Elon Musk’s Viral X Post Triggers FLOKI Price Explosion

On Monday, the meme coin market surged dramatically following a lighthearted post by Elon Musk on his platform X, showcasing his Shiba Inu, Floki. In the AI-generated clip, Musk’s dog assumed the role of the “CEO of X,” humorously declaring, “Numbers, numbers, numbers? Is this functioning properly? Hooray!”

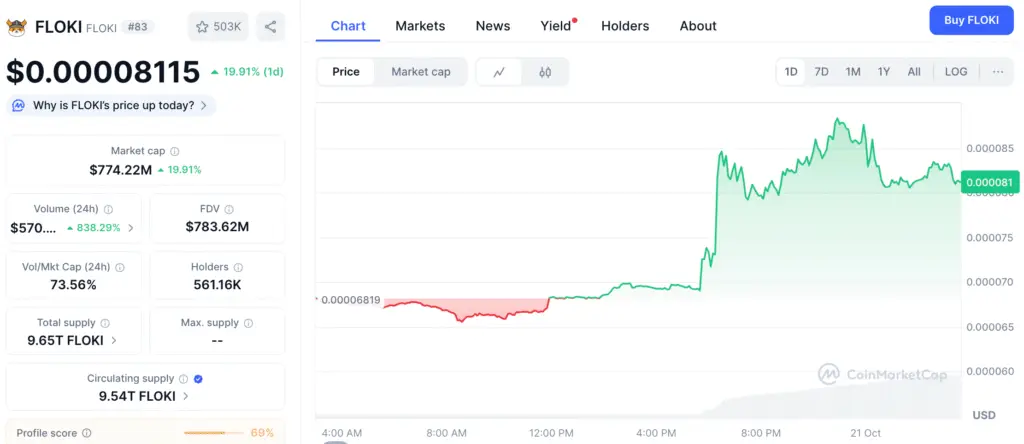

The announcement reverberated across the cryptocurrency landscape, propelling FLOKI’s price from $0.00006572 to $0.00008469 within hours—a remarkable 28.8% increase. Trading volume surged as retail investors rushed to capitalize on Musk’s revived influence over meme coins, just before prices eased slightly to $0.00007998.

Musk’s Ongoing Influence Over Meme Coin Markets

This latest surge underscores Musk’s enduring influence on speculative assets. His posts have consistently triggered sharp movements in meme coin valuations, often prioritizing sentiment over fundamentals. FLOKI’s rapid ascent mirrors past reactions in Dogecoin and Shiba Inu following Musk’s engagement.

Musk’s persona bridges popular culture and digital finance, making him one of the most influential figures in the crypto sphere. Analysts note that his social presence remains a rare constant in an otherwise unpredictable and sentiment-driven market.

FLOKI Reflects the Historical Fluctuations of Dogecoin

Musk’s relationship with meme coins dates back years, defined by playful endorsements and spontaneous references. From Dogecoin’s logo briefly appearing on X to cryptic posts that sparked massive rallies, his digital footprint has repeatedly fueled price volatility. FLOKI’s recent momentum continues this pattern of personality-driven trading.

Although Musk maintains that his posts are intended as humor, they often trigger surges in trading activity across decentralized exchanges. The phenomenon highlights how personality-driven narratives continue to shape speculative sectors of the cryptocurrency ecosystem.

Recommended Article: Floki Price Holds at Lower Bollinger Band Amid Oversold Signals

The Legal Context of Musk’s Impact on Cryptocurrency

In 2022, Musk faced a class-action lawsuit alleging that he manipulated Dogecoin prices through social media posts and public remarks. The plaintiffs claimed deliberate market interference, but the lawsuit was dismissed in November 2024, closing one of crypto’s most publicized legal sagas.

Despite past controversies, Musk’s social activity remains a key market catalyst. His posts continue to capture attention from retail traders and institutional observers alike, cementing his role as a polarizing yet powerful figure in digital finance.

Meme Coin Sector Shows Signs of Recovery After Heavy Losses

The broader meme coin market has endured a volatile October. Just days before Musk’s post, two sharp declines on October 10 and 11, erased nearly $28 billion in market capitalization, cutting valuations across major tokens by as much as 40%.

By October 11, the total market value had fallen from $72 billion to $44 billion, effectively wiping out three months of gains. FLOKI’s rapid rebound has provided short-term relief amid the broader downturn.

FLOKI Trading Volume Triples as Retail Interest Surges

Monday’s rally was accompanied by a dramatic rise in trading activity across both centralized and decentralized exchanges. FLOKI’s trading volume tripled week-over-week, underscoring renewed retail enthusiasm and speculative participation.

However, analysts caution that such momentum is often short-lived. The stabilization of FLOKI around $0.00007998 suggests initial profit-taking, with sustained growth likely dependent on ongoing community participation and network engagement rather than hype alone.

Wider Market Influence and Investor Mood

The meme coin revival occurred amid renewed volatility across the crypto market. On Friday, approximately $230 billion in total market value evaporated due to global trade uncertainty and shifting U.S. monetary expectations.

Musk’s viral post temporarily reversed the bearish tone, reigniting retail optimism. Yet, experts warn that meme coins remain among the most volatile digital assets, with performance driven more by social media engagement than technical or fundamental strength.