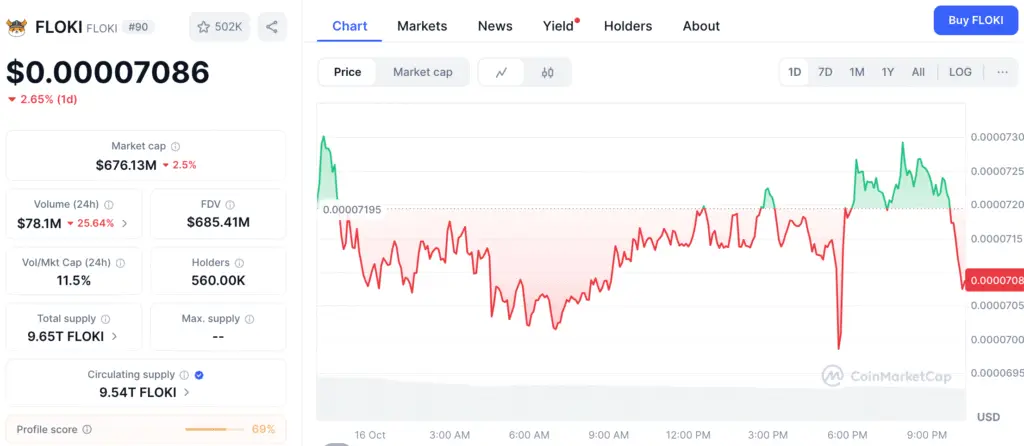

Floki Enters a Period of Stability Following a Turbulent Sell-off

Floki (FLOKI) is presently in a phase of consolidation following a volatile week, during which the token dipped briefly below $0.000005 before experiencing a slight recovery. In the wake of the significant liquidation event that eliminated leveraged positions, the market seems to be transitioning into a period of cooling. The price action has now settled around the $0.0000071 mark, indicating a careful approach from traders who are on the lookout for fresh directional signals.

The muted activity indicates that both buyers and sellers are currently in a state of temporary balance. As participants process the recent fluctuations, the data on open interest and trading volume indicates a drop in engagement, suggesting that market players are reluctant to adopt bold positions until a more definitive breakout signal appears.

Uncertainty in the Compression Phase Signals Market

According to Coinalyze, the 1-hour chart for FLOKI reveals a distinct compression pattern, characterized by closely formed candles and reduced trading ranges. This compression typically comes before a breakout, yet it provides little clarity on direction until a clear move takes place.

The decline in open interest to 3.62 million indicates a significant decrease in speculative involvement. This contraction usually indicates that traders are closing out leveraged positions, whether because of liquidation or a desire to reduce risk. The current situation suggests that Floki is moving into a phase characterized by low liquidity accumulation, where there are fewer short-term bets influencing price fluctuations.

Floki Trades Near $0.000074 With Low Volume and Tight Price Consolidation

As reported by BraveNewCoin, FLOKI is currently trading at approximately $0.00007409, reflecting a daily decrease of 4.16% and holding a market capitalization of $715.52 million. The trading volume over the past 24 hours is recorded at $130.04 million, indicating a significant drop in recent sessions. Even with lower turnover, FLOKI maintains a position within the top 150, highlighting consistent yet muted market activity.

The price action observed between $0.000071 and $0.000076 indicates a constricted pattern characterized by minimal volatility. The token’s ability to maintain its position above immediate support suggests that sellers are starting to lose their grip in the short term. However, the lack of substantial buying volume indicates a weak level of confidence among those involved in the market.

Recommended Article: Floki Price Eyes $0.000097 As Bulls Defend Critical Support

Technical Indicators Suggest Weak Momentum

Technical readings from TradingView indicate a neutral-to-bearish configuration. FLOKI is currently priced at approximately $0.00007122, reflecting a decline of 4.67% for the day, following its inability to maintain the momentum gained from its recent local peak close to $0.00015777. The token’s trend of lower highs and lower lows indicates diminishing upward momentum, with significant resistance at approximately $0.00010 persistently limiting upward movements.

Experts pinpoint the $0.00001544 zone as a crucial support level for the long term. A strong defense of this area could establish a foundation for possible recovery, whereas a fall below might subject the token to further retracement levels.

Floki Indicators Mixed as CMF Turns Positive but MACD Stays Bearish

The Chaikin Money Flow (CMF) is presently at 0.02, indicating slight yet positive inflows. This suggests that certain buyers are gradually accumulating, yet they lack the sufficient strength to shift momentum in a decisive manner. A breakout in the CMF above 0.10 would suggest enhanced liquidity engagement, possibly indicating the initial phases of a recovery.

At the same time, the MACD indicator persists in signaling bearish trends. The MACD line is positioned beneath the signal line, while the red bars of the histogram further emphasize a persistent downside bias. These readings indicate that although the selling momentum is diminishing, there has not been a significant emergence of strong buying momentum yet.

Price Structure Points Toward Extended Consolidation

The current price movement of FLOKI indicates that the market is expected to maintain a sideways trend as we approach the end of October. The tight volatility bands, along with declining open interest, suggest that we may experience prolonged consolidation prior to a significant breakout.

If bulls manage to regain the range of $0.000085–$0.000090, a short-term breakout towards $0.00010 may occur. Nonetheless, not maintaining the $0.000071 support could lead to a decline towards $0.000065, an area where previous liquidity clusters have been noted. The overall technical landscape indicates a need for patience, suggesting a range-bound perspective in the near future.

Floki Consolidates With Solid Community Support Amid Market Stagnation

Even in the face of current stagnation, Floki’s long-term fundamentals hold steady, bolstered by ongoing community engagement and robust social sentiment. The project’s growing footprint in the meme coin and DeFi utility sectors offers a solid foundation of strength.

At this moment, traders are expected to exercise caution until the token makes a clear move above or below its existing consolidation zone. A confirmed breakout above $0.00010 would signify a shift into bullish momentum, whereas a decline below $0.000065 might indicate the onset of a deeper retracement phase.