France’s Bitcoin Proposal Shifts European Policy Focus

France is making global headlines with its proposal to allocate roughly $48 billion, or 2% of its reserves, to Bitcoin. The motion, led by lawmaker Éric Ciotti, directly challenges the European Central Bank’s digital euro initiative. By integrating Bitcoin into national reserves, France aims to boost sovereignty and diversify away from traditional fiat exposure. This initiative signals growing institutional acceptance of digital assets at the government level.

A Bold Step Toward Financial Independence

The plan advocates adopting Bitcoin and stablecoins while rejecting the digital euro framework. Ciotti’s motion outlines how Bitcoin-backed reserves could strengthen France’s independence from centralized EU monetary control. The strategy also introduces the use of cryptocurrencies as institutional collateral within France’s financial system. If approved, the policy would position France as Europe’s first major economy to formally hold Bitcoin reserves.

Rising Political Support for Bitcoin in Europe

The proposal reflects a shifting political environment where crypto adoption is becoming a matter of national strategy. Several lawmakers view Bitcoin as a hedge against monetary debasement and geopolitical risk. France’s approach aligns with moves by Bhutan and U.S. states experimenting with digital asset reserves. This could influence other European nations to reexamine their policies toward decentralized digital currencies.

Recommended Article: Metaplanet Unveils $500M Buyback to Close Bitcoin Value Gap

SoFi Enters Crypto Trading With Record Revenue Surge

Adding to the momentum, SoFi Technologies announced plans to launch Bitcoin trading following a record $950 million Q3 revenue. The fintech company will also introduce its SoFi USD stablecoin in early 2026 to enhance cross-border payment efficiency. CEO Anthony Noto emphasized that digital assets will form a crucial pillar of SoFi’s financial ecosystem. The announcement contributed to a mild uptick in Bitcoin’s market price during the session.

Central Banks Embrace Tokenization Amid Gold Weakness

BlackRock CEO Larry Fink highlighted a growing shift among central banks toward tokenization and blockchain integration. Speaking at the Future Investment Initiative in Saudi Arabia, Fink cited Bitcoin’s expanding role as a digital hedge. Gold’s dip below $4,000 reinforced investor interest in decentralized alternatives, particularly as tokenized assets gain legitimacy. Bitcoin briefly surged past $115,500 following Fink’s remarks, reinforcing bullish sentiment across global markets.

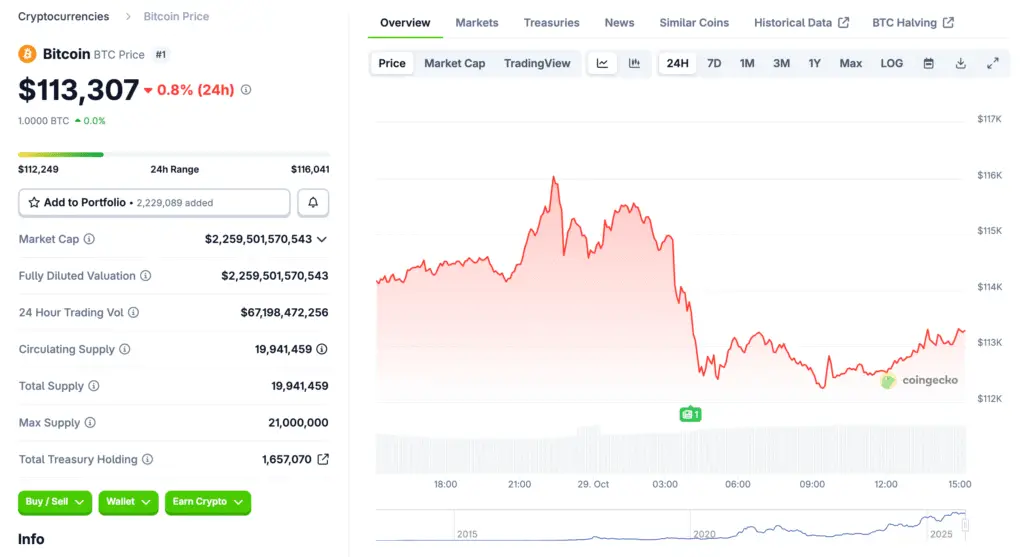

Bitcoin Technical Outlook: Bulls Target $124K Resistance

Bitcoin currently trades near $112,400 after retreating from the $117,600 resistance level earlier this week. The price structure suggests a short-term consolidation phase within a descending channel. Support is identified near $108,600, while the key breakout zone remains at $117,600. A decisive move above this neckline could trigger an advance toward $124,100 and potentially $130,000.

Market Sentiment and Institutional Positioning

Analysts note that despite short-term volatility, institutional inflows into Bitcoin continue to expand globally. Traders view the current consolidation as a healthy pause before a potential macro breakout. With the 20-day EMA at $114,900 acting as dynamic resistance, momentum could quickly shift once price reclaims this level. The RSI near 49 suggests neutral momentum, leaving room for renewed bullish expansion.

Bitcoin Hyper Bridges Speed and Scalability on Solana

Bitcoin Hyper ($HYPER) introduces Solana’s speed to Bitcoin’s security, creating a new cross-chain Layer 2 ecosystem. Built on the Solana Virtual Machine, it allows low-cost smart contracts, decentralized apps, and meme coin creation backed by BTC’s stability. The project’s presale surpassed $25 million, underscoring strong investor interest in hybrid blockchain solutions. As Bitcoin’s ecosystem evolves, innovations like Hyper are redefining what scalability and efficiency look like for digital assets.