FLOKI Nears a Decisive Turning Point

FLOKI has been correcting for months, but it looks like it is now entering a crucial accumulation period that might set the course for its next big trend. The meme coin is holding steady in historical demand zones that have acted as launch pads for big rallies in the past. This is thanks to the strength of the community and speculative interest.

Experts say that this long time of low volatility is generally a sign that big price changes are on the way. Both optimistic and negative traders are now keenly looking for technical confirmation. The next breakthrough level will probably set the short-term direction of FLOKI.

FLOKI Holds Above Key Demand Zone as Bulls Eye $0.000015–$0.000020 Range

Crypto analyst Chimp of the North suggests that FLOKI’s long-term structure is still in a major accumulation zone, a price range that has caused rebounds since mid-2023. Long-term investors are drawn to this consolidation area, as it is technically above long-term support, a base structure often seen before big bullish reversals.

The expert believes that FLOKI’s correction may be coming to an end, and if buyers can protect this demand zone, it might aim for mid-range resistances between $0.00001500 and $0.00002000, an early sign of recovery strength. If current levels don’t hold, further retracements may occur, making this a crucial time for traders watching FLOKI’s next move.

Market Overview: Momentum Slows but Confidence Persists

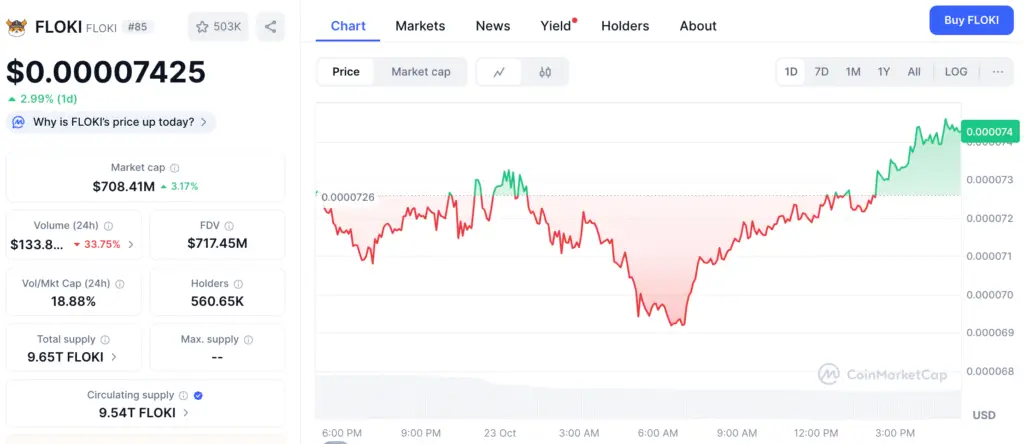

BraveNewCoin says that FLOKI trades for around $0.00007100, which is down 3.82% in the last 24 hours. The coin has a market worth of $686.5 million and trades over $171.8 million per day. Even if the price dropped, FLOKI is still one of the top meme currencies in the world. This shows how strong its community is and how many people are still interested in it.

Short-term volatility has gone down, which might mean that traders are unsure of what to do. However, this quiet time could be the calm before a bigger breakout. People in the market seem to be waiting for a clear move before putting more money into the asset or moving it around.

Recommended Article: Floki Gains 20% After Elon Musk’s Viral X CEO Dog Mention

FLOKI Consolidates After Sharp Decline, Hinting at Recovery Setup

The FLOKI/USDT daily chart shows the token is currently at $0.000071, following a recent drop from a high of $0.000157. Technical indicators suggest negative momentum, but data suggests the impetus to go down may be receding. The BB Power indicator shows a negative score, indicating weak purchasing strength and limited upward energy.

The Chaikin Money Flow (CMF) number is -0.10, suggesting slowing selling outflows and an early accumulation. This convergence suggests FLOKI may be developing a price base, indicating a gradual build-up before a recovery phase.

Key Levels to Watch for Confirmation

The key level for bullish traders is $0.00008000, and if the price breaks above this level and volume increases, it may indicate a change in market mood and a potential price rise towards the $0.00010000–$0.00012000 zone.

If FLOKI doesn’t hold support below $0.00006500, it may go down in the short term, potentially testing lower accumulation areas. Market observers suggest monitoring volume patterns and RSI divergences to strengthen the argument for a bullish turnaround in November 2025.

FLOKI’s Broader Market Context

The meme currency market as a whole has been quiet lately, with major coins like DOGE and SHIB trading in small ranges. FLOKI’s community-driven projects and expanding ecosystem, which are supported by its marketing activities and listings on exchanges, keep it at the top of the meme asset category.

Even if people’s feelings about it alter, the FLOKI project’s persistent presence on key exchanges and social media sites keeps it one of the most talked-about coins in retail trading circles. Analysts think that continued accumulation and eventual stability might set the stage for a fresh bullish wave if the crypto market has more liquidity.

FLOKI Consolidates as On-Chain Data Signals Selling Pressure Easing

FLOKI’s present consolidation is a key step in the accumulation process. Even while people are still cautious in the short term, on-chain and technical signs show that selling pressure is easing and a comeback may be on the way.

If the price goes over $0.00008000, it might change the story in favor of bulls. If support levels aren’t held, recovery hopes will be put on hold. Traders are keeping a careful eye on the market as it approaches the last quarter of 2025. This tranquil accumulation phase might be the calm before the next big rise for FLOKI.