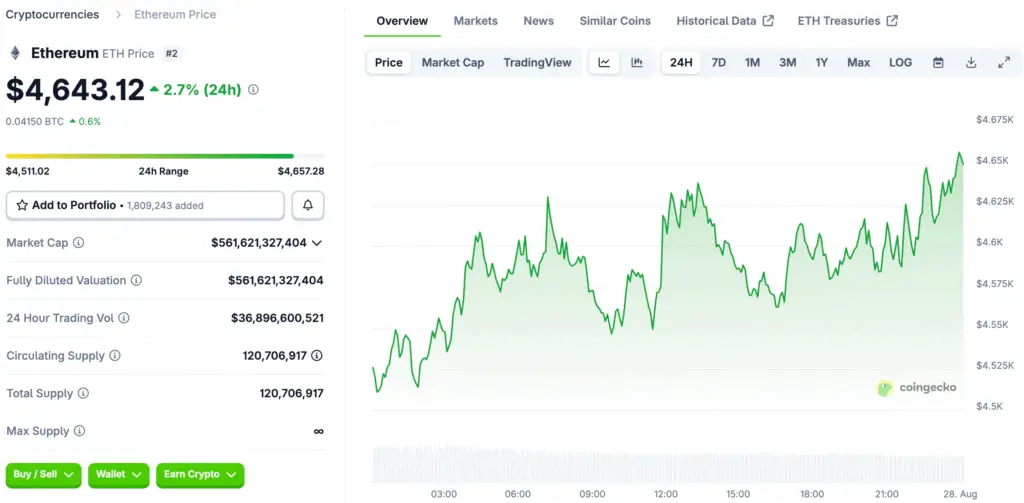

From a technical analysis perspective, Ethereum’s recent rebound from its summer lows is forming a “V-shaped” recovery pattern. This pattern is characterized by a sharp decline followed by an equally sharp and sustained rebound, creating a chart that resembles the letter V. Analysts often view this as a powerful bullish signal, as it suggests that the selling pressure has been exhausted and that buyers have returned to the market with conviction.

The V-shaped recovery is a sign of a strong bottom, and it has historically preceded major bull runs in previous market cycles. For instance, a similar pattern was seen in late 2020, which preceded a massive bull run that pushed ETH to new all-time highs. The current formation of this pattern is giving many analysts and investors confidence that a major upward movement is on the horizon.

Future Price Targets and Expert Forecasts

The confluence of bullish signals, including whale accumulation, corporate buying, ETF inflows, and the V-shaped recovery pattern, has led to some highly optimistic price forecasts for Ethereum. While the exact targets vary, many analysts believe that a significant price climb is imminent. Some technical setups suggest that the price of ETH could climb toward the $10,000 to $20,000 range in the coming months.

These forecasts are supported by the growing utility of the Ethereum network and the increasing demand from institutional players. Geoffrey Kendrick, the head of digital assets at Standard Chartered, has even gone on record to anticipate that ETH could hit $7,500 by the year’s end. These forecasts, while speculative, reflect a broad sense of optimism and a belief that Ethereum’s future is exceptionally bright.

Ethereum’s Strong Accumulation Phase

The recent activity of a dormant Ethereum whale and the subsequent on-chain and institutional data paint a clear picture of a market that is in a strong accumulation phase. The strategic buying by large players, the steady inflows into Spot Ethereum ETFs, and the formation of a bullish V-shaped recovery pattern all serve to reinforce the view that Ethereum’s recent price dip was a temporary correction rather than a market breakdown.

While the cryptocurrency market is always subject to volatility, the collective actions of these major players provide a powerful signal that a sustained bull run may be on the horizon. This period of quiet accumulation by whales and institutions is a key indicator of the market’s underlying health and a powerful testament to the long-term value proposition of Ethereum.

Read More: Ethereum Price Surges to New Highs After Fed Rate Cut Hint