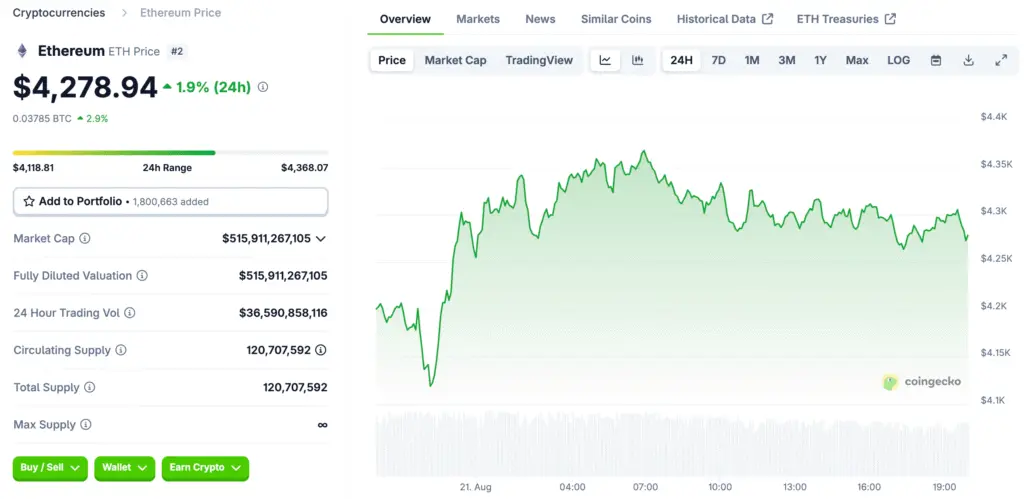

Diverging Trends Emerge in Ethereum’s Market

Ethereum is experiencing a significant split in market sentiment, with short-term and medium-term trends moving in different directions. The futures market is exceptionally active, indicating a period of caution and re-evaluation among traders. Exchange reserves of Ethereum have edged higher, indicating more ether is available for potential selling. This increased supply could create near-term price pressure, although the buildup has not yet reached a level that should cause significant alarm.

On the derivatives side, futures taker volume over the past 90 days remains skewed toward selling, suggesting professional traders are hesitant to open new long positions. Ethereum’s futures volume “bubble map” shows red clusters near recent price highs, a classic sign of an overheating market. In the immediate future, a correction toward the $3,950-$4,100 support band is a distinct possibility, particularly if a liquidation cascade unfolds.

The Bullish Case for Ethereum’s Fundamentals

Ethereum’s medium-term outlook is robust, supported by several structural drivers. The most significant factor is the substantial inflow of capital into Ethereum-based exchange-traded funds, which have seen unprecedented demand, indicating institutional investors’ comfort with Ethereum as an asset class. Corporate treasury adoption is also growing, with publicly traded companies integrating Ethereum into their core financial strategies.

The expansion of real-world asset tokenization on the Ethereum blockchain is also crucial, as tangible assets like real estate and private credit are being tokenized. These fundamental pillars provide a solid foundation for Ethereum to absorb short-term selling pressure and pave the way for a powerful new rally. These factors contribute to the confidence of long-term investors and institutions in Ethereum.

The Rise of Ethereum Treasury Companies

Companies are increasingly holding Ethereum in their treasuries, challenging Bitcoin’s traditional dominance in this area. Firms like BitMine Immersion Technologies and SharpLink Gaming are leading a new wave of corporate Ethereum accumulation, not just buying and holding it passively but actively using it as a productive asset that can generate yield through staking. BitMine has amassed over 1.5 million ETH, making it the largest corporate holder of the asset.

SharpLink has raised hundreds of millions of dollars to fund its aggressive acquisition strategy. This shift is driven by Ethereum’s ability to offer a yield, a feature that differentiates it from Bitcoin, which is primarily a passive store of value. By staking their Ether, these companies can generate a new source of revenue and enhance shareholder value.

Ethereum’s Role in Real-World Asset Tokenization

The tokenization of real-world assets is a transformative application of blockchain technology, and Ethereum has cemented its position as the leading platform for this innovation. Real-world assets, or RWAs, are physical or financial assets like real estate, bonds, and credit that are represented as digital tokens on a blockchain. This process dramatically increases the liquidity and accessibility of traditionally illiquid and exclusive assets. For example, a single piece of property can be fractionalized into hundreds of tokens, allowing a wider range of investors to own a portion of it.

The Ethereum network, with its robust smart contract capabilities, is the ideal infrastructure for this. Major financial players are actively involved, with the on-chain value of tokenized RWAs on Ethereum now exceeding billions of dollars. This is a powerful validation of the network’s utility and its ability to bridge the gap between traditional finance and decentralized technology. As this sector continues to grow, it will drive a steady and compounding demand for the Ethereum network’s blockspace, which could have a lasting effect on the price of Ether.

ETF Inflows Signal a New Wave of Institutional Adoption

The approval of spot Ethereum ETFs in the US and other regions has facilitated a new class of institutional investors, providing regulated access to the Ethereum market without the complexities of direct ownership or self-custody. This has led to significant capital inflows, with some single-day totals reaching over a billion dollars. This indicates that institutional demand for Ether is becoming a primary investment thesis, with competition among major asset managers like BlackRock and Fidelity validating the market.

The efficient process of “in-kind” creations and redemptions makes these funds more attractive to large-scale investors. This flood of institutional money is a key factor in the long-term bullish narrative for Ethereum.

The Growing Gap Between Bitcoin and Ethereum

The crypto community has been predicting a “flippening” where Ethereum’s market capitalization surpasses Bitcoin’s. However, recent surges in corporate treasury adoption and ETF inflows have rekindled this discussion. Ethereum’s weekly spot trading volumes have tripled those of Bitcoin, indicating capital rotation into Ether. The market cap of ETH-focused firms has also increased, with major players like BitMine Immersion and SharpLink Gaming emerging.

Bitcoin’s primary value proposition is “digital gold,” while Ethereum, often called “digital oil,” serves as the foundation for decentralized applications, smart contracts, and new financial paradigms. The growing utility of Ethereum’s network and supply-reducing tokenomics could lead to a faster value accumulation than Bitcoin’s. These trends suggest a significant and structural narrowing of the gap between the two leading cryptocurrencies.

Why a Pullback Is a Good Thing for ETH

The crypto market is known for its volatility, and even with strong long-term fundamentals, short-term price corrections are inevitable. The current market dynamics, with overheated futures markets and increasing exchange reserves, are a prime example of this. The likely outcome is a “volatility reset” in the coming weeks. A short-lived dip triggered by a liquidation cascade could flush out excess leverage from the system, creating a healthier, more sustainable foundation for the next price rally.

This type of cleansing event is often a necessary precursor to a significant upward move, as it removes the weak hands and speculative froth from the market. If exchange reserves stabilize and the sell-side dominance in futures subsides, Ethereum would be in an excellent position to reclaim the $4,300 mark and extend its rally towards new all-time highs. The combination of its robust utility, institutional validation, and the potential for a cleansed market suggests that a short-term pullback may be a necessary and ultimately beneficial event for the world’s second-largest cryptocurrency.

Read More: Ethereum Price Drops as Network Activity Declines and $3.91B Unstaking Queue Grows